Popular Insurance Resume Examples

Entry-level insurance resume

An entry-level resume for insurance should focus on relevant education, internships, certifications, and strong analytical and communication skills to effectively demonstrate potential in the field despite limited experience.

Focuses on goals: The job seeker demonstrates a strong commitment to professional development in insurance, achieving significant client retention and efficiency improvements while continuously improving their skills through relevant certifications and education.

Prioritizes clarity: Using a clean template like a simple resume template ensures your qualifications stand out clearly, allowing recruiters to quickly discern the value you bring without distractions. This approach helps highlight your strengths in the insurance field effectively.

Mid-career insurance resume

A mid-career insurance professional's resume should emphasize their expertise, adaptability to industry changes, and continuous learning to illustrate a robust mix of experience, skills, and career development.

Balances hard and soft skills: This resume effectively highlights a mix of technical expertise in insurance processes and strong interpersonal skills, showcasing the job seeker's comprehensive ability to manage client relationships while delivering exceptional service.

Features a strong professional summary: An effective professional summary showcases your extensive experience in insurance, highlighting skills such as client portfolio management and risk assessment. This clarity enables recruiters and ATS to swiftly recognize your suitability for the role.

Experienced insurance resume

An experienced insurance resume should prioritize highlighting quantifiable achievements and relevant skills, clearly demonstrating the applicant’s growth and adaptability within the industry to attract potential employers.

Embraces a modern style: This modern resume template highlights the job seeker's commitment to excellence and innovative strategies in insurance, showcasing their ability to improve client satisfaction and streamline processes effectively.

Leads with experience: The resume's opening summary effectively showcases 13 years of experience in insurance, emphasizing key achievements such as a 15% increase in client retention and a 30% reduction in claim processing time. This immediately establishes a professional tone and instills confidence in the job seeker's capabilities.

No experience insurance resume

A resume for an applicant with no experience should highlight transferable skills, relevant coursework, and any volunteer work to showcase their potential and eagerness to learn in the insurance industry.

Shows achievements: Including an accomplishments section with academic achievements and extracurriculars helps this resume show expertise and credibility despite a lack of experience.

Uses a simple style: This resume's straightforward and organized layout effectively highlights qualifications, showcasing achievements in volunteer coordination and education without unnecessary clutter.

More resume examples

Insurance Resume Template

Looking to showcase your qualifications? Start with this insurance resume template as a foundation — simply tailor it with your unique experiences and skills for a standout application.

Emma Park

Portland, OR 97203

(555)555-5555

Emma.Park@example.com

Professional Summary

Experienced insurance professional with strong expertise in policy management, risk assessment, and client retention. Proven track record in increasing revenue and reducing claims through strategic compliance and premium plan development.

Work History

Insurance

SecureTrust Inc. - Portland, OR

August 2021 - August 2025

- Manage policies improving client retention 15%

- Develop premium plans increasing revenue by 0K annually

- Ensure compliance reduced claims 10%

Insurance Advisor

SafetyNet Solutions - Portland, OR

August 2018 - July 2021

- Provide risk assessments for 200+ clients

- Design insurance packages saving clients 0K

- Perform audits boosting policy accuracy by 20%

Insurance Consultant

AssureGuard Associates - Portland, OR

August 2015 - July 2018

- Create customized insurance plans for 150+ clients

- Analyze market trends increasing portfolio by 25%

- Coordinate with underwriters reducing risks by 12%

Skills

- Insurance Policy Management

- Risk Assessment

- Client Retention

- Compliance Assurance

- Audit Coordination

- Market Trend Analysis

- Customized Insurance Solutions

- Revenue Optimization

Education

Master of Business Administration Finance

University of New York New York, NY

May 2015

Bachelor of Science Economics

Boston College Boston, MA

May 2013

Certifications

- Certified Insurance Counselor - National Alliance

- Risk Management Specialist - IRM Academy

Languages

- Spanish - Beginner (A1)

- French - Beginner (A1)

- German - Intermediate (B1)

Writing Your Insurance Resume

Having explored effective resume examples, you're now prepared to delve into the process of how to write a resume. We'll provide you with a clear, step-by-step guide that breaks down each section, ensuring you create a standout document tailored for success in the insurance industry.

List your most relevant skills

Crafting an effective skills section for your insurance resume is important in showcasing your qualifications. You should include both technical skills—like knowledge of underwriting processes and claims management—as well as essential soft skills such as analytical thinking and customer service.

