Table of contents

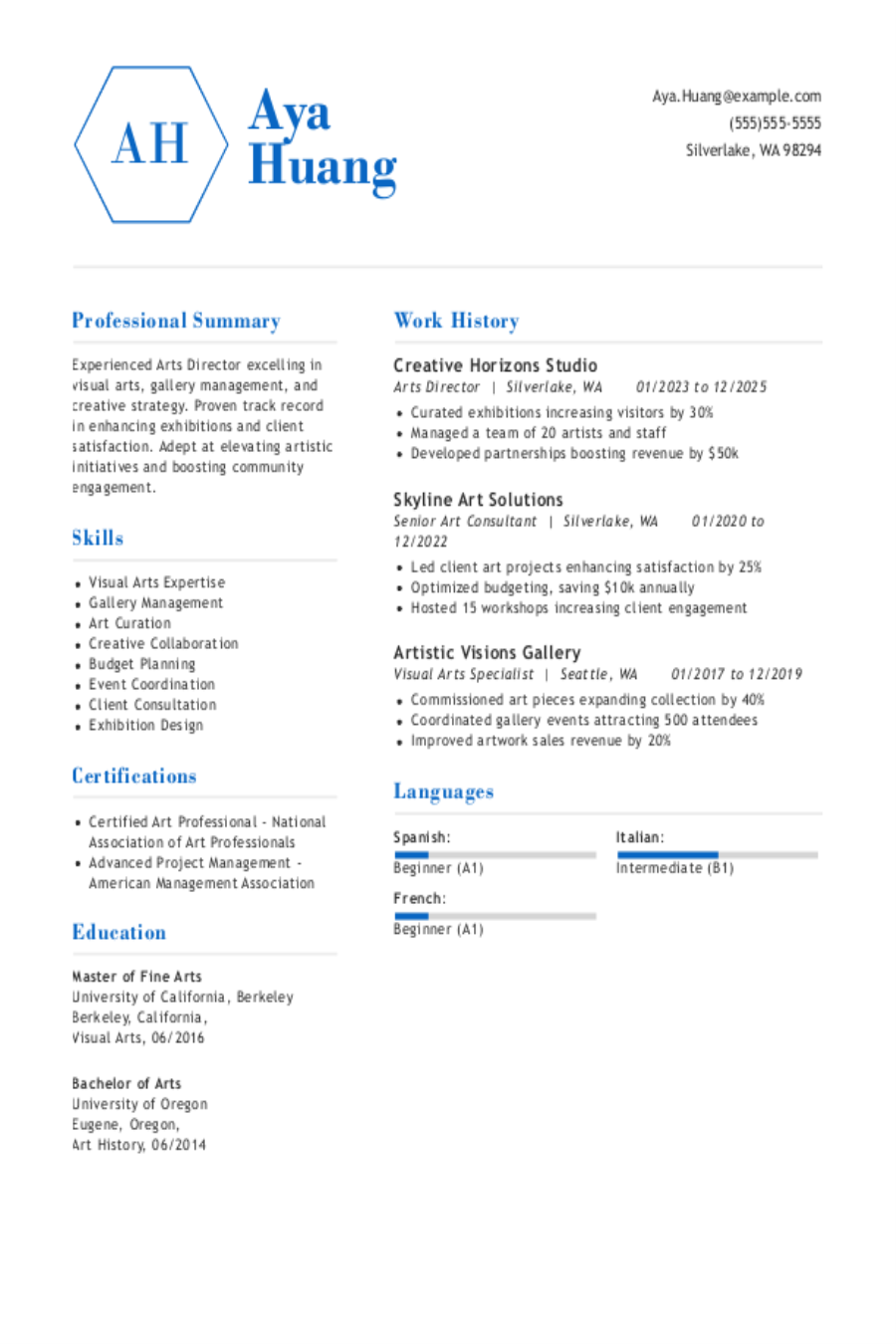

Popular Loan Officer Resume Examples

Entry-level loan officer resume

An entry-level resume for a loan officer should focus on relevant education, customer service skills, certifications, and any internships or volunteer work to showcase your ability to assist clients effectively.

Focuses on goals: The job seeker demonstrates a strong foundation in finance through their role as a loan officer and credit analyst, emphasizing continuous improvement and commitment to client satisfaction and risk management.

Prioritizes clarity: Using a clean and straightforward simple resume template improves clarity, enabling recruiters to swiftly identify key qualifications. This method highlights your achievements and skills without distractions.

