Popular Fraud Analyst Resume Examples

Entry-level fraud analyst resume

An entry-level resume for a fraud analyst should focus on relevant coursework, internships, analytical skills, volunteer work, and any certifications to demonstrate readiness for the role despite limited experience.

Functional format: The functional resume format is ideal for highlighting critical skills like fraud detection and data analysis. This format emphasizes skills over a work history, which is perfect when you're early in your career.

Emphasis on soft skills: This resume highlights strong analytical and investigative abilities, which effectively compensate for limited experience. For example, their soft skills in analyzing data trends resulted in a 15% reduction in fraud loss.

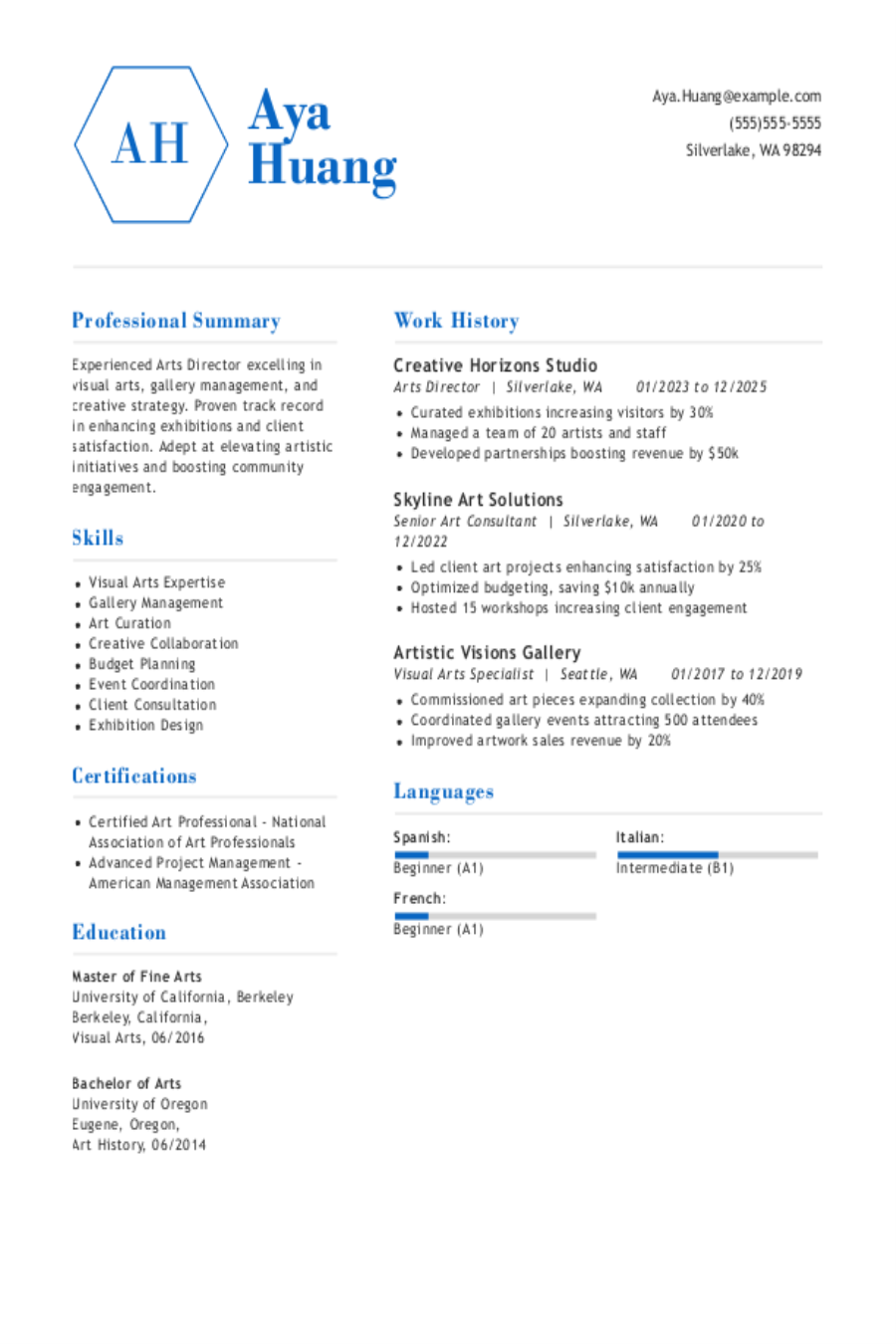

Mid-career fraud analyst resume

A mid-career fraud analyst resume should emphasize a combination of analytical experience, technical skills, and work experience to effectively demonstrate value to potential employers in the financial sector.

