Table of contents

Many Americans are stepping into 2026 with heightened financial anxiety and growing uncertainty about their economic futures. The 2026 Financial Outlook Report, a new national survey from Resume Now, reveals deep pessimism about the financial future among U.S. employed adults.

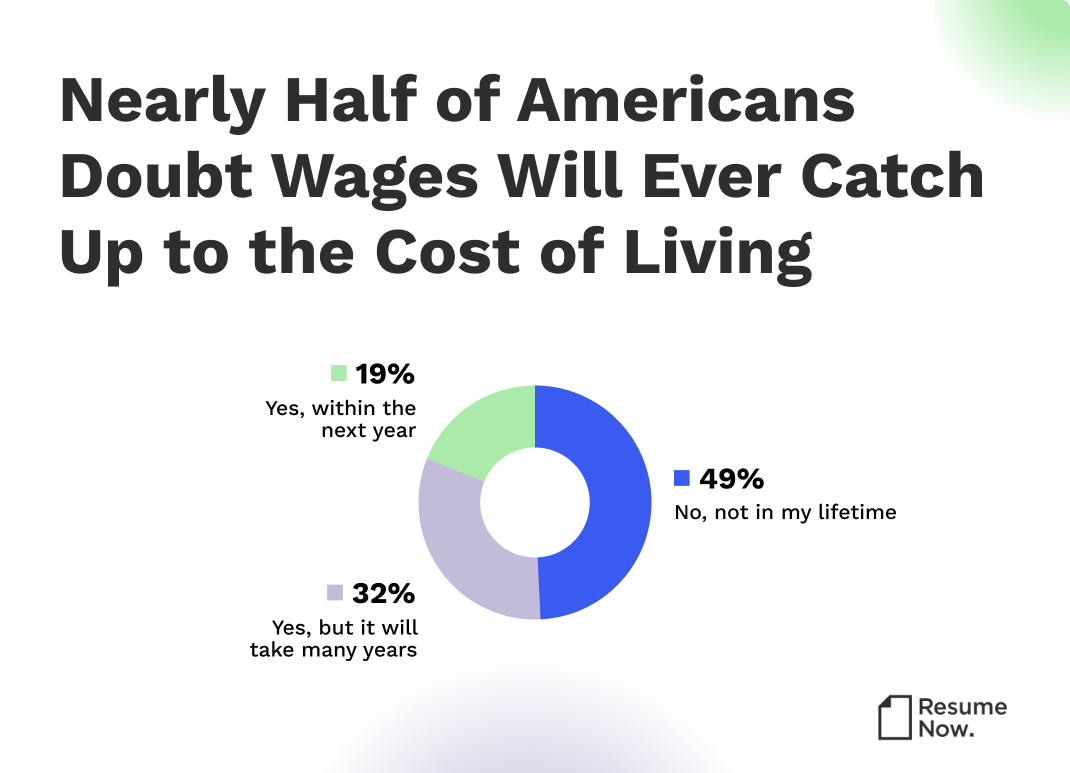

Based on 1,011 respondents, nearly half of working Americans (49%) say they do not believe their wages will ever catch up with the rising cost of living, with another 32% saying their wages won't catch up for many years. Less than 1 in 5 (19%) think their wages will catch up to inflation in 2026.

Key Findings

- Half of American workers (49%) believe their wages will never catch up to the cost of living.

- Nearly half (48%) have postponed a major life milestone, including buying a home, having children, or changing careers, due to rising costs.

- More than one-third (38%) expect financial stress to increase in 2026, and 39% overall expect no improvement.

- Pay transparency remains a major workplace issue. 77% of workers feel unclear about salary ranges, raises, or bonus structures at their own companies.

- If given a raise, most workers would use it for survival, not optional spending. 37% would save it, 32% would cover basic expenses, and 26% would pay down debt.

- A combined 69% feel underpaid, with only 2% believing they are overpaid.