Mid-career loan officer resume

A mid-career loan officer's resume should emphasize a strong balance of industry experience, key skills in customer service and finance, and evidence of ongoing professional development to attract potential employers.

Balances hard and soft skills: This job seeker effectively combines hard skills in loan origination and credit analysis with soft skills in customer relations and mentorship, demonstrating a well-rounded capability to excel as a loan officer.

Features a strong professional summary: This candidate's professional summary highlights essential qualifications, showcasing the loan officer's expertise in loan origination and credit analysis. This clarity allows recruiters and ATS to quickly recognize relevant experience and achievements.

Experienced loan officer resume

An experienced loan officer resume should emphasize measurable achievements, highlight relevant skills in lending and customer service, and clearly outline career progression to demonstrate expertise and reliability in the mortgage industry.

Opens with experience: The resume opens with a concise summary that emphasizes the applicant's extensive experience as a Loan Officer. It effectively highlights key skills and accomplishments, creating a professional tone that invites further exploration of their qualifications.

Quantifies accomplishments: Quantifiable achievements, such as managing over $10M in loan applications monthly and increasing the loan portfolio by 25% annually, provide clarity on a job seeker’s impact. These metrics allow recruiters to quickly grasp the applicant's capabilities and contributions in tangible terms.

No experience loan officer resume

A resume for an applicant with no experience should highlight transferable skills, relevant coursework, and any volunteer work to showcase their potential and commitment to the financial services industry.

Avoids jargon: Job seekers often resort to using complex jargon or inflated descriptions to embellish their basic responsibilities. However, a straightforward and honest approach is far more effective, as it clearly communicates skills and experiences without confusing employers.

Uses a simple style: The resume's clear layout effectively highlights qualifications, emphasizing relevant financial expertise and community involvement that align perfectly with the loan officer role.

More resume examples

Loan Officer Resume Template

Kickstart your career with this versatile loan officer resume template—effortlessly tailor it with your unique information to showcase your skills and experience.

Emma Park

Northwood, OH 43619

(555)555-5555

Emma.Park@example.com

Professional Summary

Experienced Loan Officer with expertise in financial analysis, risk assessment, and client relationship management. Proven track record in increasing loan approval rates and managing portfolios worth overM. Proficient in credit evaluation and data analytics.

Skills

- Financial Analysis

- Loan Processing

- Risk Assessment

- Client Relationship Management

- Portfolio Management

- Quantitative Methods

- Credit Evaluation

- Data Analytics

Work History

Loan Officer

Financial Growth Bank - Northwood, OH

June 2021 - September 2025

- Processed 100+ loan applications monthly

- Increased loan approval rate by 15%

- Managed loan portfolios worth M

Credit Analyst

PrimeLend Financial - Northwood, OH

January 2017 - May 2021

- Assessed creditworthiness of 200+ clients

- Reduced default rates by 10%

- Generated credit reports for M accounts

Finance Associate

MoneyWise Solutions - Cleveland, OH

March 2016 - December 2016

- Supported financial analysis for M

- Optimized reporting processes by 20%

- Reviewed 70+ financial statements

Certifications

- Certified Loan Officer - National Loan Officer Association

- Financial Risk Manager - Global Association of Risk Professionals

Education

Master of Business Administration Finance

Columbia University New York, NY

June 2015

Bachelor of Science Economics

University of California Los Angeles, CA

June 2013

Languages

- Spanish - Beginner (A1)

- French - Beginner (A1)

- German - Beginner (A1)

Must-Have Skills on a Loan Officer Resume

A strong skills section is vital for showcasing your abilities and increasing your chances of landing an interview.

Professionals in finance, banking, and insurance play a crucial role in maintaining trust and stability. The skills you highlight should reflect your ability to support accurate, efficient operations and contribute to sound decision-making. This section is your chance to show how you help safeguard and advance organizational goals.

The following data highlights the most sought-after hard and soft skills for a loan officer based on insights from Resume Now’s internal resume database.

When you’re ready to improve your resume with key skills, check out our AI Resume Skills Generator, which offers tailored suggestions that align with your job title, ensuring you present a balanced and compelling skill set.

Writing Your Loan Officer Resume

Having explored these effective resume examples, you're now prepared to dive into the detailed process of crafting your own resume. We'll walk you through how to write a resume step by step, breaking down each section for clarity and confidence in your approach.

List your most relevant skills

Your skills section should highlight core competencies such as financial analysis, customer service, and knowledge of lending regulations. This is important because it directly relates to the responsibilities you'll face in the role. By aligning your skills with those required by employers, you demonstrate that you possess what they are looking for.

