Popular Banker Resume Examples

Entry-level banker resume

An entry-level resume for a banker should focus on relevant coursework, internships, customer service skills, and certifications to effectively show capability and potential despite limited professional experience.

Emphasizes soft skills: This resume showcases the applicant's strong soft skills, including client relationship management and communication abilities, which help make up for limited technical experience.

Places skills over experience: The functional resume format is strategic for this entry-level banker as it highlights skills like asset management and financial analysis, showcasing relevant competencies over limited experience.

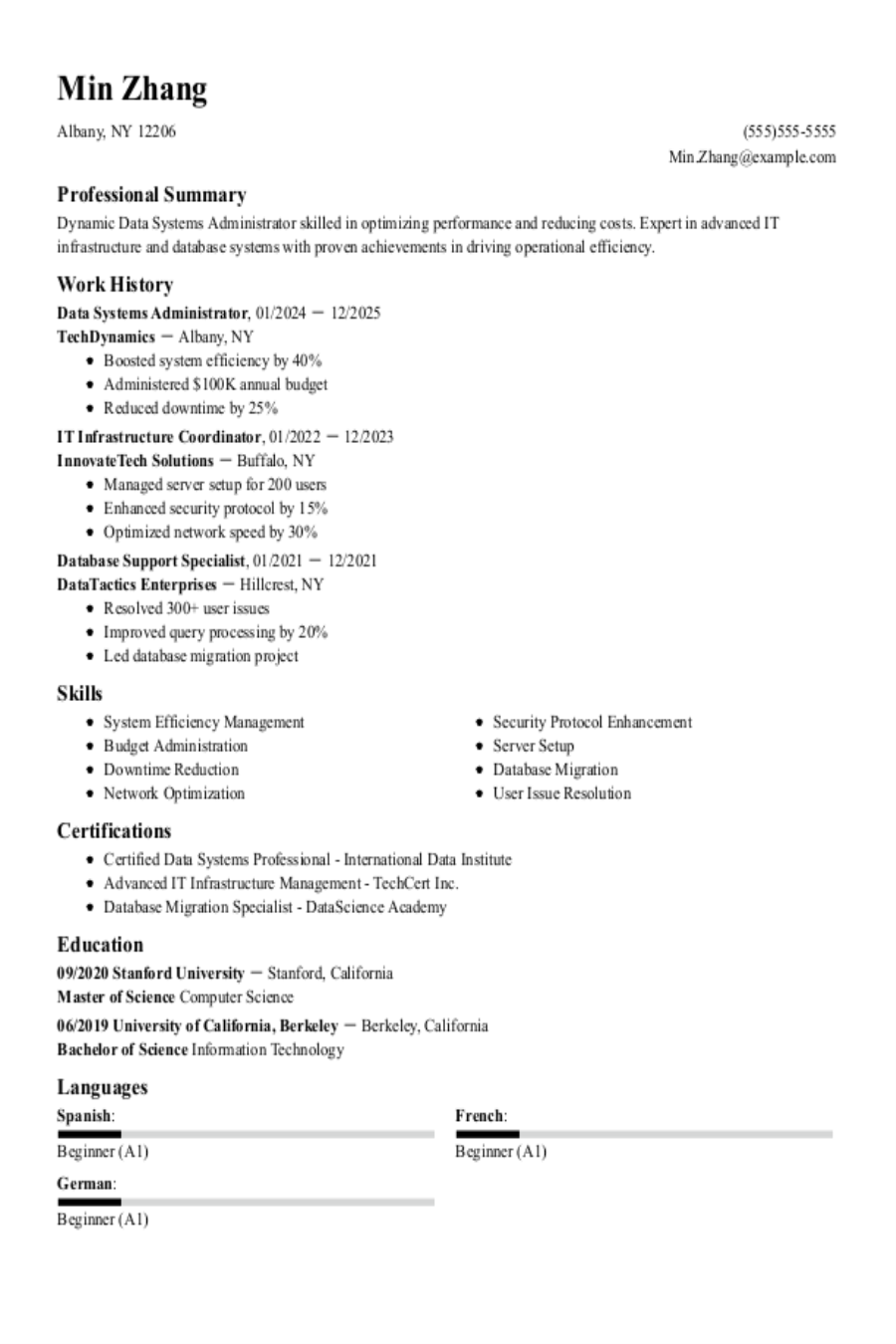

Mid-career banker resume

A mid-career banker’s resume should emphasize a robust combination of relevant experience, key skills in financial analysis, and evidence of professional growth to attract prospective employers' attention.