Americans Are Losing Faith That Wages Will Catch Up

Americans remain deeply uncertain about whether their wages will ever keep pace with the rising cost of living, and the latest financial stress statistics shows a clear split in expectations. When asked if they believed wages would ever fully catch up to the cost of living, here's how workers responded:

- Yes, within the next year: 19%

- Yes, but it will take many years: 32%

- No, not in my lifetime: 49%

The following is a visual representation of the data above:

What this means: This outlook reflects a workforce that feels financially strained and unsure about long-term stability. With nearly half believing wages will never catch up, many workers may continue adjusting spending, delaying milestones, and seeking additional income sources to stay afloat.

Most Workers Feel Underpaid

According to the survey data, a large majority of American workers feel they are not being paid what they deserve.

- 27% say their salary is much lower than it should be.

- 42% say it is somewhat lower.

- Only 2% feel overpaid.

What this means: Feeling underpaid can affect both morale and productivity, cause worker burnout, and may lead employees to seek higher-paying opportunities. With a significant amount of workers dissatisfied with their compensation, businesses may face increasing pressure to adjust wages and improve retention.

If Given a Raise, Most Would Use It for Survival, Not Luxury

When asked what they would do with a cost-of-living raise, most Americans would focus on covering immediate financial needs rather than extras or luxuries.

- 37% would add to savings.

- 32% would cover everyday expenses.

- 26% would pay down debt.

- 3% would pay for a vacation.

- 2% would pay for education or career development.

What this means: This response reflects the ongoing struggle many workers face as wages lag behind the rising cost of living. With the majority planning to use additional income for savings, everyday expenses, or debt repayment, it is clear that financial survival remains the top priority.

Many Americans Are Delaying Major Life Milestones

Rising living costs are causing many Americans to put significant life decisions on hold.

- 48% have postponed a major life decision due to cost-of-living pressures. Examples include buying a home, having children, going back to school, or changing jobs.

The following is a visual representation of the data above:

What this means: Nearly half of respondents report delaying important life milestones in response to the rising cost of living. This trend highlights how financial pressures are forcing individuals to adjust their long-term plans and priorities.

Financial Stress Is Expected to Get Worse

Most Americans anticipate that financial stress will continue or worsen in the year ahead. Workers' expectations for 2026:

- Stress will stay the same: 39%

- Stress will increase somewhat: 25%

- Stress will increase significantly: 13%

Only 23% expect a decrease.

What this means: Workers are entering 2026 with persistent uncertainty and concern about their financial well-being. Many may need to adjust spending, savings, and lifestyle choices to cope with ongoing economic pressures.

Employer Pay Transparency Is Lacking

Many feel unclear on salary ranges, raises, and bonus structures. Employees believe their workplaces to be:

- Very transparent: 23%

- Somewhat transparent: 43%

- Not very or not at all transparent: 34%

What this means: When asked about employer transparency, responses reveal that a large number of employees do not feel fully informed about their compensation. This lack of clarity can affect trust, engagement, and confidence in career growth.

Methodology

The findings provided were gathered through a survey of 1,011 U.S. adults on December 7, 2025. Participants answered a wide range of questions about income, financial stress, cost of living, wage trends, employer transparency, and future economic outlook. Question formats included multiple choice, scaled responses, and multi-select options.

About Resume Now

Resume Now is a powerful resource dedicated to helping job-seekers achieve their potential. Resume Now's AI Resume Builder is a cutting-edge tool that makes creating a resume fast, easy, and painless. Resume Now has been dedicated to serving job seekers since 2005. Alongside its powerful AI Resume Builder and stylish ready-to-use templates, it also features free advice for job seekers at every career stage, guides for every step of the hiring process, and free resources for writing cover letters. Resume Now is committed to supporting job seekers and workers alike and has conducted numerous surveys related to the experience, trends, and culture of the workplace. These surveys have been featured in Business Insider, CNBC, Fast Company, Yahoo!, Forbes, and more. Keep up with Resume Now on LinkedIn, Facebook, X, and Pinterest.

For press inquiries, contact Alexa Kalechofsky at alexa.kalechofsky@bold.com.

Keith is a Certified Professional Resume Writer (CPRW) and trusted media source in the career industry with over a decade of experience helping job seekers stand out.

More resources

AI-Resistant Careers Index 2026: 20 Jobs That AI Can’t Replace

Resume Now s latest report breaks down the most AI-proof caree...