To improve your visibility to both human recruiters and applicant tracking systems (ATS), incorporate keywords from the job listing into your skills section. For example, if a listing emphasizes "mortgage processing" or "client relationship management," make sure these terms appear within your skills. This helps your resume pass through ATS and impress employers.

Example of skills on a loan officer resume

- Proficient in evaluating financial documents to assess borrower eligibility

- Skilled in developing and maintaining client relationships

- Strong negotiation abilities to secure favorable loan terms

- Attentive to detail with exceptional organizational skills for managing multiple applications

Highlighting your soft skills on your resume can set you apart from other job seekers. Employers greatly value interpersonal abilities, as they are often challenging to teach; showcasing these skills demonstrates your potential to contribute positively to the team dynamic and workplace culture.

Highlight your work history

Your work experience section is a key part of your loan officer resume. This is where you can truly highlight your achievements and demonstrate how your skills have made a positive impact in previous roles. Focus on specific accomplishments that relate to the loan process, customer service, or financial analysis, and use strong language that incorporates key industry terms.

When detailing each job entry, include your title, the name of the employer, and the dates you were employed. This information not only builds your credibility but also provides context for your experiences.

Example of a loan officer work experience entry

- Loan Officer

First National Bank - Denver, CO

June 2019 - Present - Processed and approved over $20 million in loan applications annually, achieving a 95% approval rate while adhering to bank policies and regulations

- Provided expert financial advice to clients, resulting in a 30% increase in customer retention and satisfaction scores

- Conducted detailed credit analyses and assessments, reducing default rates by 15% through diligent risk management strategies

- Collaborated with cross-functional teams to develop innovative loan products, boosting new product sales by 25%

- Trained and mentored junior officers on compliance standards and effective client relations, improving team performance and efficiency

Aim for clarity in your resume bullet points by including specific achievements without excessive detail. Use active language to highlight your contributions, ensuring each point captures a significant outcome while remaining succinct and easy to read.

Include your education

The education section of your loan officer resume should be structured in reverse-chronological order, starting with your most recent degree or certification. Include relevant degrees such as a bachelor's in finance, business administration, or related fields. If you hold a higher degree, there's no need to mention your high school diploma or associate degree.

In cases where your education is ongoing, indicate the highest level you have completed and provide an expected graduation date. Lend credibility to your resume with bullet points highlighting coursework that directly relates to lending practices or financial regulations, especially if you're a current student or recent graduate.

Common certifications for a loan officer resume

- Licensed Mortgage Loan Originator (MLO) – Nationwide Mortgage Licensing System (NMLS)

- Certified Residential Mortgage Specialist (CRMS) – National Association of Mortgage Brokers (NAMB)

- Certified Mortgage Planning Specialist (CMPS) – Mortgage Bankers Association (MBA)

- FHA Direct Endorsement Underwriter Certification – Federal Housing Administration (FHA)

Sum up your resume with an introduction

Creating an effective profile section on your resume is important for making a strong first impression. This section serves as your personal introduction to potential employers, giving them a snapshot of your qualifications and career focus right from the start.

For experienced job seekers, a professional summary is ideal. It allows you to showcase significant accomplishments and relevant skills tailored to the loan officer role. Beginner loan officer candidates may also include a resume objective section that highlights their career development and professional goals.

Professional summary example

Dynamic loan officer with over 5 years of experience in the financial services industry. Demonstrated success in securing funding for clients while maintaining high satisfaction levels through personalized service and expert guidance. Proficient in credit analysis, risk assessment, and mortgage underwriting, with a strong commitment to helping borrowers achieve their financial goals.

Resume objective example

Enthusiastic loan officer eager to use strong analytical and interpersonal skills to support customer financial goals and improve lending processes. Committed to leveraging attention to detail and problem-solving abilities to improve loan approval efficiency and foster positive client relationships in a progressive financial institution.

When crafting your resume profile for a loan officer position, focus on embedding relevant keywords from the job description. This is your chance to showcase your qualifications and ensure your resume stands out to applicant tracking systems (ATS). By aligning your profile with the specific skills and experiences requested by employers, you improve your chances of making a strong impression.

Add unique sections to set you apart

Optional resume sections for loan officer positions can help you stand out by highlighting your unique qualifications beyond standard work experience. These sections provide an opportunity to present skills and attributes that align with the role.

