Popular Accounting Manager Resume Examples

Entry-level accounting manager resume

An entry-level resume for an accounting manager should emphasize relevant coursework, internships, certifications, and demonstrated skills in financial analysis, leadership, and problem-solving, as well as past roles that have prepared you for your entry into a leadership role.

Education: This resume highlights the candidate's impressive academic background. This helps future employers quickly ascertain their expertise and technical knowledge.

Emphasis on soft skills: This applicant's resume highlights strong soft skills, such as analytical skills and leadership abilities, which compensate for limited experience. For example, managing portfolios totaling $5M and achieving a 25% revenue growth demonstrates capability in driving financial success.

Mid-career accounting manager resume

A mid-career accounting manager resume should emphasize a comprehensive mix of leadership experience, technical skills, and continuous professional development to effectively demonstrate value to potential employers in the finance sector.

Active language: In the accounting field, using action verbs such as "led," "streamlined," and "managed" highlights a commitment to driving results and fostering team success.

Powerful resume profile: This candidate's professional summary effectively highlights the applicant's extensive experience as an accounting manager, showcasing achievements like a 20% reduction in audit discrepancies. This clarity allows recruiters and ATS to quickly ascertain relevant qualifications.

Experienced accounting manager resume

An experienced accounting manager resume should prioritize highlighting key achievements and leadership roles in financial management, ensuring a clear narrative of professional growth and impact on organizational success.

Quantifiable achievements: Quantifiable achievements significantly improve an accounting manager's resume by providing clear metrics that illustrate their impact. For instance, showcasing a 30% improvement in financial reporting speed or a $200K annual cost-saving initiative makes accomplishments easily recognizable and compelling to recruiters.

Traditional format: The chronological resume format effectively illustrates the job seeker’s extensive experience, allowing them to present a clear narrative of their career advancement while demonstrating key achievements and skills in each role.

More resume examples

Additional Guides

Accounting Manager Resume Template

Looking to create a standout application? This professional accounting manager resume template serves as an excellent foundation—simply personalize it with your own details and experiences.

Justin Barnes

Minneapolis, MN 55402

(555)555-5555

Justin.Barnes@example.com

Professional Summary

Experienced Accounting Manager with 6 years of expertise in financial reporting, budgeting, and audits. Proven track record in cost reduction and team leadership, managing up to M in budgets. Skilled in regulatory compliance, driving operational efficiency by 30%.

Work History

Accounting Manager

Prime Financial Solutions - Minneapolis, MN

January 2023 - August 2025

- Streamlined accounting processes, reducing errors by 25%

- Spearheaded monthly audits, improving compliance by 15%

- Managed M in budgets, ensuring 100% accuracy and timeliness

Senior Accountant

Summit Corporate Services - Minneapolis, MN

January 2020 - December 2022

- Enhanced financial reporting accuracy, reducing delays by 20%

- Supervised five junior accountants, achieving 30% productivity boost

- Developed cost-saving strategies, cutting expenses by 0K annually

Staff Accountant

Vanguard Ledger Group - Minneapolis, MN

January 2017 - December 2019

- Prepared client tax filings, achieving 98% accuracy

- Led monthly financial reconciliations, saving six hours per cycle

- Implemented accounting software upgrade, reducing errors by 15%

Skills

- Financial Reporting

- Budget Management

- Accounting Software

- Tax Compliance

- Auditing and Reconciliation

- Process Optimization

- Team Leadership

- Regulatory Compliance

Education

Master of Science Accounting

University of Texas at Austin Austin, Texas

May 2017

Bachelor of Business Administration Accounting

University of Texas at Austin Austin, Texas

May 2015

Certifications

- Certified Public Accountant (CPA) - American Institute of CPAs

- Certified Management Accountant (CMA) - Institute of Management Accountants

- Advanced Excel for Financial Analysis - Coursera

Languages

- Spanish - Beginner (A1)

- French - Intermediate (B1)

- German - Beginner (A1)

Writing Your Accounting Manager Resume

Having explored these impressive resume examples, you're now prepared to dive into the essential steps of crafting your own. We'll walk you through how to write a resume, detailing each section to ensure you create a standout document that showcases your skills and experience effectively.

