Popular Fraud Investigator Resume Examples

Entry-level fraud investigator resume

An entry-level resume for a fraud investigator should focus on analytical skills, relevant coursework, certifications, internships, and any volunteer experience to demonstrate capability despite limited professional experience.

Emphasizes soft skills: This resume effectively highlights the job seeker's strong soft skills, such as analytical abilities and teamwork, which compensate for limited direct experience.

Showcases education: This resume starts with education, helping the candidate’s degrees serve as a foundation for their professional image.

Mid-career fraud investigator resume

A mid-career fraud investigator resume should emphasize a strong combination of investigative experience, analytical skills, and ongoing professional development to effectively demonstrate expertise in combating fraud.

Begins with a powerful summary: This resume's professional summary highlights the job seeker's extensive experience in fraud detection and risk assessment. This clarity allows recruiters and ATS to quickly recognize their relevant qualifications.

Employs active language: Using action verbs like "recovered," "reduced," and "conducted" illustrates a proactive approach, showcasing tangible achievements and leadership in fraud investigation.

Experienced fraud investigator resume

An experienced fraud investigator resume should emphasize relevant skills and achievements that illustrate the job seeker's expertise in detecting and preventing fraudulent activities while highlighting their professional growth.

Quantifies achievements: Quantifiable achievements provide clear evidence of a fraud investigator's impact. By showcasing specific numbers, such as dollar amounts saved or percentage improvements, recruiters can quickly grasp the effectiveness and significance of their contributions in combating fraud.

Follows traditional format: The chronological resume format clearly outlines the extensive experience of the job seeker, allowing them to effectively demonstrate their career progression and achievements in fraud investigation through a structured timeline of roles and responsibilities.

No experience fraud investigator resume

A resume for an applicant with no experience should highlight relevant skills, education, and any internships or volunteer work that showcase analytical abilities and attention to detail.

Draws from diverse experiences: Incorporating volunteer experiences, especially extracurricular activities like fraud prevention roles, improves a resume by showcasing analytical skills and commitment to integrity, which are important for a fraud investigator position.

Favors clarity over complexity: The resume's straightforward layout effectively highlights relevant experience and skills, making it easy for employers to recognize qualifications in fraud investigation.

More resume examples

Fraud Investigator Resume Template

Looking to highlight your expertise? Use this comprehensive fraud investigator resume template as a base that you can adapt to showcase your unique skills and experiences.

Ming Li

Jacksonville, FL 32201

(555)555-5555

Ming.Li@example.com

Professional Summary

Results-driven fraud investigator with 9 years' experience reducing financial crime. Expertise in risk assessment and data analysis, ensuring compliance and effective fraud detection.

Skills

- Fraud Detection

- Risk Assessment

- Data Analysis

- Investigative Techniques

- Compliance Expertise

- Forensic Accounting

- Regulatory Knowledge

- Team Leadership

Certifications

- Certified Fraud Examiner - Association of Certified Fraud Examiners

- Anti-Money Laundering Certified - ACAMS

Education

Master of Science Criminology

Columbia University New York, NY

May 2014

Bachelor of Arts Sociology

University of California, Berkeley Berkeley, CA

May 2012

Work History

Fraud Investigator

Integrity Assurance Corp - Jacksonville, FL

July 2022 - October 2025

- Reduced fraud by 30% using analytics tools.

- Conducted 200+ investigations within tight deadlines.

- Trained 10 team members on fraud detection methods.

Financial Crime Analyst

SafeGuard Financial Group - Jacksonville, FL

July 2017 - June 2022

- Analyzed fraud cases, increasing solution rate by 40%.

- Developed new audits, saving $500K annually.

- Collaborated with law enforcement on 50+ cases.

Risk Management Specialist

SecureHold Consulting - Miami, FL

June 2014 - June 2017

- Identified high-risk transactions, preventing $1M loss.

- Implemented risk controls, improving efficiency by 25%.

- Led 5 training workshops on fraud prevention.

Languages

- Spanish - Beginner (A1)

- French - Intermediate (B1)

- German - Beginner (A1)

Must-Have Skills on a Fraud Investigator Resume

A strong skills section is essential for making your resume stand out in the competitive job market.

The following data outlines the most frequently sought-after hard and soft skills for a fraud investigator resume, based on Resume Now’s extensive internal database.