Powerful resume profile: The professional summary starts the resume strong by showcasing relevant experiences and quantifiable achievements. A high-quality summary aids recruiters and applicant tracking systems in quickly recognizing a job seeker's expertise.

Balanced skills section: This resume effectively highlights a mix of hard skills, such as fraud detection and data analysis, alongside soft skills like collaboration and compliance awareness, presenting a well-rounded application.

Experienced fraud analyst resume

An experienced fraud analyst resume should prioritize quantifiable achievements, relevant skills, and a clear career progression.

Numerical data: Quantifiable achievements significantly improve a job seeker's profile by providing clear metrics that demonstrate their impact. For instance, noting a 30% reduction in fraud or recovering $500K from fraudulent activities showcases the job seeker's effectiveness and makes their contributions tangible to recruiters.

Reverse-chronological experience: The chronological resume format effectively highlights the job seeker's extensive experience, presenting a clear and organized timeline that showcases their career advancements in fraud analysis and risk management.

No experience fraud analyst resume

A resume for an applicant with no experience should highlight relevant skills, academic achievements, and any volunteer work or internships that showcase analytical abilities and attention to detail.

Emphasis on relevant skills: Putting the focus on critical skills illustrates the applicant's readiness for a fraud analyst role despite limited professional experience.

Extracurricular activities: Incorporating volunteer experiences and extracurricular activities can improve a resume by demonstrating valuable skills in communication, teamwork, and problem-solving, which are important in this arena.

More resume examples

Fraud Analyst Resume Template

Kickstart your career with this resume template designed for fraud analysts. Simply personalize it with your details to showcase your skills and experiences effectively.

Danielle Ross

Jersey City, NJ 07304

(555)555-5555

Danielle.Ross@example.com

Professional Summary

Experienced fraud analyst with expertise in detecting and mitigating financial crimes. Skilled in risk assessment, forensic accounting, and fraud detection tools. Proven record of saving over M and reducing fraud incidents by up to 35%.

Work History

Fraud Analyst

SecureEdge Financial Services - Jersey City, NJ

March 2022 - August 2025

- Reduced fraud incidents by 35% through advanced analytics.

- Investigated over 120 fraud cases monthly with 98% accuracy.

- Designed fraud monitoring tools, boosting detection by 25%.

Risk Associate

Fortress Insurance Group - Maplewood, NJ

February 2019 - February 2022

- Analyzed 200+ transactions daily for fraudulent patterns.

- Developed predictive models, reducing risk exposure by 20%.

- Collaborated with law enforcement in solving 15+ fraud cases.

Fraud Monitoring Specialist

Integrity Bank Solutions - Maplewood, NJ

August 2016 - January 2019

- Identified M+ in fraudulent transactions, saving the bank.

- Trained 10 team members on fraud detection techniques.

- Optimized workflow, reducing case resolution time by 15%.

Skills

- Fraud Detection

- Risk Analysis

- Data Analytics

- Financial Investigations

- Forensic Accounting

- Anti-Money Laundering (AML)

- SQL for Data Analysis

- Compliance Monitoring

Education

Master of Science Forensic Accounting and Fraud Examination

University of Texas at Austin Austin, Texas

May 2016

Bachelor of Science Accounting

Texas A&M University College Station, Texas

May 2014

Certifications

- Certified Fraud Examiner (CFE) - Association of Certified Fraud Examiners

- Anti-Money Laundering Specialist Certification - Association of Certified Anti-Money Laundering Specialists (ACAMS)

Languages

- Spanish - Beginner (A1)

- French - Intermediate (B1)

- German - Beginner (A1)

Must-Have Skills on a Fraud Analyst Resume

A strong skills section is essential for crafting a compelling resume.

Professionals in finance, banking, and insurance play a crucial role in maintaining trust and stability. The skills you highlight should reflect your ability to support accurate, efficient operations and contribute to sound decision-making. This section is your chance to show how you help safeguard and advance organizational goals.

The following data highlights the most sought-after hard and soft skills for a fraud analyst according to Resume Now’s internal resume data.

Once you’re ready to improve your resume with skills, try our AI Resume Skills Generator. It offers tailored suggestions based on your job title, helping you craft an impressive and individualized skill set.

Writing Your Fraud Analyst Resume

Having explored some effective resume examples, you're now prepared to make your own. We’ll guide you through how to write a resume step by step, giving you pro tips along the way.