List your most relevant skills

Crafting an effective skills section for your accounting manager resume is important to highlight your qualifications. This section allows you to showcase how well you fit the role, so be sure to read the job listing closely and incorporate relevant keywords from the job listing that reflect your expertise.

Using these keywords not only demonstrates your suitability to human recruiters but also improves your chances of passing through applicant tracking systems (ATS). By aligning your skills with those mentioned in the job posting, you show that you're a qualified applicant who understands what’s needed in an accounting manager position. Tailor this section thoughtfully to make a strong impression.

Example of skills on a accounting manager resume

- Proficient in financial reporting and analysis to drive strategic decision-making

- Strong leadership skills with a focus on team collaboration and development

- Expert in budgeting processes and cost management strategies

- Detail-oriented with exceptional organizational abilities for accurate record-keeping

Highlighting your soft skills on your resume can set you apart from other applicants. Employers greatly value interpersonal abilities, as they are often challenging to develop. Showcasing these traits demonstrates not only your qualifications but also your potential to thrive in a collaborative work environment.

Highlight your work history

Your work experience section is a key part of your accounting manager resume. It should highlight not only your job duties but also achievements that demonstrate how you used your skills effectively.

For each job entry, include important details like your title, the employer's name, and the dates of employment. Providing this information ensures employers can quickly evaluate your professional background and build credibility. Incorporating quantifiable results—such as cost savings or process improvements—into each role will make your experience more compelling.

Example of a accounting manager work experience entry

- Accounting Manager

Fintech Solutions Inc. - New York, NY

June 2018 - Present - Oversee and coordinate monthly financial close processes, ensuring timely reporting and compliance with GAAP standards, resulting in a 15% reduction in close cycle time

- Develop and implement budgeting strategies that led to a 20% decrease in operational costs while maintaining service quality

- Lead a team of 6 accountants, fostering a collaborative environment that improved team efficiency by 30% through regular training and mentorship programs

- Prepare detailed financial reports for executive management, enabling data-driven decisions that increased profitability by 10% year-over-year

- Improve internal controls and audit readiness practices, achieving zero audit findings for two consecutive years

Quantifying your achievements as an accounting manager demonstrates your impact on financial performance and efficiency. For example, stating that you led a team to reduce monthly closing time by 40% highlights your ability to streamline processes and improve overall departmental productivity.

Include your education

The education section of your accounting manager resume should be structured to highlight your academic qualifications in reverse-chronological order, starting with your most recent degree. Include all relevant diplomas and degrees while omitting your high school diploma if you hold a bachelor’s degree or higher. This approach ensures that the most relevant information is easily accessible to potential employers.

If you are currently pursuing further education or have incomplete coursework, list the highest level of education you've achieved along with an expected graduation date. It can be beneficial to include bullet points highlighting specific courses or academic honors that directly relate to accounting management.

Common certifications for a accounting manager resume

- Certified Public Accountant (CPA) – American Institute of Certified Public Accountants (AICPA)

- Chartered Global Management Accountant (CGMA) – Association of International Certified Professional Accountants

- Certified Management Accountant (CMA) – Institute of Management Accountants (IMA)

- Enrolled Agent (EA) – Internal Revenue Service (IRS)

Sum up your resume with an introduction

Creating a strong profile section is essential for your resume as it serves as the first point of contact with potential employers. This section should effectively convey who you are professionally and what unique skills you bring to the table.

Write your resume profile in the form of either a professional summary or a resume objective.

A professional summary quickly discusses your experience and key achievements. If you're an early-career candidate, a resume objective may make more sense because it highlights your career development and future goals.

Professional summary example

Results-driven accounting manager with over 10 years of experience in optimizing financial operations within diverse industries. Demonstrated success in improving financial reporting accuracy, implementing cost-saving measures, and leading audit preparations that consistently exceed compliance standards. Proficient in budgeting, forecasting, and team leadership to drive organizational growth and financial integrity.

Resume objective example

Enthusiastic accounting manager job seeker eager to use strong analytical skills, attention to detail, and skill in financial reporting to improve team performance. Aiming to support effective budgeting processes and foster accurate financial forecasting within a collaborative environment, contributing positively to organizational growth.

As an accounting manager job seeker, it’s important to keep your resume profile concise and packed with essential information. Aim for no more than three sentences that highlight your key skills and achievements. Remember, any additional details can be elaborated on in your cover letter, allowing you to maintain clarity and focus in your resume.