When you’re ready to improve your resume, check out our AI Resume Skills Generator. It recommends tailored hard and soft skills suited to your job title, enabling you to create a comprehensive and customized skill set.

Writing Your Fraud Investigator Resume

Having explored these effective resume examples, you are now prepared to dive into the essential steps of writing your own resume. We will walk you through each section thoroughly so you can confidently understand how to write a resume that stands out.

List your most relevant skills

An effective skills section needs to highlight both technical skills, such as data analysis and investigative techniques, and soft skills like critical thinking and attention to detail. This balance demonstrates that you have the expertise required to identify and tackle fraudulent activities efficiently.

Make sure to read the job listing carefully and incorporate keywords from the job listing directly into your skills section. Doing so will not only catch the eye of human recruiters but also improve your chances of passing applicant tracking systems (ATS). By aligning your skills with what employers are seeking, you position yourself as a strong applicant ready to take on challenges in fraud investigation.

Example of skills on a fraud investigator resume

- Proficient in analyzing financial records and transaction data to detect fraudulent activities

- Experienced in using advanced investigative techniques and software tools

- Strong communicator with excellent interpersonal skills for collaborating with law enforcement

- Careful attention to detail for accurate reporting and documentation

Highlighting your soft skills on your resume can set you apart from other applicants. Employers greatly value interpersonal abilities, as these traits are often challenging to develop and play an important role in fostering a positive work environment.

Highlight your work history

Your work experience section should demonstrate how you've applied your investigative skills in practical situations, emphasizing any successful outcomes and incorporating keywords that will attract the attention of hiring managers.

When detailing each job entry, include essential components such as your title, the employer's name, and the dates of employment. This information provides a clear timeline of your professional journey and establishes credibility with potential employers. Make sure to articulate any quantifiable successes, like reduced fraud rates or improved investigation processes.

Example of a fraud investigator work experience entry

- Fraud Investigator

XYZ Financial Services - New York, NY

June 2021 - Present - Conduct thorough investigations into suspected fraudulent activities, analyzing transaction patterns and client behaviors to identify red flags

- Develop and implement strategies that reduced fraud losses by 30% through improved monitoring and reporting processes

- Collaborate with law enforcement and legal teams to support prosecution efforts in cases of financial crime, ensuring a 100% success rate in legal actions taken

- Train junior investigators on advanced investigative techniques and the use of forensic tools, improving team efficiency by 25%

- Create detailed reports for upper management summarizing findings and trends, which informed policy changes that further mitigated risk

Quantifying achievements as a fraud investigator is essential for illustrating the impact of your work. For example, stating that you uncovered fraudulent activities resulting in $500,000 in recoveries not only highlights your effectiveness but also demonstrates your value to potential employers.

Include your education

The education section of your fraud investigator resume should start with the most recent academic achievements displayed in reverse-chronological order. Include degrees and diplomas relevant to the field, while leaving off your high school diploma if you've obtained higher educational qualifications. Highlighting honors can also improve this part of the resume.

For ongoing or incomplete education, mention the highest level attained along with an anticipated graduation date. Including bullet points on significant coursework or academic accomplishments is beneficial for students or recent graduates, as it shows their foundational knowledge relevant to fraud investigation.

Common certifications for a fraud investigator resume

- Certified Fraud Examiner (CFE) – Association of Certified Fraud Examiners (ACFE)

- Fraud Specialist (FS) – International Association of Financial Crimes Investigators (IAFCI)

- Certified Forensic Accountant (CFA) – American Board of Forensic Accounting and Auditing (ABFA)

- Certified Internal Auditor (CIA) – Institute of Internal Auditors (IIA)

Sum up your resume with an introduction

Creating a powerful profile section on your resume is important for making a strong first impression. This section serves as your personal pitch, summarizing your qualifications and setting the tone for the entire document.

If you have significant experience in fraud investigation, consider using a professional summary at the top of your resume. This format allows you to highlight key accomplishments and relevant expertise that demonstrate your value to potential employers. If you’re at the start of your career, write a resume objective that communicates your goals and potential.

Professional summary example

Analytical fraud investigator with over 5 years of experience in detecting and preventing financial crimes within corporate settings. Demonstrated success in conducting thorough investigations, analyzing complex data patterns, and collaborating with law enforcement to secure convictions. Expertise in risk assessment, forensic analysis, and regulatory compliance ensures the integrity of financial operations.