List your most relevant skills

Creating a compelling skills section for your fraud analyst resume is your chance to highlight the technical abilities that make you an ideal job seeker, such as data analysis, risk assessment. But don't forget about soft skills like attention to detail and analytical thinking—these traits are equally important in this role.

To ensure your skills resonate with recruiters and applicant tracking systems (ATS), carefully read the job listing and incorporate relevant keywords. By aligning your skills section with the specific language used in the job posting, you demonstrate that you're a fit for the position.

Example of skills on a fraud analyst resume

- Proficient in analyzing financial data to detect irregularities and potential fraud

- Adept at using advanced analytical tools and software for fraud detection

- Strong communicator with the ability to present findings clearly to stakeholders

- Highly organized with excellent time management skills to handle multiple cases efficiently

When crafting your resume as a fraud analyst, don’t overlook the importance of soft skills. Employers value interpersonal abilities like communication and teamwork highly because they can be challenging to develop, often making you stand out in a competitive job market.

Highlight your work history

Your work experience section is a key component of your fraud analyst resume. This section should highlight your major achievements and demonstrate how you have effectively applied your analytical skills in real situations. Ensure that each entry is filled with relevant keywords that showcase your expertise, making it easy for hiring managers to see the value you bring.

For each job entry, it’s essential to include specific details: your job title, the name of the employer, and the dates you were employed. This information not only establishes your professional credibility but also helps employers understand your career timeline at a glance. Additionally, emphasize measurable accomplishments that illustrate how you've contributed to fraud detection or prevention efforts in previous roles.

Example of a fraud analyst work experience entry

- Fraud Analyst

XYZ Financial Services - New York, NY

June 2019 - Present - Conduct thorough investigations of fraudulent activities, analyzing data patterns and trends to identify potential threats and mitigate risks.

- Use advanced analytical tools to monitor transactions in real-time, successfully reducing fraud incidents by 30% over two years.

- Collaborate with cross-functional teams to develop and implement comprehensive fraud prevention strategies, improving overall security measures.

- Train junior analysts on industry best practices for detecting and reporting suspicious activity, fostering a knowledgeable and proactive team environment.

- Prepare detailed reports for management outlining investigative findings and recommendations, contributing to informed decision-making processes.

Quantifying achievements helps show your impact on reducing losses and improving security measures. For example, noting that you identified and prevented $500,000 in fraudulent transactions over a year highlights your effectiveness in safeguarding company assets.

Include your education

The education section of your fraud analyst resume should present your diplomas and degrees in reverse-chronological order, starting with the most recent. It’s essential to include relevant degrees or certifications while omitting your high school diploma if you have a bachelor's degree or higher. Highlighting any honors or specific coursework related to fraud analysis can help strengthen this portion of your resume.

If you are currently pursuing further education or have not completed a degree, list the highest level of education attained along with an expected graduation date. For students or recent graduates, including bullet points that detail relevant coursework, academic projects, or achievements tied to fraud detection and analysis can demonstrate foundational knowledge and skills in this area.

Common certifications for a fraud analyst resume

- Certified Fraud Examiner (CFE) – Association of Certified Fraud Examiners (ACFE)

- Certified Financial Crime Specialist (CFCS) – Association of Certified Financial Crime Specialists (ACFCS)

- Certified Anti-Money Laundering Specialist (CAMS) – Association of Certified Anti-Money Laundering Specialists (ACAMS)

- Chartered Financial Analyst (CFA) – CFA Institute

Sum up your resume with an introduction

The profile section of your resume represents prime real estate for making a strong first impression and demonstrating your fit for the position. This concise yet impactful section can influence whether hiring managers view you as a serious contender for the role.

Determining whether to use a professional summary or resume objective depends on your professional background and target audience. Experienced candidates can capitalize on summaries to present compelling evidence of their capabilities through past accomplishments and industry knowledge. Recent graduates and career transitioners should consider objectives that highlight relevant education, applicable competencies, and enthusiasm for their new professional direction.

Professional summary example

Analytical fraud analyst with over 5 years of experience in detecting and preventing financial crimes within the banking sector. Demonstrated success in implementing advanced analytical techniques that have reduced fraudulent transactions by 30%. Proficient in data analysis, risk assessment, and regulatory compliance, ensuring robust protection against emerging threats while improving overall operational integrity.

Resume objective example

Enthusiastic fraud analyst eager to apply analytical thinking and attention to detail within a forward-thinking organization. Committed to using strong data analysis and problem-solving skills to identify fraudulent patterns and improve fraud prevention strategies, ultimately contributing to improved financial integrity.