Add unique sections to set you apart

Including optional resume sections as an accounting manager can highlight your unique qualifications and make your application stand out. These sections allow you to present skills and experiences that might not fit into traditional categories.

By incorporating relevant hobbies, volunteer work, or professional development activities, you give potential employers insight into your personality and values. For example, if you've volunteered for financial literacy programs, it showcases your commitment to community engagement. These elements enrich your resume and paint a fuller picture of who you are as a job seeker.

Three sections perfect for a accounting manager resume

- Languages: As an accounting manager, effective communication with diverse teams is essential. Highlighting language skills on your resume can improve collaboration and client relations, giving you a competitive edge.

- Volunteer Work: Including volunteer work on a resume can improve your professional skills and demonstrate your dedication to community service. Highlighting this experience showcases your ability to lead, collaborate, and make a positive impact, all valuable traits for an accounting manager.

- Accomplishments: As an accounting manager, quantifiable accomplishments are important for demonstrating your impact on financial health. You could mention reducing monthly closing time by 25% and increasing accuracy in reports by 15%.

5 Resume Formatting Tips

- Choose a format that matches your career stage.

When crafting your resume, considering your career level and experience is key to choosing the best resume format. If you have extensive experience, a chronological format showcases your growth effectively. For those just starting out, a functional resume emphasizes skills over work history. Mid-level professionals might find a combination format effective, as it mixes both approaches to present a well-rounded view of their qualifications.

- Pick a smart resume template.

Opt for a professional resume template to ensure your qualifications stand out. This approach makes your resume visually appealing and easy to read, helping potential employers quickly grasp your skills and experience. If you're crafting it yourself, keep the format straightforward with ATS-friendly fonts to improve readability.

- Use an appropriate font.

When crafting your resume, opt for a clean and professional font to improve readability. Fonts like Helvetica, Georgia, or Verdana are excellent choices. Ensure the size is between 10-12 points for optimal clarity, making your resume easy to read for both ATS and hiring managers.

- Use consistent formatting.

Ensure your resume features a clean layout with left alignment and uniform margins to create a polished, professional look that stands out to employers.

- Keep your resume to one or two pages.

When crafting your resume, remember that resumes should be one page long, especially if you’re early in your career. Keeping your content concise and focused ensures hiring managers quickly grasp your qualifications and experience, making a stronger impression at first glance.

Tools for Your Job Search

Are you preparing to apply for that accounting manager position you've been eyeing? Before submitting your application, take advantage of our ATS Resume Checker. This essential tool assesses how well your resume performs with the automated screening systems many companies use, ensuring you stand out in today's competitive job market.

Need help crafting a standout resume? Our AI Resume Builder is designed just for you. It provides tailored recommendations based on your accounting expertise and offers a variety of professional templates that effectively showcase your skills and accomplishments to potential employers.

These tools not only improve the quality of your resume but also streamline the entire creation process. By generating customized sections quickly, they save you precious time while allowing you to focus on what truly matters—your career success in accounting management.

Frequently Asked Questions

Last Updated: September 8, 2025

Absolutely. A cover letter is important as it adds depth to your resume and creates an opportunity for you to connect with potential employers. It allows you to express your enthusiasm for the accounting manager role while detailing how your specific skills and experiences make you a strong applicant. Don't overlook this chance; write a cover letter that improves your application.

For a quick and efficient solution, consider using our AI Cover Letter Generator, which can help you produce a tailored cover letter in just minutes. Plus, you can choose from various cover letter template options that complement your resume perfectly, ensuring a polished presentation of your qualifications.

A CV (curriculum vitae) is generally more expansive and detailed than a resume. While resumes typically range from one to two pages, CV templates can extend across several pages to include comprehensive information about your academic background, research contributions, publications, and professional experiences.

You’ll often need a CV for specialized roles in academia, science, law, or medicine. If you find that a CV is the right choice for your job application, our online CV Maker can assist you in crafting a personalized document in minutes. With various templates designed for different industries and career levels, creating an impressive CV has never been easier.

An accounting manager resume should typically be one page long, providing a concise overview of your qualifications and experience. However, if you have extensive experience or a diverse skill set, a two-page resume may be appropriate to effectively showcase your background and achievements. Tailor the length to best reflect your professional journey while maintaining clarity and relevance.