60% of U.S. Workers Expect AI to Eliminate More Jobs Than It Creates in 2026

Resume Now s newest report shows growing concerns about the im...

Best Resume Font for 2026 (+ Size and Formatting Tips)

Find the best resume font for your resume with our comprehensi...

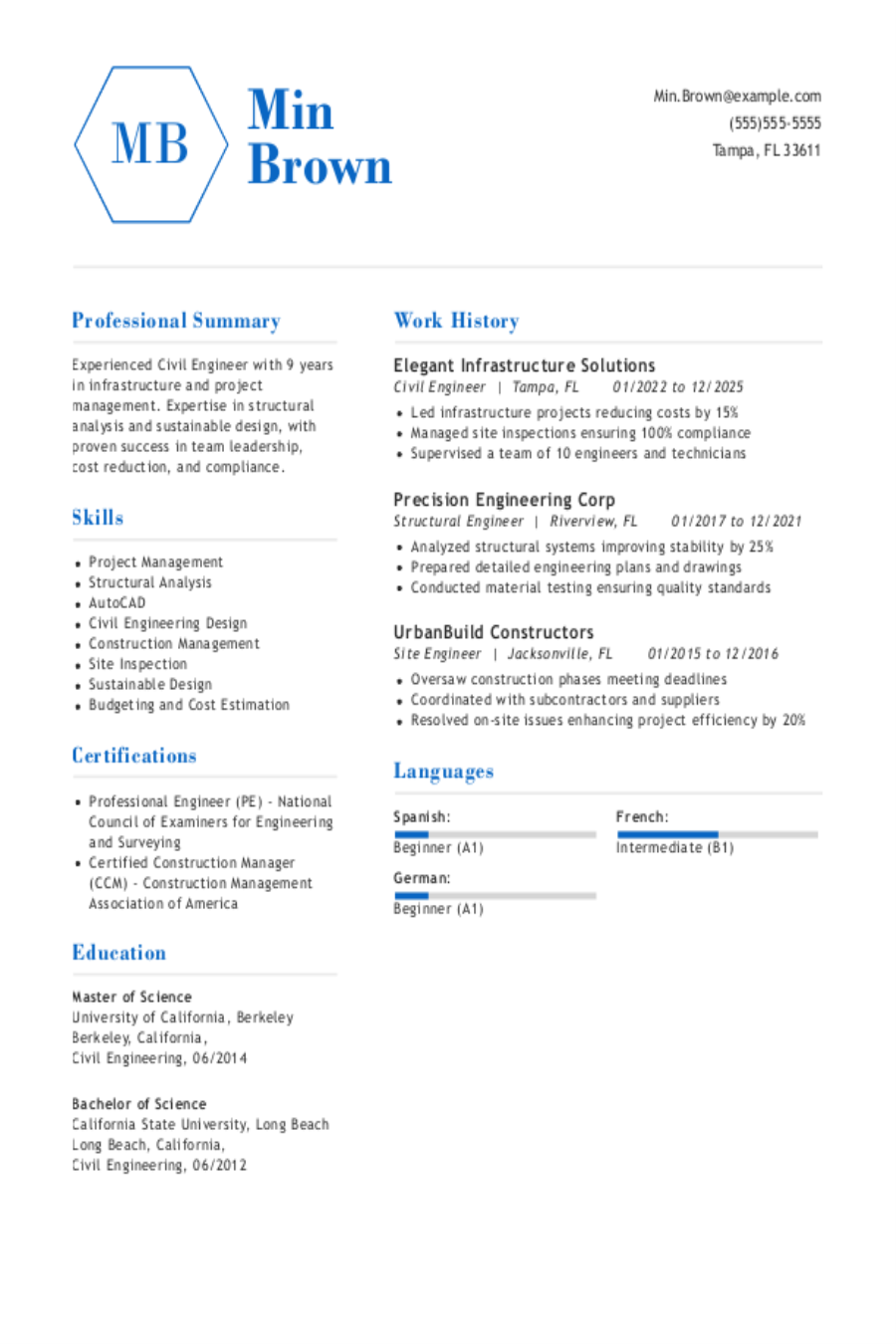

Civil Engineering Resume: Examples & Templates

As a civil engineer your resume must showcase your technical ...