Your resume profile serves as your first impression. Use this section to strategically insert keywords from the job description, ensuring that your qualifications align with what employers seek.

Add unique sections to set you apart

Optional resume sections are an excellent way for you to highlight your unique qualifications. These segments can capture the attention of potential employers by showcasing skills and experiences that set you apart from other applicants.

By including relevant hobbies or volunteer work, you not only demonstrate your dedication to personal and professional growth but also reflect your values. For instance, if you engage in community service related to financial literacy, it illustrates your commitment to combating fraud beyond the workplace. Such insights into your life help employers see how your character aligns with their organizational culture and mission, improving your overall candidacy.

Three sections perfect for a fraud analyst resume

- Languages: Highlighting language skills on your resume can improve your ability to interact with diverse clients and stakeholders, making it a strong asset.

- Volunteer work: Including volunteer work on a resume showcases your dedication to the community while improving your professional skills. It demonstrates your ability to collaborate, lead, and create positive change—qualities that employers highly value.

- Accomplishments: Quantifiable achievements are important to illustrate your impact on reducing losses. You could mention identifying fraudulent activities that saved the company over $500,000 or increasing detection rates by 30%.

5 Resume Formatting Tips

- Choose a format that matches your career stage.

When selecting a resume format, consider your career level and experience. If you're an experienced fraud analyst, a chronological resume effectively highlights your work history and accomplishments. For those just starting in the field, using a functional resume can emphasize relevant skills over experience. Another option is the combination format, which allows you to showcase both skills and job history to create a well-rounded presentation of yourself.

- Pick a smart resume template.

Using a professional resume template ensures your qualifications stand out. It simplifies the formatting process, allowing you to focus on content rather than design. Whether you opt for a premade template or create your own, prioritize simplicity and use ATS-friendly fonts to make sure your resume is easy to read both by humans and automated systems.

- Use an appropriate font.

When crafting your resume, opt for a clean and professional font. Fonts such as Helvetica, Georgia, or Verdana can ensure your document is easy to read both digitally and in print, making a positive impression on potential employers.

- Use consistent formatting.

Make sure your resume is neatly aligned with uniform margins to create a polished and professional look that improves readability and makes a strong impression on potential employers.

- Keep your resume to one or two pages.

In general, resumes should be one page long unless you have extensive experience to showcase. Keeping your content concise helps highlight the most relevant information and makes it easier for employers to quickly see your qualifications.

Tools for Your Job Search

Are you gearing up to apply for a fraud analyst position? Before you hit that submit button, consider using our ATS Resume Checker. This essential tool provides insights on how your resume performs with the automated systems commonly used by financial institutions to screen applications during the hiring process.

Seeking to elevate your resume further? Our AI Resume Builder is designed just for you, offering tailored recommendations based on your specific background in fraud analysis. With professional templates at your fingertips, you can effectively showcase your skills and achievements to captivate hiring managers.

Frequently Asked Questions

Last Updated: August 23, 2025

Absolutely. A cover letter adds depth to your resume and creates valuable communication opportunities with employers. It allows you to express your enthusiasm for the fraud analyst role while highlighting how your unique skills and experiences make you an ideal job seeker. Don’t overlook this essential step to write a cover letter that truly represents you.

For a fast and efficient way to create your cover letter, try our AI Cover Letter Generator. This tool helps you craft a personalized, strong cover letter in no time. Plus, you'll have access to various cover letter template options that perfectly match your resume, ensuring consistency and professionalism in your application materials.

A resume is generally a concise document that spans one to two pages, summarizing your skills, experience, and education. In contrast, a CV (curriculum vitae) can extend several pages and offers detailed information about your academic achievements, research contributions, publications, and professional experiences.

You’ll typically need a CV for roles in academia or specialized fields such as law or medicine. If you're unsure whether to use a resume or CV for your next application, our online CV Maker simplifies the process of creating tailored CVs in minutes. Choose from various CV templates designed for different industries and career levels to get started on showcasing your qualifications effectively.

To write a strong CV, focus on organizing your content effectively by using clear headings such as education, work experience, and skills. Choose modern and professional templates that are easy to read and compatible with applicant tracking systems (ATS). Tailor your CV for each application by incorporating relevant keywords from the job description to highlight your suitability for the role.

Additionally, reviewing CV examples from successful professionals in your field can provide valuable insights into how to showcase your qualifications. Look for inspiration in their formatting, language, and presentation styles, which can help you stand out while crafting your own unique document.