To tailor your accounting manager resume effectively, focus on highlighting the key skills mentioned in the job description. Carefully read the job listing to pinpoint relevant keywords and phrases. Incorporate these into your resume to showcase how your experience aligns with the role, making it clear that you are a strong job seeker for the position.

An active LinkedIn presence is important for an accounting manager's job search. It allows you to expand your professional network, demonstrate your expertise in financial management, and connect with potential employers who value your skills.

To ace your accounting manager interview, practice answering job interview questions and answers. This preparation not only boosts your confidence but also helps you tackle any surprises that may come up during the discussion. Remember, being well-prepared is key to a successful interview experience!

Was this information helpful? Let us know!

Hailey is a career advice writer dedicated to helping job seekers excel in their careers.

More resources

Half of American Workers Doubt Wages Will Ever Catch Up to the Cost of Living

Resume Now s wage stagnation report shows that American worker...

How to Write a CV: The Ultimate Guide

Here is a complete and comprehensive guide to writing a CV ev...

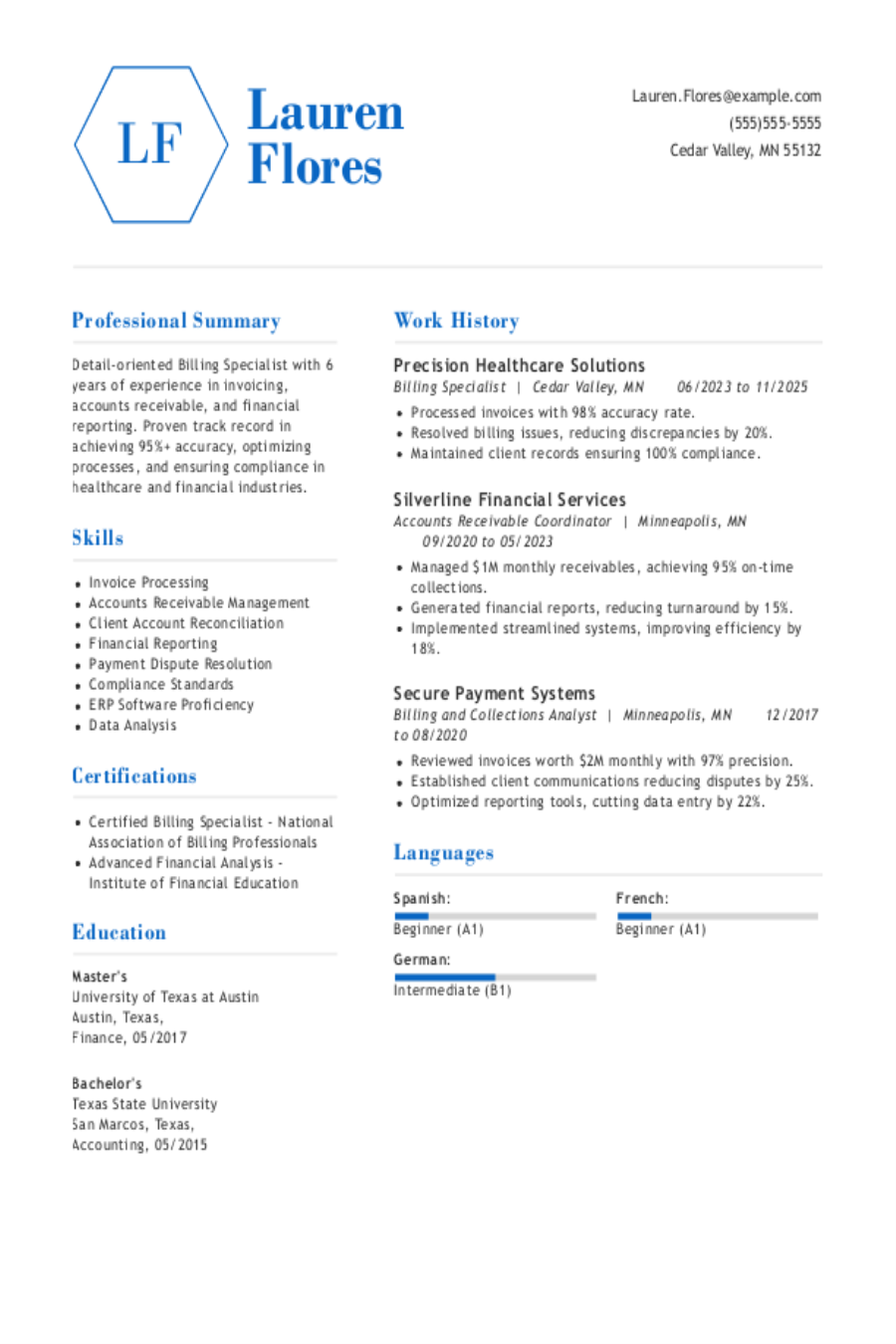

Billing Resume: Examples & Templates

As a billing professional you need a resume that captures the...

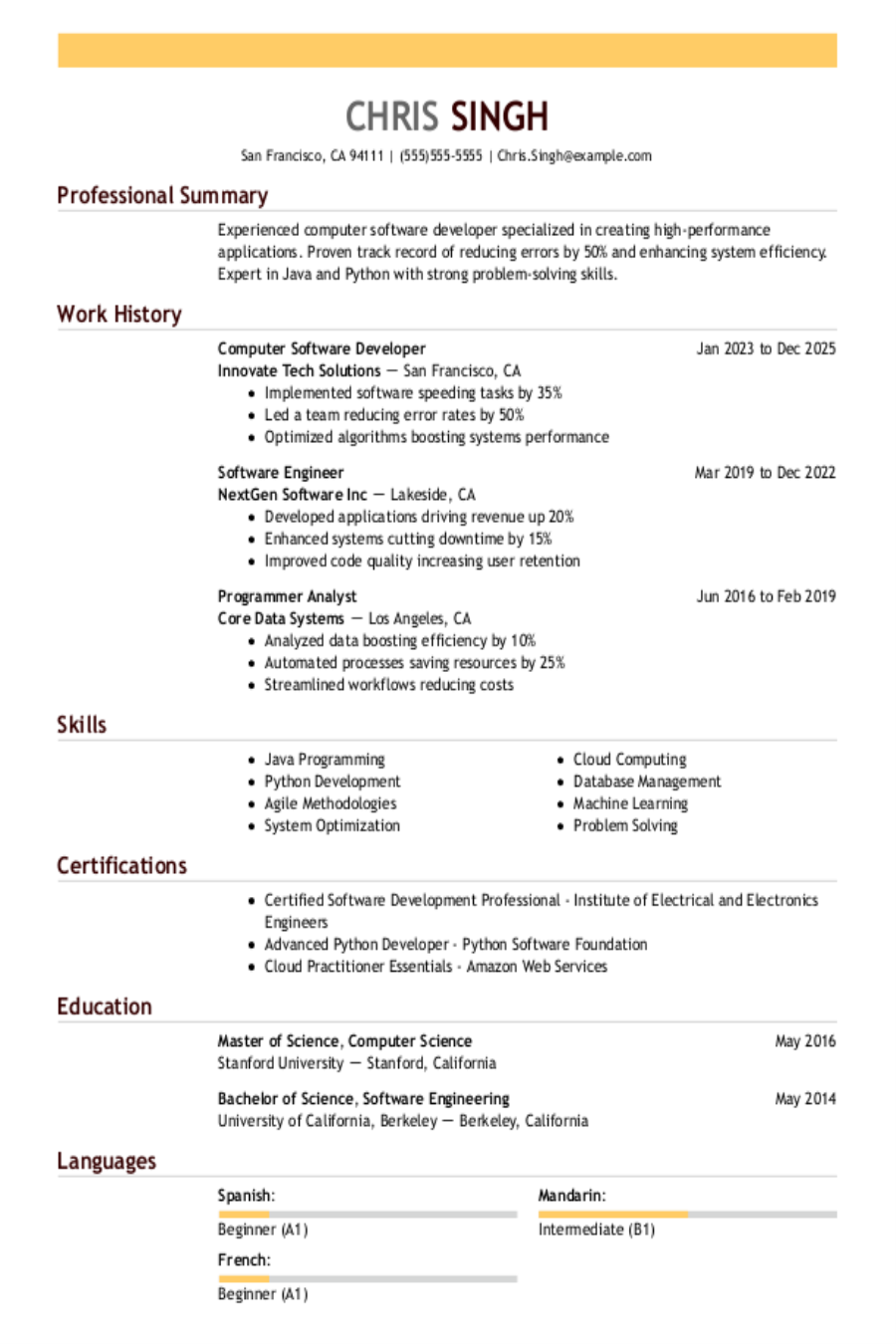

Interview-Winning Computer Software Resumes Examples and Tips

As a computer software professional your resume should showca...