To optimize your chances of getting noticed by both human recruiters and applicant tracking systems (ATS), it's important to incorporate keywords from the job listing directly into your skills section. This strategy demonstrates that you understand the specific requirements of the position, making it easier for employers to see how you fit their needs and increasing your visibility in their job seeker pool.

Example of skills on an insurance resume

- Proficient in analyzing insurance policies and coverage options to provide tailored client solutions

- Adept at managing claims processes with a focus on efficiency and client satisfaction

- Strong communicator with the ability to simplify complex insurance concepts for diverse audiences

- Driven team player who thrives in fast-paced environments and embraces challenges

When crafting your resume, don't overlook the importance of soft skills. Employers highly value interpersonal abilities because they are often challenging to teach. Highlighting these traits can set you apart and demonstrate your potential to contribute positively to the workplace culture.

Highlight your work history

Crafting an effective work experience section is important for your insurance resume. By showcasing specific accomplishments, you can demonstrate how you've used your skills to make a positive impact in previous roles. Be sure to include industry-relevant keywords that will catch the attention of hiring managers.

For each job entry, it’s essential to provide key details such as your title, the employer's name, and the employment dates. These elements help establish your professional credibility and give potential employers a clear understanding of your background. Highlighting quantifiable achievements—like reducing claims processing time or improving customer satisfaction scores—can set you apart from other applicants.

Example of an insurance work experience entry

- Insurance

State Farm - Dallas, TX

March 2019 - Present - Develop and maintain strong customer relationships by providing tailored insurance solutions to meet individual needs, resulting in a 30% increase in client retention rates

- Conduct comprehensive policy reviews and recommend adjustments, improving coverage adequacy for over 150 clients annually

- Achieve sales targets consistently by using effective communication skills and thorough market analysis to identify new business opportunities

- Assist clients with claims processing, ensuring timely resolution and maintaining a satisfaction rating of 98%

- Participate in ongoing training sessions to stay updated on industry trends and regulatory changes, leading to improved service delivery and risk assessment capabilities

Quantifying achievements in the insurance field is vital for showcasing your impact. For example, stating that you reduced claim processing times by 30% demonstrates your ability to improve operational efficiency and improve customer satisfaction, making you a valuable asset to potential employers.

Include your education

The education section of your insurance resume should detail your academic qualifications in reverse-chronological order, starting with the most recent degree you have earned. This typically includes college or university degrees and relevant certifications. If you have a bachelor's degree, you can leave your high school diploma off your resume.

For those currently pursuing further education or who have not completed their studies, it's advisable to list the highest degree attained along with an anticipated graduation date. Including bullet points for specific coursework or notable projects can be beneficial, particularly for entry-level positions where practical experience may be limited.

Common certifications for a insurance resume

- Chartered Property Casualty Underwriter (CPCU) – The Institutes

- Associate in Risk Management (ARM) – The Institutes

- Certified Insurance Counselor (CIC) – National Alliance for Insurance Education & Research

- Fellow, Life Management Institute (FLMI) – LIMRA

Sum up your resume with an introduction

Creating a standout profile section in your resume is important for making a strong first impression. This section serves as your elevator pitch, providing prospective employers with a snapshot of your qualifications and career trajectory.

If you have significant experience in the field, it's best to use a professional summary. This allows you to showcase your most notable achievements and competencies upfront, catering to recruiters who want immediate insights into what you bring to the table. If you're less experienced, write a goal-oriented resume objective that gives employers insight into your development.

Professional summary example

Dedicated insurance specialist with over 10 years of experience in optimizing policy management and improving risk assessment protocols. Demonstrated success in reducing claim processing time by implementing innovative workflows and fostering strong client relationships. Proficient in underwriting, regulatory compliance, and claims analysis, consistently delivering results that exceed organizational goals.

Resume objective example

Enthusiastic insurance professional eager to apply strong analytical skills and attention to detail to support a thriving insurance team. Committed to leveraging effective communication and problem-solving abilities to improve client satisfaction and contribute positively to organizational goals.

As an insurance job seeker, it’s important to keep your resume profile concise and packed with essential information. Aim for no more than three sentences highlighting your most relevant skills and experiences. Save any additional details for your cover letter, where you can elaborate further on your qualifications and fit for the role.

Add unique sections to set you apart

Including optional resume sections is a great way to highlight your unique qualifications for insurance positions. These additions can set you apart by showcasing the diverse skills and experiences that make you an ideal applicant.