A frequent mistake fraud analysts make is using a generic resume format that fails to pass through ATS filters. To improve your chances, ensure your resume template is ATS-friendly and tailor your content to reflect the specific job description. This approach not only improves compatibility but also showcases your suitability for the role.

An effective skills section combines your technical abilities, such as data analysis software and investigative techniques, with soft skills like critical thinking and attention to detail. In your experience section, illustrate how you applied these skills to detect fraudulent activities and protect company assets successfully.

Tailor your resume by focusing on the specific skills highlighted in job listings. Identify keywords that reflect the requirements of the position and incorporate them throughout your resume. This will not only showcase your relevant experience but also demonstrate your alignment with the role you’re pursuing.

Was this information helpful? Let us know!

Hailey is a career advice writer dedicated to helping job seekers excel in their careers.

More resources

50+ Resume Statistics Job Seekers Need to Know in 2026

If you want to be a competitive applicant you need to be on t...

How to Put AI Skills on Your Resume in 2026 + Examples

Artificial intelligence (AI) skills have become a valuable ass...

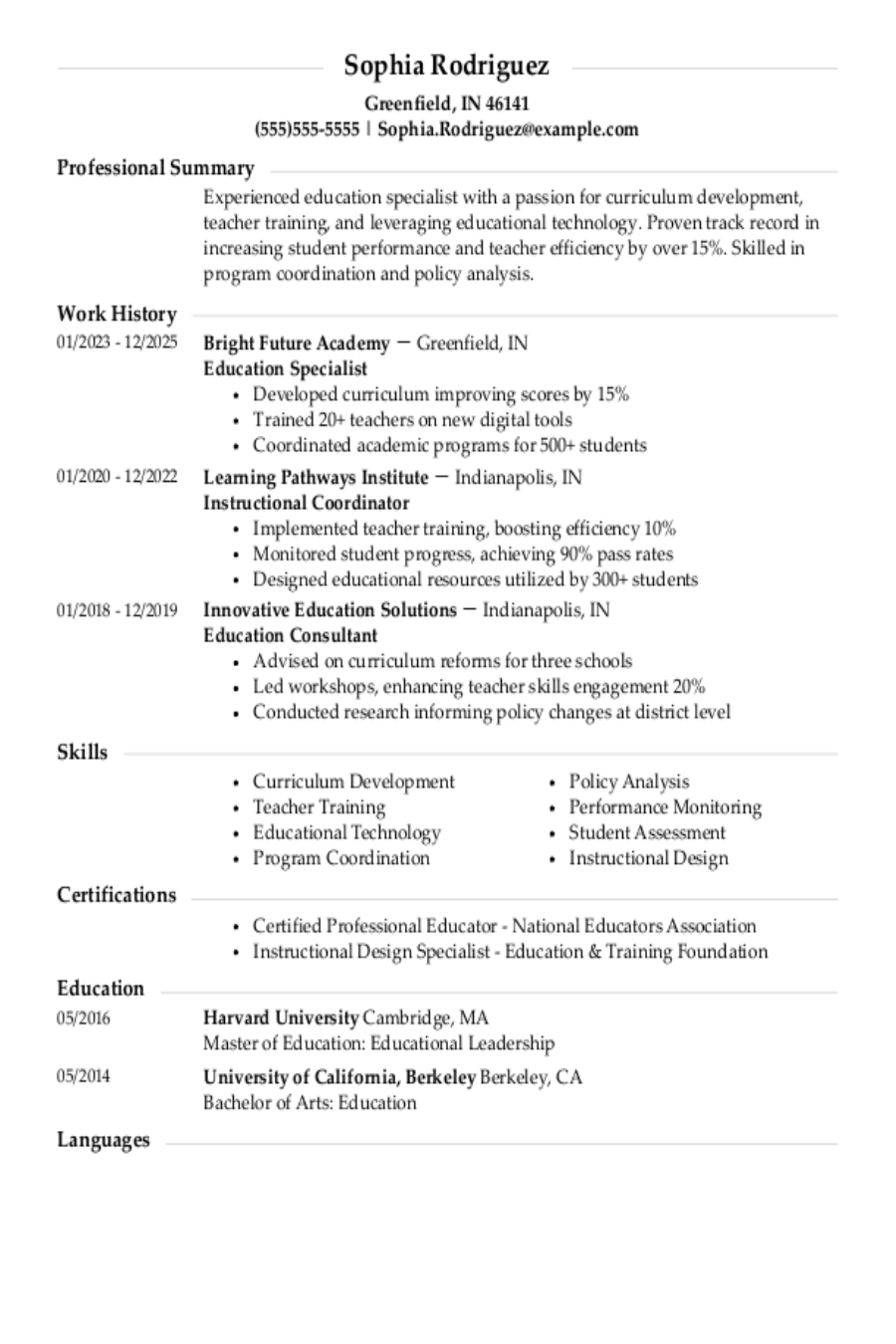

Education Resume: Examples & Templates

As an educator you need a resume that captures the attention ...