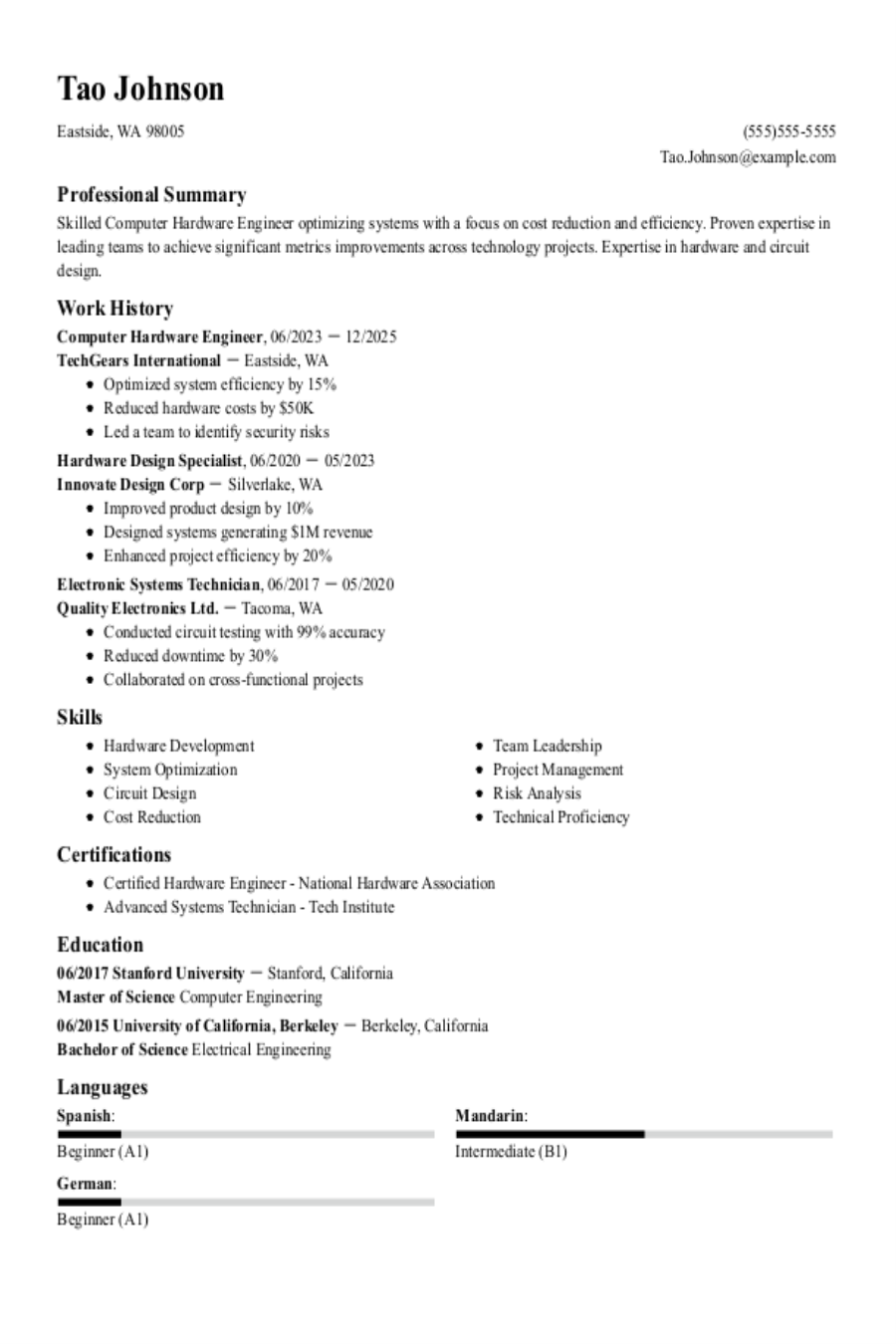

Computer Hardware Resume: Examples & Templates

As a computer hardware professional you need a resume that sh...