Leads with a strong professional summary: A thoughtful professional summary highlights this banker’s extensive experience in portfolio management and client retention, ensuring that recruiters and ATS swiftly recognize their significant contributions to revenue growth and operational efficiency.

Employs active language: Using strong action verbs such as "managed," "increased," and "streamlined" clearly illustrates a proactive approach.

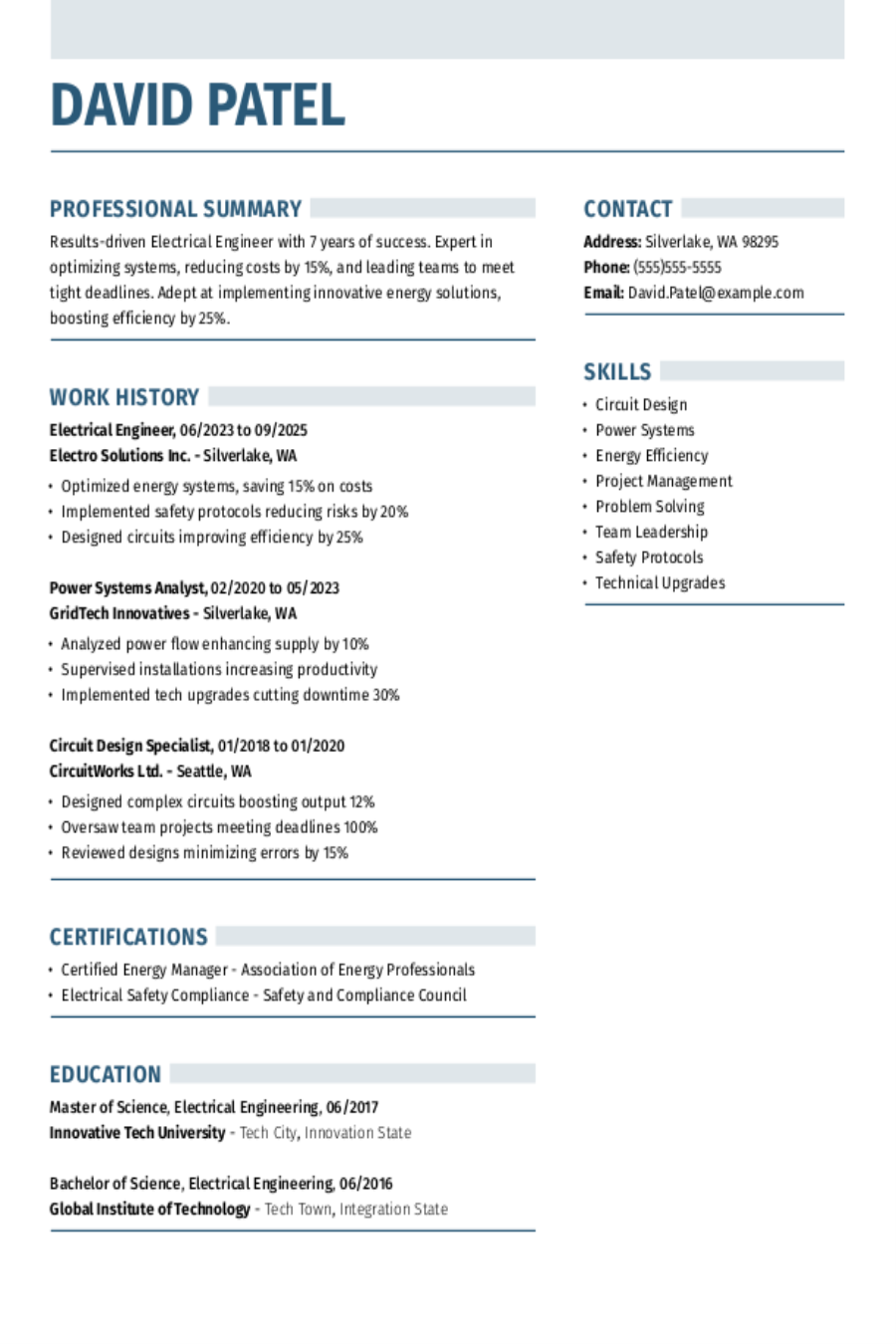

Experienced banker resume

An experienced banker resume should prioritize highlighting key achievements, relevant skills, and a clear trajectory of professional growth to effectively demonstrate the job seeker's expertise and suitability for advanced roles in the financial sector.

