Popular Controller Resume Examples

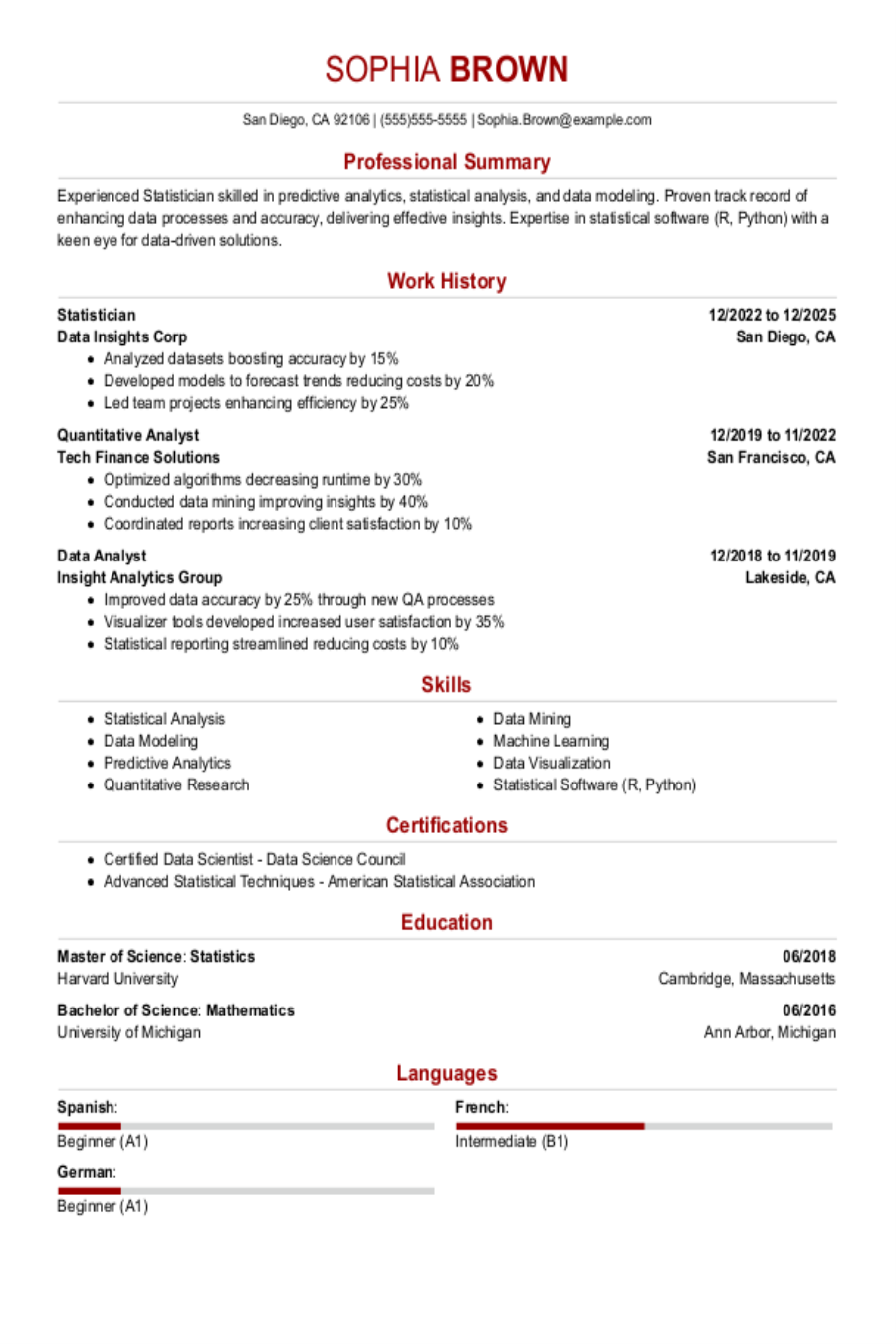

Entry-level controller resume

An entry-level resume for a controller should highlight relevant coursework, internships, financial software skills, and analytical abilities to show potential even with limited professional experience.

Prioritizes readability: Choosing a simple resume template allows the applicant to present their skills and achievements clearly, enabling recruiters to quickly recognize their suitability for the controller role.

Showcases education: This resume builds the candidate’s early career credibility by placing a strong focus on their educational background.