These sections allow you to present different facets of your professional identity, from relevant hobbies that demonstrate your dedication to the field, to volunteer work that reflects your values. By sharing these insights, you give employers a glimpse into your working style and commitment, reinforcing how well-rounded you are as a potential team member in the insurance industry.

Three sections perfect for a insurance resume

- Languages: In the insurance industry, clear communication is essential for building client trust and understanding policy details. Highlighting your language skills on your resume can make you more appealing to diverse clients.

- Volunteer Work: Including volunteer work on a resume not only showcases your skills but also highlights your dedication to community service. It demonstrates to potential employers that you value helping others, improving your professional profile.

- Quantifiable Metrics: In the insurance field, quantifiable accomplishments are important for demonstrating your impact on client satisfaction and retention. Integrate metrics into your experience bullet points or include them in their own resume section.

5 Resume Formatting Tips

- Choose a format that matches your career stage.

Choosing the right resume format is important for showcasing your experience effectively. If you have significant experience, a chronological resume highlights your career progression. For those just starting out or with gaps in employment, a functional resume can emphasize skills over job history. A combination format serves as a middle ground, allowing you to mix both styles and present yourself in the best light.

- Pick a smart resume template.

Using a professional resume template is important for ensuring your information is easily readable and well-organized. A good template not only improves the visual appeal but also keeps your formatting consistent, which is key for applicant tracking systems (ATS). Choose a clean, modern design that highlights your strengths without overwhelming the reader with cluttered text.

- Select an appropriate font.

Choose a clean, professional font like Helvetica, Georgia, or Verdana to improve your resume's readability. These fonts are excellent choices that appeal to both applicant tracking systems and hiring managers alike.

- Use consistent formatting.

Ensure your resume features left alignment and uniform margins to create a polished, professional look that attracts potential employers' attention.

- Keep your resume to one or two pages.

When crafting your resume, remember that resumes should be one page long. If you have extensive experience, a two-page format may be acceptable, but ensure all content is relevant and presented clearly to highlight your key achievements effectively.

What’s the Average Insurance Salary?

Insurance salaries vary based on location, career level, and qualifications.

This data, provided by the Bureau of Labor Statistics, will show you expected salary ranges for insurances in the top 5 highest-paying states, including the District of Columbia. The figures reflect the most current salary data available, collected in 2024.

- Full Range

- Most Common (25th–75th percentile)

- Average

District of Columbia

Most common: $81,240 - $133,600

Washington

Most common: $72,630 - $128,880

New York

Most common: $49,320 - $116,460

Massachusetts

Most common: $77,890 - $130,280

South Dakota

Most common: $60,050 - $110,390

Tools for Your Job Search

Are you ready to advance your career in insurance? Before you submit your application for that coveted position, consider using our ATS Resume Checker. This essential tool provides valuable insights on how effectively your resume meets the criteria set by automated systems used by many insurance companies during their initial screening process.

Looking for a way to elevate your resume? Our AI Resume Builder is here to help with tailored recommendations specifically designed for your insurance background, along with professional templates that make your qualifications and achievements stand out to potential employers.

Frequently Asked Questions

Last Updated: September 18, 2025

Absolutely. A cover letter is important as it improves your resume by providing context and creating additional communication opportunities with employers. It allows you to convey your enthusiasm for the insurance role and demonstrate how your experience makes you a great fit. Don’t underestimate its power; write a cover letter that captures attention.

For a quick and effective solution, try our AI Cover Letter Generator, designed to help you create a tailored cover letter in minutes. You can choose from various cover letter template options that align perfectly with your resume, ensuring a polished and professional application every time.

When it comes to job applications, understanding the difference between a curriculum vitae (CV) and a resume is important. Resumes are typically concise documents, spanning one to two pages, focusing on your skills and experiences relevant to the job at hand. In contrast, CVs can be several pages long and provide in-depth details about your academic history, research contributions, publications, and professional experiences.

For specialized roles in academia, science, law, or medicine, you should use a CV. If you’re unsure which document to create for your application, our online CV Maker can assist you in crafting a tailored CV quickly. With a variety of CV templates designed for different industries and career levels, you'll find the perfect fit for your needs in no time.

When crafting a resume for an insurance professional, aim for one page as it generally suffices to showcase your qualifications effectively. However, if you possess extensive experience or specialized skills, consider a two-page resume to provide a comprehensive view of your career accomplishments and relevant expertise.

In the insurance field, key skills such as "risk assessment" and "customer service" are important on resumes. Be sure to review job descriptions for additional important keywords and phrases that can improve your application and make you stand out to employers.