Resume objective example

Enthusiastic fraud investigator eager to apply strong analytical skills and attention to detail in a challenging role. Looking to use problem-solving abilities and effective communication techniques to improve investigative processes and support a proactive team dedicated to combating fraud.

When crafting your resume profile, start with your job title as a fraud investigator. This strategy ensures that employers immediately recognize your professional identity and understand what you bring to the table in the field of fraud investigation.

Add unique sections to set you apart

Optional resume sections can be a great way to highlight your unique qualifications as a fraud investigator. These segments allow you to showcase skills and experiences that set you apart from other applicants.

When you include relevant hobbies or volunteer work, it provides insight into your character and values. This additional information can illustrate your commitment to ethical practices and attention to detail, which are important in fraud investigation. By sharing these aspects, you not only present yourself as a well-rounded job seeker but also demonstrate how your personal interests align with the demands of the job.

Three sections perfect for a fraud investigator resume

- Languages: As a fraud investigator, clear communication is important. If you can speak multiple languages, highlight these language skills on your resume. They improve your ability to interact with diverse clients and gather information effectively.

- Volunteer Work: Incorporating volunteer work on a resume highlights your investigative skills and dedication to protecting others, showcasing your proactive approach in combating fraud.

- Accomplishments: As a fraud investigator, measurable results are vital to validate your effectiveness in detecting and preventing fraud. Incorporate these achievements into your experience section, or highlight them separately under an accomplishments section.

5 Resume Formatting Tips

- Choose a format that matches your career stage.

Choose a chronological resume format if you have extensive experience. If you're new to the field, opt for a functional format. A combination resume is ideal when you want to highlight both skills and experience.

- Pick a smart resume template.

Using a professional resume template improves readability and ensures your key information stands out. Use a clean, structured layout that makes it easy for hiring managers to quickly scan your qualifications. An ATS-friendly format can also improve your chances of getting noticed in applicant tracking systems.

- Select an appropriate font.

Choose from professional font options like Arial, Calibri, or Times New Roman for your resume to ensure it is easily readable by both software and hiring managers.

- Use consistent formatting.

Ensure your resume is neatly aligned to the left with uniform margins. This creates a clean, professional look that makes your application stand out.

- Keep your resume to one or two pages.

While crafting your resume, it's important to note that resumes should be one page long in most situations. Keep your content concise and focused on key experiences that showcase your skills effectively.

Tools for Your Job Search

Are you preparing to apply for a fraud investigator position? Before you send off your application, take advantage of our ATS Resume Checker. This essential tool analyzes how well your resume meets the criteria used by automated systems in many organizations, ensuring that your application stands out from the get-go.

Looking to improve your resume even further? Our AI Resume Builder provides tailored recommendations based on your unique skills and experiences as a fraud investigator. With professionally designed templates, you can effectively showcase your expertise and achievements to potential employers.

Frequently Asked Questions

Last Updated: October 23, 2025

Absolutely. A cover letter is important as it adds depth to your resume and fosters communication with potential employers. It’s your opportunity to express your enthusiasm for the fraud investigator role and highlight how your unique skills and experiences make you an ideal job seeker. So, take the time to write a cover letter that sets you apart.

For a quick and efficient way to create a tailored cover letter, try our AI Cover Letter Generator. It allows you to produce a job-winning cover letter in minutes, complete with various cover letter template options that align perfectly with your resume, ensuring a polished application presentation.

A resume is typically concise, spanning one to two pages, while a curriculum vitae (CV) can extend several pages and includes comprehensive details about your academic background, research contributions, and professional experiences. This length difference allows you to showcase your qualifications in greater depth with a CV.

You should use a CV when applying for roles in academia or specialized fields such as law and medicine. If you're uncertain whether to create a CV or resume for your application, our online CV Maker is here to assist! With various CV templates tailored for different industries and career levels, you can quickly craft an impressive CV that meets your needs.

To craft a standout fraud investigator resume, select a polished template and infuse it with relevant keywords from the job description. This strategy showcases your qualifications and aligns with employer expectations effectively.

A frequent error fraud investigators make is using a resume that does not comply with ATS requirements. To improve your chances, ensure your resume template is ATS-friendly and tailor your content to align closely with the specific job description you're applying for.

To make an effective skills section as a fraud investigator, mix your technical proficiencies—like data analysis and investigative software—with vital soft skills, such as critical thinking and communication. In your experience section, illustrate how you applied these skills to uncover fraud and drive positive outcomes, showcasing your value.