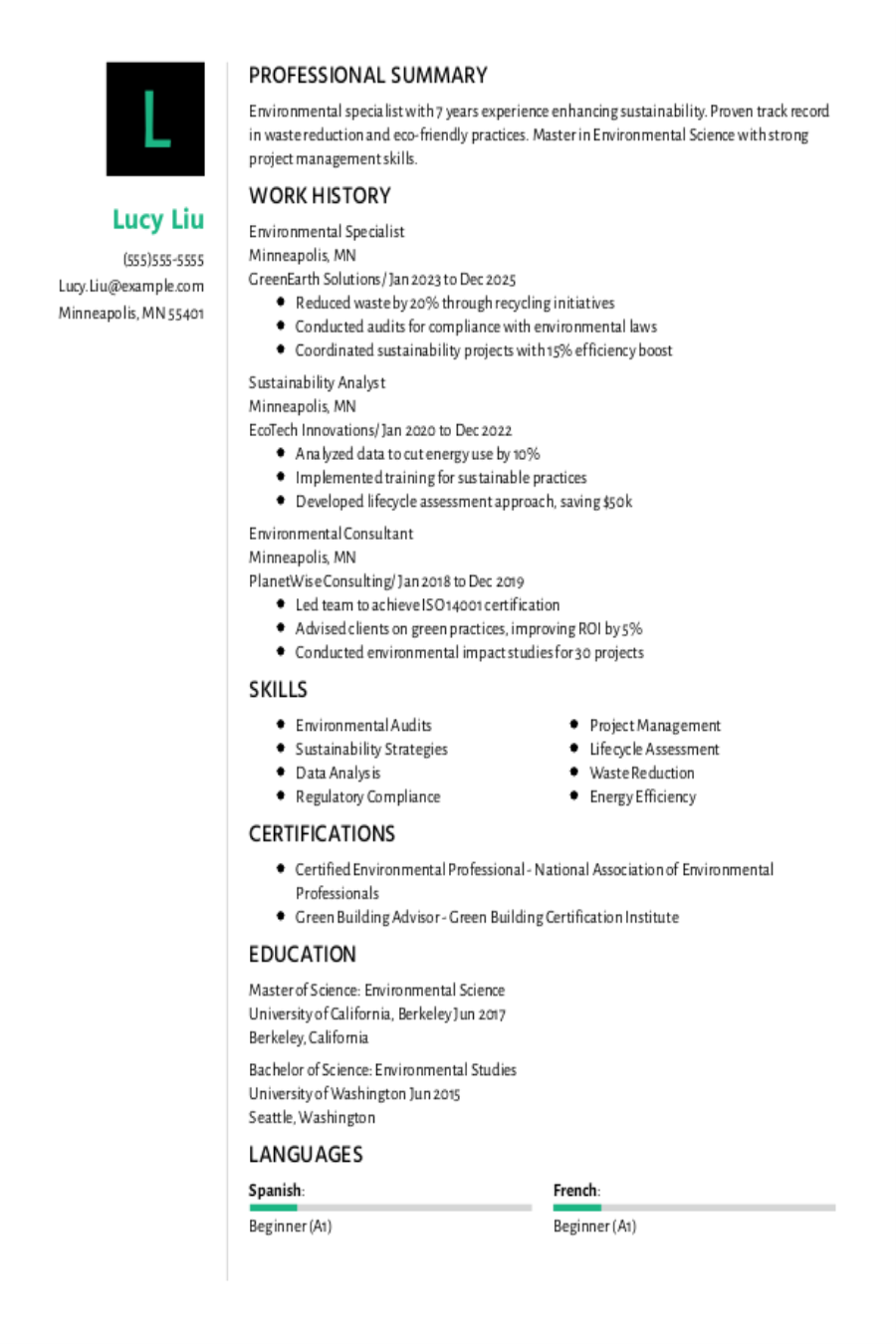

Environmental Resume: Examples & Templates

As an environmental professional you need a resume that captu...