Embraces the modern style: This modern resume template effectively showcases the applicant's innovative approach and professional brand.

Numerical data: Quantifiable achievements in a banker’s resume provide clear evidence of their impac. By showcasing specific metrics—like managing portfolios over $10M or achieving a 15% increase in client retention—this candidate effectively illustrates their contributions and value.

No experience banker resume

A resume for an applicant with no experience should highlight transferable skills, relevant coursework, and any internships or volunteer activities that showcase financial acumen and customer service abilities.

Emphasizes professional skills: Emphasizing strong financial analysis and customer service skills demonstrates the job seeker's readiness for an entry-level banker role, despite limited formal experience in the field.

Relies on a simple style: The resume's straightforward layout effectively highlights qualifications in finance and community service, allowing potential employers to quickly recognize the applicant's relevant experience and skills.

More resume examples

Banker Resume Template

Looking to create a standout application? This banker resume template offers a solid foundation for you to personalize and showcase your unique skills and experiences effectively.

David Garcia

Silverlake, WA 98293

(555)555-5555

David.Garcia@example.com

Professional Summary

Dynamic banker with proven experience in financial analysis and client management. Skilled at crafting strategic investment plans, enhancing loan strategies, and optimizing customer satisfaction. Seeking opportunity to leverage skills at Skyline Financial Group.

Work History

Banker

Skyline Financial Group - Silverlake, WA

January 2023 - August 2025

- ProcessedM in loan applications monthly.

- Financial Consultant

- Greenfield Financial Advisors - Tacoma, WA

- January 2022 - December 2022

- Managed portfolios worth M.

- Conducted market analysis increasing sales by 15%.

- Led a team in improving efficiency by 20%.

Investment Analyst

Comet Investments LLC - Seattle, WA

January 2021 - December 2021

- Analyzed market trends predicting 10% growth.

- Optimized asset allocation reducing risks by 30%.

- Prepared forecasts aiding strategic planning.

Skills

- Financial analysis

- Loan processing expertise

- Client relationship management

- Market forecasting

- Investment strategies

- Portfolio management

- Risk assessment

- Strategic planning

Education

Master of Business Administration Finance

New York University New York, NY

December 2020

Bachelor of Science Economics

Boston College Boston, MA

June 2017

Certifications

- Certified Financial Planner - CFP Board

- Chartered Financial Analyst - CFA Institute

Languages

- Spanish - Beginner (A1)

- French - Beginner (A1)

- Mandarin - Intermediate (B1)

Writing Your Banker Resume

Having explored these impressive resume examples, you're now prepared to dive into the art of crafting your own. We'll walk you through the essential steps involved in how to write a resume, examining each section thoroughly to ensure your success.

List your most relevant skills

An effective skills section on your banker resume is important for showcasing your qualifications. This section should highlight both technical abilities, such as financial analysis and risk management, as well as essential soft skills like client relations and attention to detail.

To maximize your chances of passing through applicant tracking systems (ATS), incorporate keywords from the job listing. For instance, if the posting emphasizes "financial modeling" or "customer service," make sure these phrases appear in your skills section to maximize your visibility to ATS.

Example of skills on a banker resume

- Proficient in financial analysis and investment strategies

- Expertise in client relationship management and personalized banking solutions

- Strong analytical skills with a focus on risk assessment and mitigation

- Effective communicator with the ability to collaborate across departments for seamless service delivery

When crafting your resume, don't underestimate the power of soft skills. Employers highly value interpersonal abilities because they are often challenging to teach; highlighting these traits can set you apart from other applicants and show your potential to contribute positively to a team environment.