Including relevant hobbies or volunteer work in your resume allows potential employers to see different aspects of your professional life. For instance, if you participate in financial literacy programs as a volunteer, it showcases your commitment to community engagement and illustrates how you apply your expertise outside of work.

Three sections perfect for a loan officer resume

- Languages: As a loan officer, effective communication is important when guiding clients through financial decisions. Highlighting your language skills on your resume can expand your client base and improve trust, making you a more attractive applicant in diverse markets.

- Volunteer Work: Incorporating volunteer work on a resume showcases not only your professional skills but also your dedication to community service. Highlighting this commitment to helping others can make you stand out to potential employers.

- Accomplishments: As a loan officer, quantifiable accomplishments are important for illustrating your impact on clients and the financial institution. You can reference your key achievements within your work experience section or create a unique section to house quantifiable metrics.

5 Resume Formatting Tips

- Choose a format that matches your career stage.

When choosing the ideal resume format, it's important to consider your career level and experience. If you have extensive experience as a loan officer, a chronological format effectively showcases your progress. However, if you're just beginning, a functional resume highlights your skills rather than work history. A combination format mixes both styles, providing a comprehensive view of your qualifications.

- Pick a smart resume template.

Using a professional resume template can greatly improve the readability of your application. It allows hiring managers to quickly scan your qualifications and experience. If you opt for a custom format, ensure it remains clean and uses ATS-friendly fonts to avoid any issues during the application process.

- Select an appropriate font.

Choose a clean, professional font to improve your resume's readability. Fonts such as Arial, Calibri, or Georgia not only look polished but also work well with applicant tracking systems (ATS), making it easier for hiring managers to read your qualifications effectively.

- Use consistent formatting.

Align your resume to the left and maintain uniform margins to improve readability and present a polished, professional image to potential employers.

- Keep your resume to one or two pages.

When crafting your resume, keep in mind that resumes should be one page long to maintain focus on your key qualifications. If you have extensive experience, consider a two-page format, but always prioritize clarity and conciseness to effectively showcase your strengths.

What’s the Average Loan Officer Salary?

Loan officer salaries vary based on location, career level, and qualifications.

This data, provided by the Bureau of Labor Statistics, will show you expected salary ranges for loan officers in the top 5 highest-paying states, including the District of Columbia. The figures reflect the most current salary data available, collected in 2024.

- Full Range

- Most Common (25th–75th percentile)

- Average

District of Columbia

Most common: $78,590 - $139,390

New York

Most common: $64,990 - $161,920

Massachusetts

Most common: $76,530 - $133,110

Vermont

Most common: $62,690 - $127,190

New Jersey

Most common: $63,070 - $127,610

Tools for Your Job Search

Aiming for that coveted loan officer position? Before submitting your application, make sure to use our ATS Resume Checker. This essential tool provides valuable insights on how effectively your resume performs against the automated systems many financial institutions use for initial job seeker screening.

Need more comprehensive support in crafting your resume? Our AI Resume Builder offers tailored content recommendations specific to your experience as a loan officer and comes with professionally designed templates. These features help emphasize your expertise in areas like risk assessment and client relations, making a lasting impression on hiring managers.

Frequently Asked Questions

Last Updated: September 19, 2025

Absolutely. A cover letter is important as it adds depth to your resume and creates a valuable opportunity for you to communicate directly with potential employers. It’s your chance to express why you're excited about the loan officer role and showcase how your unique experiences make you a great fit. Don’t overlook this important step; write a cover letter that highlights your passion and qualifications.

For a quick and effective solution, consider using our AI Cover Letter Generator. It helps you create tailored cover letters in just minutes, complete with various cover letter template options that align perfectly with your resume, making sure you present yourself in the best light possible.

A resume is generally a concise document, typically ranging from one to two pages. In contrast, a curriculum vitae (CV) can extend several pages and offers an in-depth look at your academic background, research contributions, publications, and professional experiences. This level of detail makes CVs ideal for those in academia or specialized fields.

You should use a CV when applying for positions in education, research, law, or medicine. If you're looking to create an impressive CV quickly, our online CV Maker is the perfect solution. With various CV templates designed for different industries and career levels at your fingertips, you can tailor your CV to meet specific job requirements with ease.

A frequent resume mistake loan officers make is submitting documents that ATS systems cannot effectively read. To improve your chances, use a resume template is ATS-friendly and tailor your resume to align with the specific job descriptions you apply for. This customization shows employers you're a perfect match for the position, increasing your visibility in the hiring process.