To improve your insurance resume, focus on customizing its content to highlight essential skills relevant to the job you're targeting. Review the job description carefully and extract keywords that reflect your qualifications. By weaving these terms into your resume, you can effectively demonstrate how your experience aligns with the specific role you're applying for.

To improve your networking skills in the insurance field, regularly connect with former colleagues and check in on their professional journeys. Consider joining organizations like the National Association of Insurance Commissioners to expand your contacts. Additionally, keep your LinkedIn profile current to engage with industry trends and maintain connections with peers.

Was this information helpful? Let us know!

Leisha is a career industry editor dedicated to helping job seekers excel in their careers.

More resources

50+ Resume Statistics Job Seekers Need to Know in 2026

If you want to be a competitive applicant you need to be on t...

How to Put AI Skills on Your Resume in 2026 + Examples

Artificial intelligence (AI) skills have become a valuable ass...

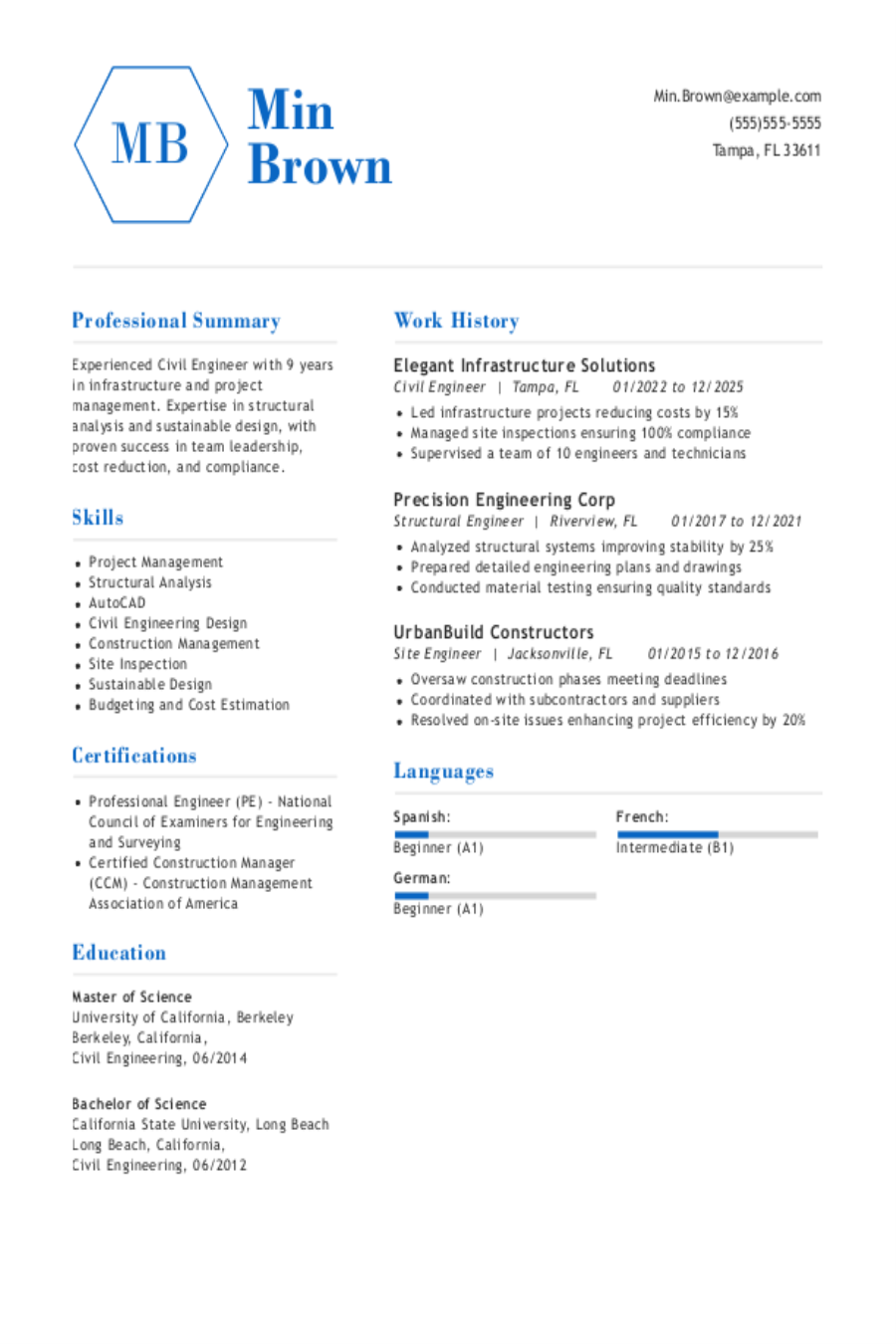

Civil Engineering Resume: Examples & Templates

As a civil engineer your resume must showcase your technical ...