Highlight your work history

Your work experience section is a critical component of your banker resume. This part should emphasize your achievements and demonstrate how you have effectively applied your skills in various banking scenarios. Use this opportunity to showcase specific accomplishments that illustrate your impact on the organization, such as increasing sales or improving customer satisfaction.

For each job entry, it's essential to include key details like your job title, the employer's name, and the dates you were employed. This information not only establishes your professional credibility but also helps employers gauge your experience level quickly.

Example of a banker work experience entry

- Banker

First National Bank - New York, NY

June 2019 - Present - Facilitate over 150 customer interactions weekly to assess financial needs and recommend suitable banking products, achieving a 90% conversion rate on sales pitches

- Develop customized financial plans for clients, resulting in a portfolio growth of 25% year-over-year for high-net-worth individuals

- Conduct regular market analysis to stay informed about product offerings and competitor pricing, leading to improved customer recommendations and increased trust in services

- Collaborate with cross-functional teams to streamline account opening processes, reducing onboarding time by 30% while maintaining compliance standards

- Mentor junior bankers through training sessions on effective sales tactics and customer relationship management, improving team performance metrics by 15%

Your resume bullet points should aim for clarity by using strong action verbs and quantifiable results. Keep each point concise—focus on specifics that showcase your achievements without unnecessary detail to maintain the reader's attention.

Include your education

The education section of your banker resume should list your academic credentials in reverse-chronological order, starting with the most recent degree. Include relevant degrees, diplomas, and any professional certifications while omitting your high school diploma if you hold a bachelor's degree or higher.

If you are currently enrolled in a program or have incomplete education, mention the highest level completed alongside an expected graduation date. You may also include bullet points to showcase relevant coursework or noteworthy academic accomplishments, particularly if you are a current student or recent graduate.

Common certifications for a banker resume

- Certified Financial Planner (CFP) – Certified Financial Planner Board of Standards

- Chartered Financial Analyst (CFA) – CFA Institute

- Financial Risk Manager (FRM) – Global Association of Risk Professionals (GARP)

- Certified Investment Management Analyst (CIMA) – Investments & Wealth Institute

Sum up your resume with an introduction

Your resume should begin with a professional summary that captivates employers and sets the tone for your application. This section is important as it provides a snapshot of your professional background, allowing hiring managers to quickly gauge your fit for the position. An effective profile not only showcases your career trajectory but also emphasizes what unique contributions you can bring to their organization.

If you're an entry-level banker, you may write a resume objective instead of a summary. This style allows you to briefly discuss your professional development and career goals.

Professional summary example

Dynamic banker with over 10 years of experience in retail and investment banking sectors. Demonstrated success in improving client portfolios and driving revenue growth through strategic financial advising and risk management. Proficient in market analysis, loan structuring, and customer relationship management, consistently exceeding performance targets while ensuring compliance with industry regulations.

Resume objective example

Enthusiastic banker eager to apply strong analytical and customer service skills to improve financial operations within a progressive bank. Committed to using attention to detail and problem-solving abilities to improve client satisfaction and drive operational efficiency while developing long-term banking strategies.

To improve your resume for a banker position, focus on crafting a compelling resume profile that includes relevant keywords from the job description. This approach allows you to showcase essential skills and qualifications right at the start, increasing your chances of passing through applicant tracking systems (ATS).

Add unique sections to set you apart

Optional resume sections can significantly improve your profile as a banker by highlighting your unique qualifications and experiences. These sections allow you to showcase aspects of your professional journey that set you apart from other applicants.

Incorporating relevant hobbies or volunteer work into your resume can reveal the values and skills that define you. This additional information not only enriches your application but also gives employers insight into how you might fit within their company culture and contribute beyond just the required tasks.

Three sections perfect for a banker resume

- Languages: As a banker, you engage with diverse clients regularly. Highlighting your language skills on your resume can improve your ability to build rapport and better understand clients' needs, making it a valuable asset.

- Volunteer Work: Including volunteer work on a resume not only showcases your dedication to community service but also highlights essential skills like teamwork and leadership. Demonstrating this commitment can set you apart in the competitive banking industry.

- Quantifiable Metrics: As a banker, quantifiable accomplishments reflect your ability to improve financial performance. Include them in your experience bullet points or create an optional section to highlight your measurable impact.