An active LinkedIn presence is important for a loan officer's job search. It helps you connect with industry professionals, expand your network, and effectively showcase your expertise in lending and finance to potential employers.

Many loan officers begin their careers as trainees or assistants in financial institutions. With experience and additional certifications, they can progress to senior loan officer roles or specialize in areas like commercial lending.

When crafting your resume as a loan officer, briefly mention your career aspirations in the summary. However, use your cover letter to delve deeper into your goals, illustrating how specific roles can facilitate your professional growth. Target positions that offer development opportunities, showcasing your commitment to advancing in the industry and improving your skill set.

Was this information helpful? Let us know!

Hailey is a career advice writer dedicated to helping job seekers excel in their careers.

More resources

63% Expect AI’s Role in Compensation to Grow Significantly in the Next 5 Years

Resume Now s latest report examines how workers are responding...

How to Include Research Skills on a Resume: 40+ Examples

Check out our guide to understand what research skills are and...

How to List Excel Skills on Your Resume (40+ Examples, Definition & Tips to Improve)

Learn how to list Excel skills on your resume with our guide f...

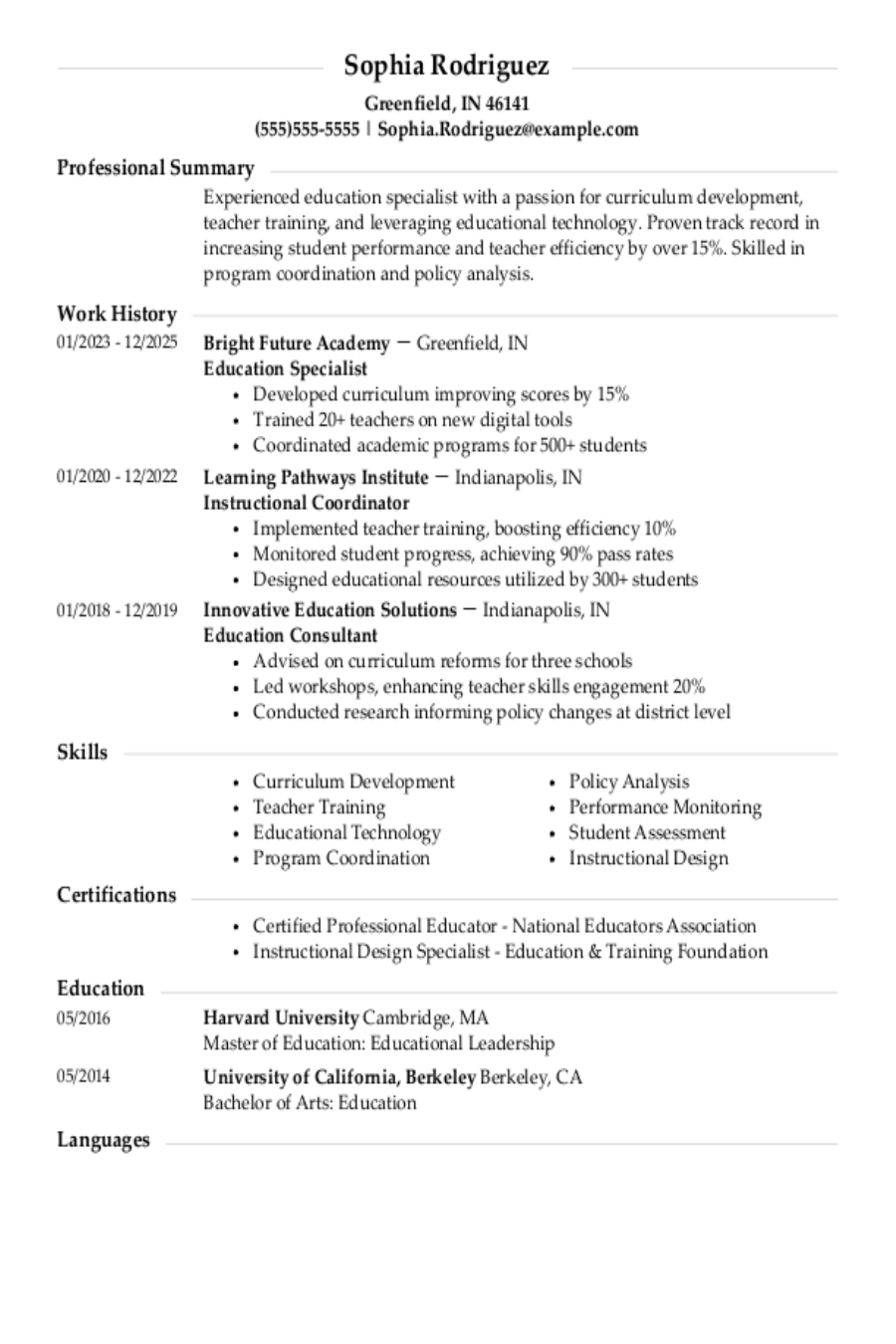

Education Resume: Examples & Templates

As an educator you need a resume that captures the attention ...