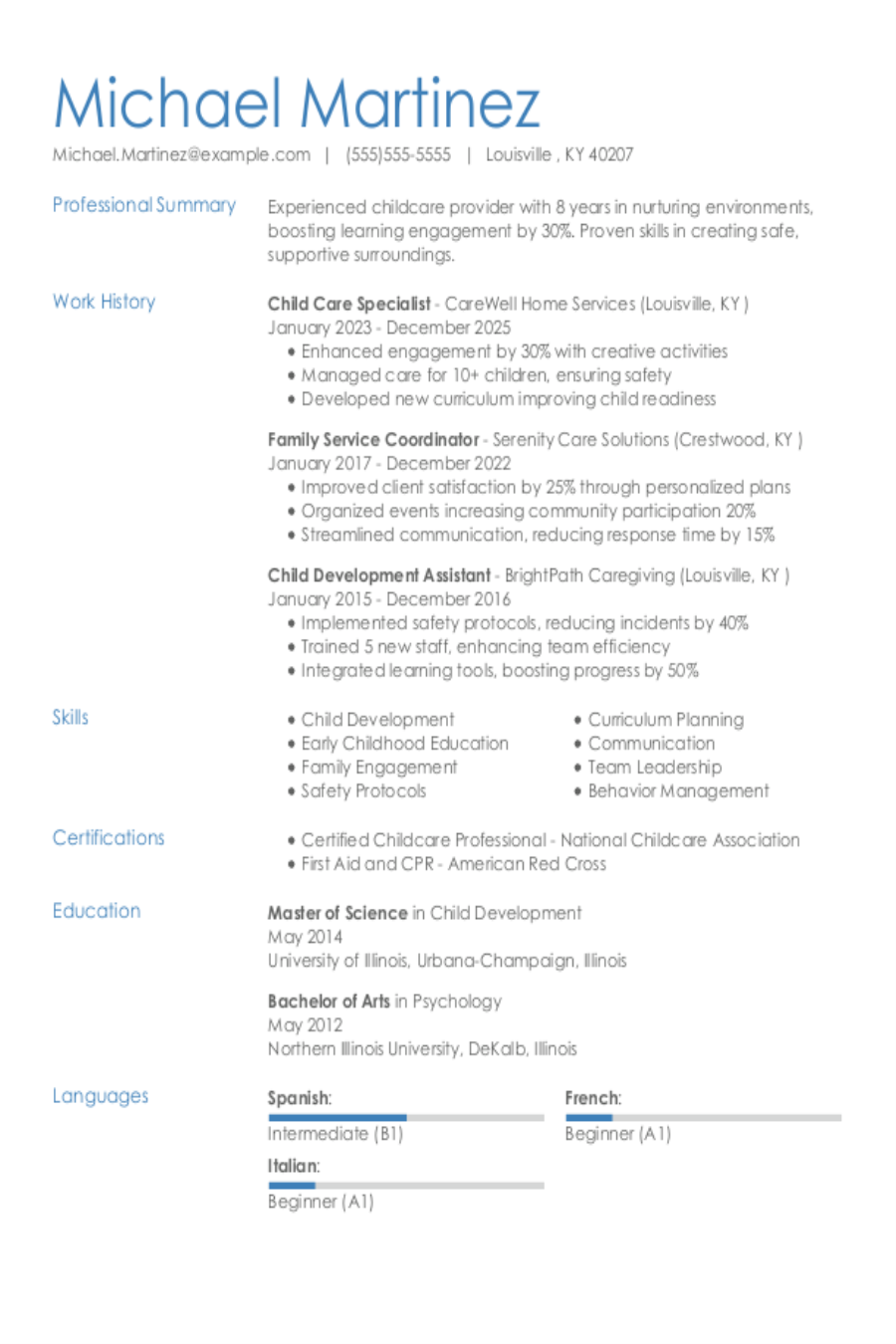

Interview-Winning Child Care Resumes Examples and Tips

As a child care professional you need a resume that showcases...

Interview-Winning Entertainment Resumes Examples and Tips

As an entertainment professional you need a resume that captu...