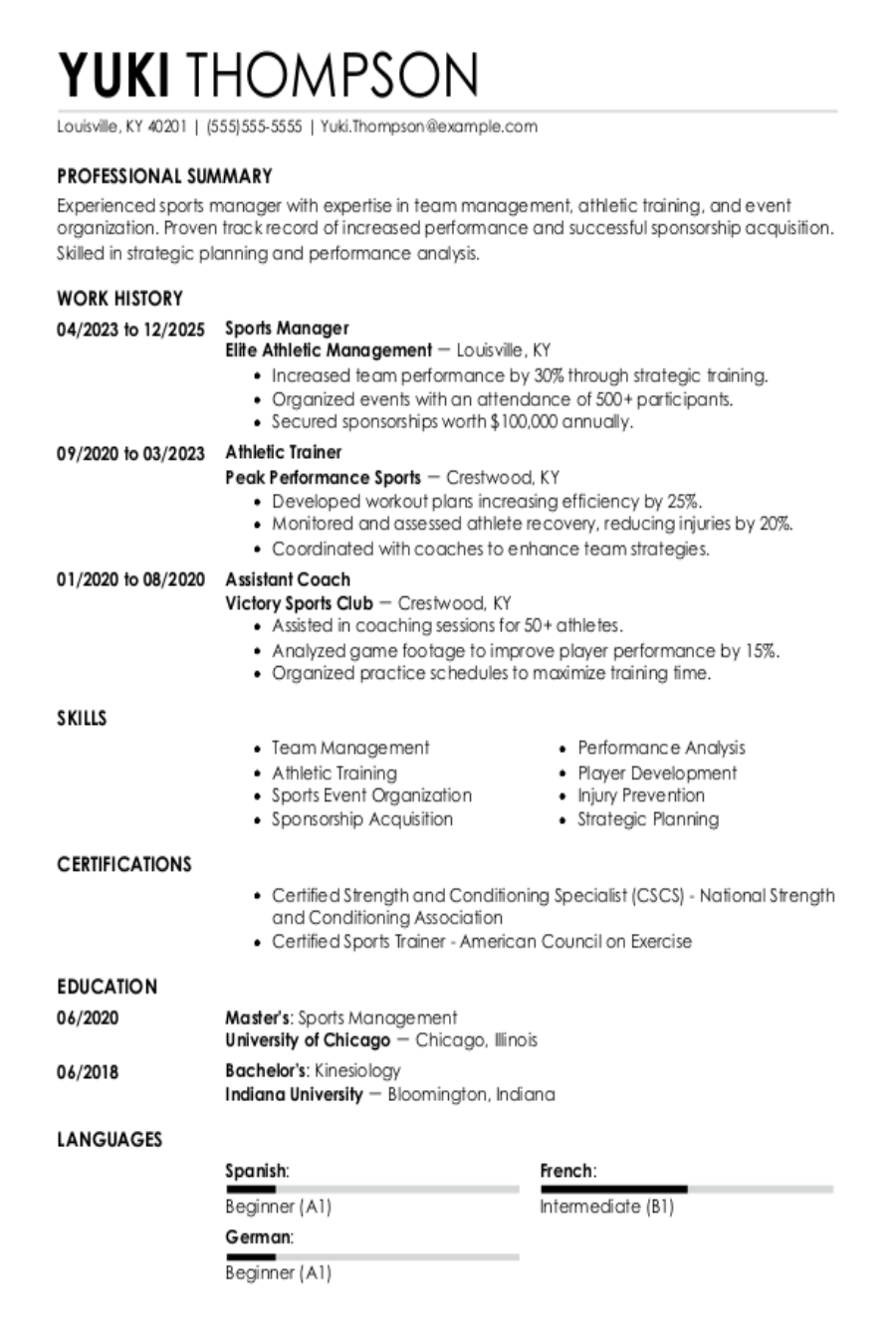

Mid-career controller resume

A mid-career controller resume should emphasize a strong combination of financial expertise, leadership skills, and measurable achievements to effectively demonstrate career growth and capability to potential employers.

Balances skills and experience: This job seeker's resume effectively showcases their technical expertise in financial analysis and budgeting while highlighting significant career progression from financial analyst to controller, reflecting strong professional growth.