5 Resume Formatting Tips

- Choose a format that matches your career stage.

Choosing the appropriate resume format is important for showcasing your banking expertise. If you have substantial experience in the field, consider a chronological format to highlight your career progression.

For those just starting out, a functional resume can emphasize skills over work history. A combination format offers a balanced approach, allowing you to present both relevant skills and professional experiences effectively. - Pick a smart resume template.

Using a professional resume template is essential for ensuring your application stands out. A well-structured template improves readability, allowing hiring managers to quickly grasp your qualifications. If you prefer a custom format, aim for simplicity and select ATS-friendly fonts to maintain clarity and professionalism throughout your document.

- Select an appropriate font.

When selecting a font for your resume, prioritize readability and professionalism. Opt for a professional font like Helvetica, Georgia, or Verdana to ensure your resume looks polished and is easy to read for both applicant tracking systems (ATS) and hiring managers alike.

- Use consistent formatting.

Ensure your resume features uniform left alignment and balanced margins to create a polished, professional look that stands out to potential employers.

- Keep your resume to one or two pages.

When crafting your resume, remember that resumes should be one page long to maintain clarity and focus. However, if you have extensive experience, a second page can be acceptable. Just ensure every detail is relevant and highlights your key achievements.

Tools for Your Job Search

Are you gearing up to apply for that exciting banker position? Before you hit send on your application, take a moment to use our ATS Resume Checker. This invaluable tool analyzes how well your resume meets the criteria of automated systems commonly used by financial institutions during their initial applicant screenings.

If you’re looking to elevate your application, our AI Resume Builder is here to help. It offers tailored recommendations and professional templates specifically designed to showcase your banking skills and achievements effectively, ensuring that your qualifications stand out in a competitive field.

Frequently Asked Questions

Last Updated: September 17, 2025

Absolutely. A cover letter is important because it adds depth to your resume and allows you to communicate directly with potential employers. It’s your chance to express why the banker role excites you and how your unique experiences make you a great fit. So, don’t hesitate—write a cover letter that showcases your enthusiasm and qualifications.

For an efficient way to create a personalized cover letter, check out our AI Cover Letter Generator. It helps you craft a tailored, winning cover letter in no time, offering various cover letter template options that align perfectly with your resume for a polished presentation.

A resume is generally a concise document, typically spanning one to two pages, focusing on relevant work experience and skills. In contrast, a CV (curriculum vitae) can extend several pages and includes extensive details about your academic history, research contributions, publications, and professional experiences.

You should use a CV when applying for specialized positions in academia, science, law, or medicine. If you're looking to create one for such roles, our online CV Maker is an excellent resource. It provides access to various CV templates tailored to different industries and career levels, helping you craft a polished and customized document quickly and easily.

One frequent resume mistake bankers make is neglecting the ATS compatibility. To avoid being filtered out, ensure your resume template is ATS-friendly. Additionally, tailor your content to align with the specific job description, highlighting relevant skills and experiences that resonate with potential employers in the banking sector.

Absolutely, essential skills such as "financial analysis" and "customer relationship management" are critical on banker resumes. Additionally, reviewing job descriptions can help you identify other important keywords and phrases that employers prioritize in job seekers.

To improve your networking skills as a banker, regularly reconnect with former colleagues to share insights and opportunities. Joining professional organizations specific to banking can also significantly expand your network. Don’t forget to keep your LinkedIn profile updated; it’s a powerful tool for connecting with industry professionals and staying informed about market trends.

To excel in your banker interview, take the time to practice common job interview questions and answers. This preparation boosts your confidence and equips you to handle any unexpected queries that may arise during the conversation.

Was this information helpful? Let us know!

Hailey is a career advice writer dedicated to helping job seekers excel in their careers.

More resources

What if I Don't Have Professional References?

Access advice on what to do if you get to the reference check ...

The Most Dangerous Jobs in America: Some Pay Less Than $40K, Others Top $190K

Resume Now s report reveals the highest and lowest paying dang...

Still in the Game: 9 in 10 Older Workers Are Upskilling to Stay Competitive

The idea that older workers are resistant to change doesn t ho...

Interview-Winning Data and Systems Administration Resume Examples and Tips

Was this information helpful? Let us know ...