Practice answering job interview questions and answers out loud. This will not only improve your confidence but also equip you to tackle unexpected inquiries with ease. The more you prepare, the better you'll handle any surprises that come your way.

Was this information helpful? Let us know!

Hailey is a career advice writer dedicated to helping job seekers excel in their careers.

More resources

What If No One Responds When You Try To Follow Up After a Job Interview?

If no one responds after you try to follow up after a job inte...

How to List Adaptability Skills on Your Resume (35+ Examples, Definition & Tips to Improve)

Our adaptability skills definition and guide will help you wri...

What if I Don't Have Professional References?

Access advice on what to do if you get to the reference check ...

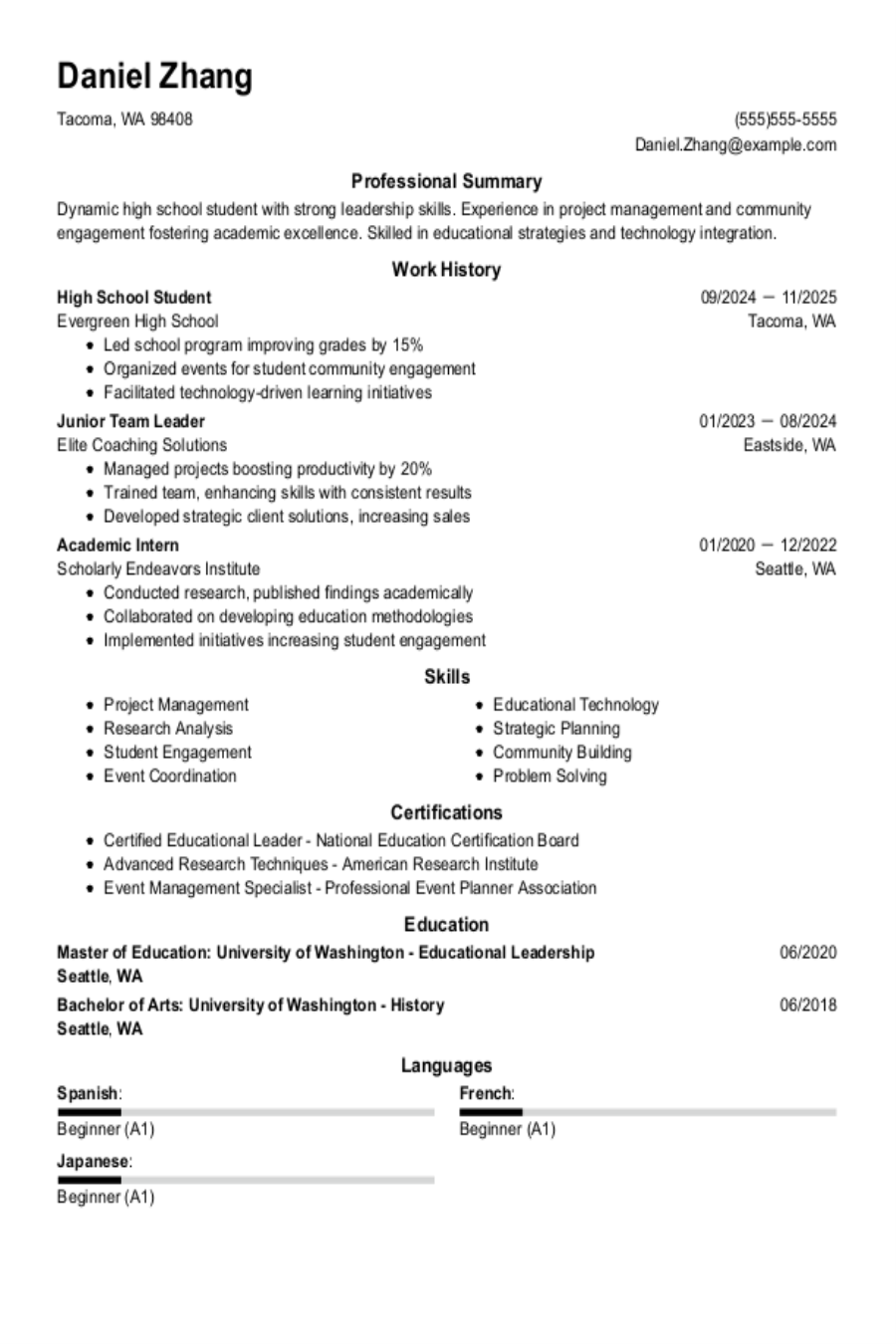

Student Resume: 2025 Examples & Templates

As a student you need a resume that captures the attention of...