Encourages quick scanning: A well-structured resume allows hiring managers to quickly identify the job seeker's expertise in financial management and team leadership, showcasing their impact on organizational success.

Experienced controller resume

A resume for an experienced controller should highlight financial oversight achievements and demonstrate progressive leadership roles clearly.

Embraces modern design: This modern resume template effectively showcases the job seeker's innovative financial expertise and establishes their professional brand as a results-oriented controller who excels in improving operational efficiency.

Highlights experience: This resume's professional summary showcases the job seeker's decade of experience in financial management. This immediately establishes credibility and sets a professional tone for the entire document.

No experience controller resume

A resume for an applicant with no experience should emphasize relevant skills, education, and any volunteer work to demonstrate their potential and enthusiasm for the position.

Overcomes lack of work history: Emphasizing education and featuring academic achievements in the accomplishments section helps establish this candidate's expertise despite limited experience.

Draws from diverse experiences: Incorporating extracurricular activities and volunteer work improves a resume by highlighting relevant skills in budget management and financial reporting that may not be evident from professional experience alone.

More resume examples

Controller Resume Template

Looking for a solid foundation? This controller resume template is ready for you to personalize with your unique details and experiences.

John Rodriguez

Westbrook, ME 04094

(555)555-5555

John.Rodriguez@example.com

Professional Summary

Experienced Controller with 7 years in financial leadership. Proven track record in cost optimization and financial reporting for top-tier enterprises. Excels in strategic planning and process improvement.

Work History

Controller

Pacific Financial Systems - Westbrook, ME

January 2022 - October 2025

- Reduced budget overspend by 15% annually

- Streamlined accounting processes, cut errors by 30%

- Managed reporting for a $150M revenue company

Senior Financial Analyst

Global Dynamics Inc. - Westbrook, ME

January 2018 - December 2021

- Analyzed market trends, boosting sales by 20%

- Improved cost efficiency, saving $200K annually

- Led financial audits, achieving 95% completion rate

Financial Analyst

Innovative Ventures - Westbrook, ME

January 2016 - December 2017

- Developed forecasting models for key projects

- Increased earnings forecast accuracy by 10%

- Assisted in strategic planning initiatives

Skills

- Financial Analysis

- Budget Management

- Forecasting

- Strategic Planning

- Cost Reduction

- Compliance

- LEAN Accounting

- Risk Management

Education

Master of Business Administration Finance

Stanford University Stanford, CA

June 2016

Bachelor of Science Economics

University of California, Berkeley Berkeley, CA

June 2014

Certifications

- Certified Management Accountant - Institute of Management Accountants

- Certified Public Accountant - AICPA

Languages

- Spanish - Beginner (A1)

- French - Beginner (A1)

- German - Beginner (A1)

Must-Have Skills on a Controller Resume

Having a well-defined skills section is important for standing out in the competitive job market.

Professionals in finance, banking, and insurance play a crucial role in maintaining trust and stability. The skills you highlight should reflect your ability to support accurate, efficient operations and contribute to sound decision-making. This section is your chance to show how you help safeguard and advance organizational goals.

The data presented highlights prevalent hard and soft skills essential for controller positions, derived from Resume Now’s extensive resume database.

When you're ready to improve your resume, try our AI Resume Skills Generator. It identifies both hard and soft skills tailored to your job title, empowering you to create a comprehensive and customized skill set.

Writing Your Controller Resume

Having explored these effective resume examples, you are now prepared to dive into the detailed process of how to write a resume. We'll walk you through each section step by step, ensuring you have all the tools needed for success.

List your most relevant skills

A strong skills section on your controller resume includes both technical abilities, like financial analysis and budgeting, as well as essential soft skills such as attention to detail and leadership.

To improve your chances with recruiters and applicant tracking systems, carefully analyze the job listing for keywords from the job listing related to the position. By integrating these keywords into your skills section, you demonstrate relevance to human readers while also optimizing your resume for ATS scanning.

Example of skills on a controller resume

- Proficient in using various data management systems to optimize workflow efficiency

- Adept at analyzing complex information and providing actionable insights

- Collaborative team player who thrives in dynamic environments

- Strong communicator with exceptional presentation skills

Highlighting your soft skills on your resume is essential. Employers greatly value interpersonal abilities since they are often challenging to develop, and showcasing them can set you apart from other job seekers.