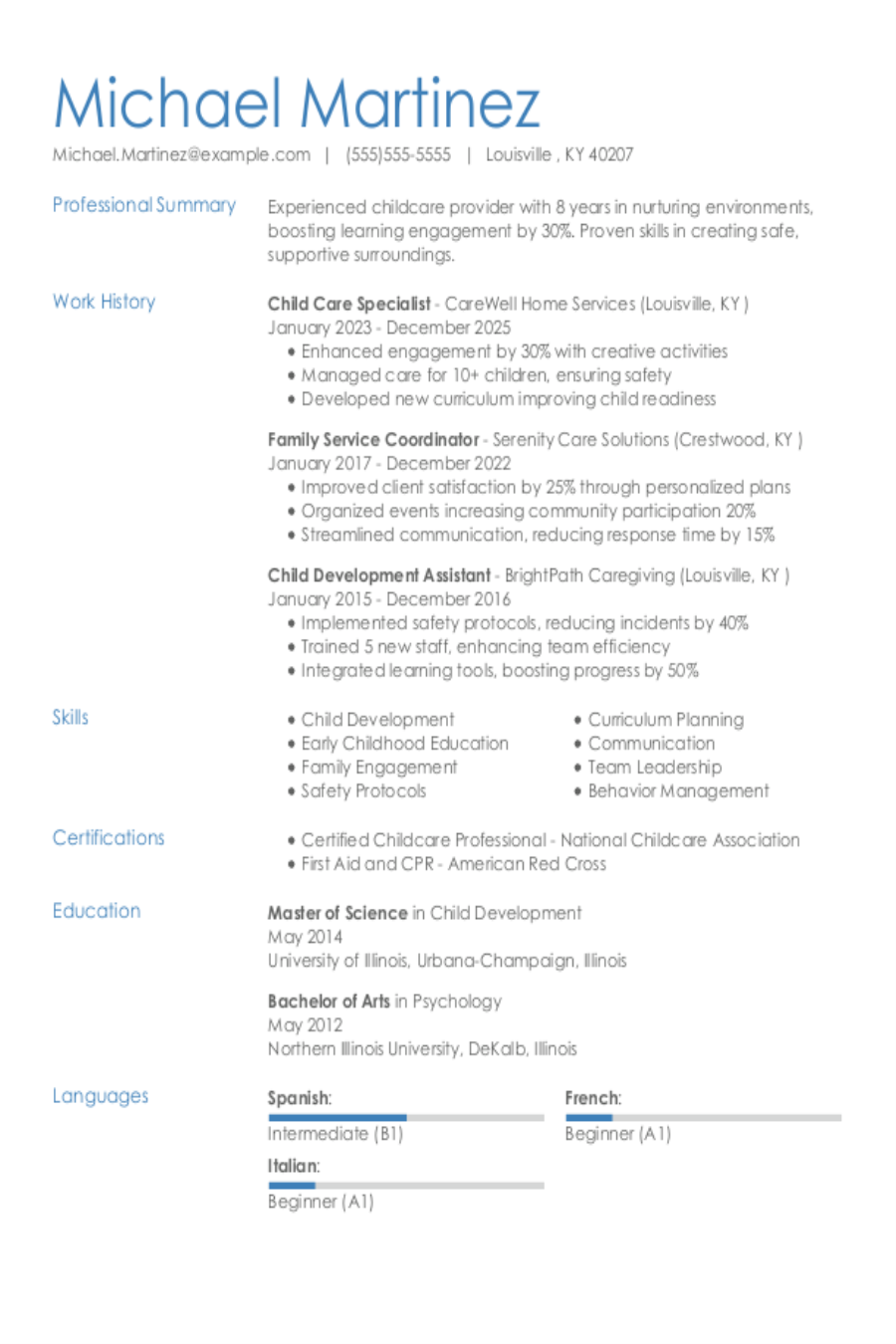

Child Care Resume: Examples & Templates

As a child care professional you need a resume that showcases...

Entertainment Resume: Examples & Templates

As an entertainment professional you need a resume that captu...