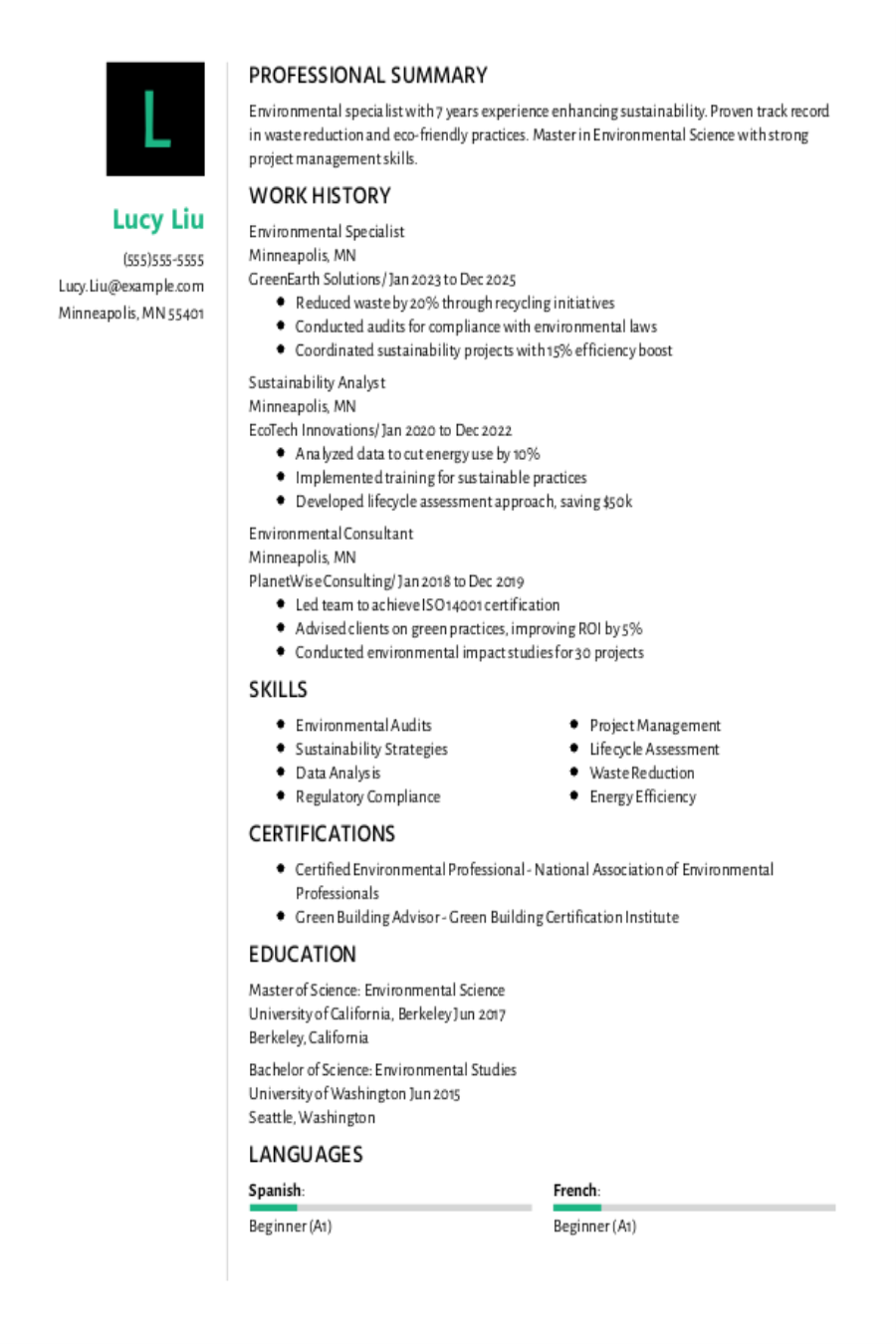

Environmental Resume: Examples & Templates

As an environmental professional you need a resume that captu...