Highlight your work history

Your work experience section should highlight your achievements and how you've effectively used your financial skills. This section is your chance to demonstrate concrete results, so make sure to include relevant keywords that align with hiring managers' expectations.

When detailing each job entry, be sure to include essential information like your job title, the company name, and employment dates. This establishes your professional credibility and helps employers quickly understand your background in finance and accounting roles.

Example of a controller work experience entry

- Controller

ABC Financial Services - New York, NY

March 2019 - Present - Oversee all financial operations, ensuring compliance with regulatory requirements and internal policies, resulting in a 30% reduction in audit discrepancies

- Lead the preparation of monthly financial statements and reports, providing actionable insights that improved strategic planning by 25%

- Implement cost-saving measures that decreased operational expenses by 15% while maintaining service quality and team morale

- Mentor a finance team of 10 professionals, fostering a culture of continuous improvement and professional development, which increased team productivity by 20%

- Collaborate with executive leadership to develop annual budgets and forecasts, achieving revenue targets consistently over three fiscal years

Quantifying achievements as a controller is vital for illustrating your impact on financial performance. For example, stating that you reduced operating costs by 15% in one year provides tangible evidence of your strategic decision-making and financial management skills.

Include your education

The education section of your controller resume should clearly present your degrees and diplomas in reverse-chronological order, starting with the most recent. It is advisable to exclude your high school diploma if you hold a bachelor's degree or higher.

For those pursuing ongoing education or with incomplete degrees, list your highest achieved level and include an expected graduation date. Highlight relevant coursework or academic achievements through bullet points, which is especially beneficial if you are a current student or recent graduate.

Common certifications for a controller resume

- Certified Management Accountant (CMA) – Institute of Management Accountants (IMA)

- Chartered Global Management Accountant (CGMA) – American Institute of CPAs (AICPA) and Chartered Institute of Management Accountants (CIMA)

- Project Management Professional (PMP) – Project Management Institute (PMI)

- Certified Internal Auditor (CIA) – Institute of Internal Auditors (IIA)

Sum up your resume with an introduction

Creating a strong profile section on your resume is important as it sets the tone for your candidacy. This brief introduction gives employers a snapshot of who you are and what you offer, helping you stand out in a competitive job market.

If you have substantial experience in the field, consider using a professional summary to showcase your key accomplishments. This approach allows you to highlight specific skills, successful projects, and relevant achievements right at the top of your resume. If your experience is limited, include a goals-based resume objective that reflects your dedication to learning and development.

Professional summary example

Dynamic controller with over 10 years of experience in financial management and reporting within diverse industries. Demonstrated ability to improve fiscal performance through strategic budgeting, comprehensive audits, and effective team leadership. Expertise in financial analysis, regulatory compliance, and risk management enables informed decision-making that drives business success.

Resume objective example

Enthusiastic controller eager to apply strong analytical skills and attention to detail in a progressive finance team. Committed to improving financial reporting processes and ensuring compliance through effective budgeting and forecasting techniques, while fostering a culture of continuous improvement.

When crafting your resume profile, always begin with your job title. This strategy allows you to instantly convey your professional identity and ensures employers quickly grasp who you are and what you contribute.

Add unique sections to set you apart

Improve your controller resume by including optional sections that highlight your unique qualifications. These additions can set you apart from other applicants and give a fuller picture of your professional profile.

Consider incorporating relevant hobbies or volunteer experiences. Sharing how you spend your free time can demonstrate valuable skills and personal values that align with the role of a controller. Whether it's participating in financial literacy programs or engaging in community service, these activities showcase your commitment to growth and responsibility, traits that are essential for success in accounting and finance roles.

Three sections perfect for a controller resume

- Languages: As a controller, you engage regularly with various stakeholders. Highlighting your language skills on your resume can improve your ability to communicate financial insights effectively, making it a valuable asset.

- Volunteer Work: Including volunteer work on a resume can improve your professional skills and demonstrate your dedication to community service. It showcases your ability to collaborate and make a positive impact, making you a more appealing job seeker.

- Accomplishments: As a controller, quantifiable accomplishments are important for showcasing your impact on financial health. Display these achievements by weaving them into your work experience or placing them in a standalone accomplishments section.

5 Resume Formatting Tips

- Choose a format that matches your career stage.

Choosing the appropriate resume format is important for effectively showcasing your skills. If you have extensive experience, a chronological format highlights your career progression. For those with limited work history, consider a functional format to emphasize skills over job titles. A combination format works well if you want to present both experience and abilities.

- Pick a smart resume template.

Opt for a professional resume template to improve readability and streamline formatting. Using a well-designed template ensures your content is easily scannable. If you decide to create your own format, prioritize simplicity and choose fonts that work well with applicant tracking systems (ATS).

- Select an appropriate font.

Use a clear and professional font to ensure that your resume is clear and readable. Fonts like Helvetica, Georgia, or Verdana work well for both applicant tracking systems and hiring managers alike.

- Use consistent formatting.

Ensure your resume features uniform margins and is left-aligned to create a clean, polished look that captures the attention of hiring managers.

- Keep your resume to one or two pages.

When crafting your resume, remember that resumes should be one page long. This keeps your content concise and ensures that hiring managers can quickly see your qualifications. If you have extensive experience, consider a two-page format, but prioritize clarity and relevance.

What’s the Average Controller Salary?

Controller salaries vary based on location, career level, and qualifications.

This data, provided by the Bureau of Labor Statistics, will show you expected salary ranges for controllers in the top 5 highest-paying states, including the District of Columbia. The figures reflect the most current salary data available, collected in 2024.

- Full Range

- Most Common (25th–75th percentile)

- Average

Virginia

Most common: $137,470 - $209,060

Minnesota

Most common: $131,890 - $198,870

Georgia

Most common: $117,230 - $193,460

Illinois

Most common: $106,560 - $201,990

Texas

Most common: $109,300 - $196,580

Tools for Your Job Search

Are you gearing up to apply for that controller position you've been interested in? Before submitting your application, consider using our ATS Resume Checker. This invaluable tool provides insights into how well your resume will perform with the automated screening systems that many companies use to filter applicants.

Looking for a way to elevate your resume? Our AI Resume Builder offers customized recommendations tailored specifically to your financial expertise, along with professionally designed templates that effectively showcase your qualifications and achievements.

Frequently Asked Questions

Last Updated: October 14, 2025

Yes. A cover letter is important because it adds depth to your resume and fosters communication with employers. This document allows you to express your enthusiasm for the controller role and highlight how your experience makes you an ideal applicant. Don’t overlook this chance—write a cover letter that improves your application.

For a hassle-free approach, consider using our AI Cover Letter Generator. It helps you create personalized, compelling cover letters in minutes, complete with a variety of cover letter template options that align perfectly with your resume, making your application stand out effortlessly.

A resume is generally concise, typically ranging from one to two pages, while a CV (curriculum vitae) can extend several pages, offering detailed insights into your academic background, research endeavors, and professional experiences. This comprehensive nature allows you to showcase your qualifications more thoroughly in a CV.

You’ll often need a CV for positions in academia, science, law, or medicine. If you're unsure about which document to use or how to create an effective CV, our online CV Maker is here to help! With various CV templates tailored for different industries and career levels, you can craft a standout CV quickly and easily.

Absolutely, essential skills like "data analysis" and "system optimization" are important on controller resumes. It’s also beneficial to examine job descriptions for additional key phrases that employers prioritize.

To build an effective skills section as a controller, merge your technical expertise in financial software and data analysis with vital soft skills like leadership and communication. Illustrate how you applied these skills in past roles to streamline processes, improve reporting accuracy, and drive strategic decisions that benefited the organization.

To tailor your controller resume effectively, focus on highlighting the essential skills that match the job description. Carefully review the job listing to pinpoint keywords and phrases. Incorporate these terms into your resume to clearly demonstrate how your experience aligns with the role you want.

Maintaining an active LinkedIn profile is important for controllers seeking new opportunities. It helps you connect with industry professionals and effectively display your financial expertise and accomplishments.

Was this information helpful? Let us know!

Hailey is a career advice writer dedicated to helping job seekers excel in their careers.

More resources

The AI Boss Effect: 97% of Workers Have Asked ChatGPT for Advice Instead of Their Manager

Resume Now s latest report explores how AI is replacing manage...

37 Unique Skills to Put on Your Resume

Trying to avoid the skills you see pop up on resumes repeatedl...

Resume Now Spotlights 14 High-Innovation, High-Growth Jobs That Pay $60K+

Resume Now s latest report highlights some of the highest payi...