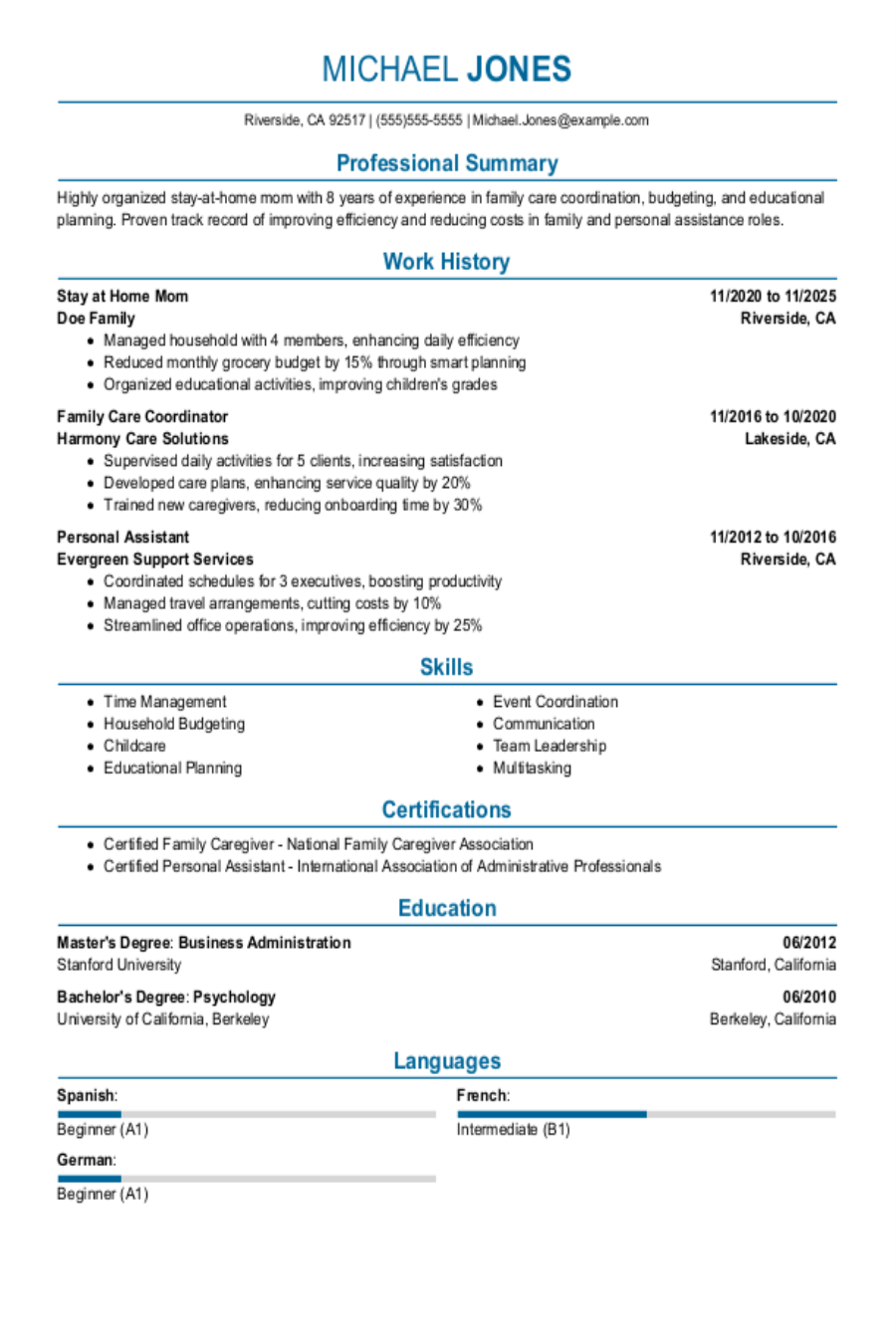

Stay At Home Mom Resume: Examples, Templates and Tips

As a stay-at-home mom building a resume that highlights your ...

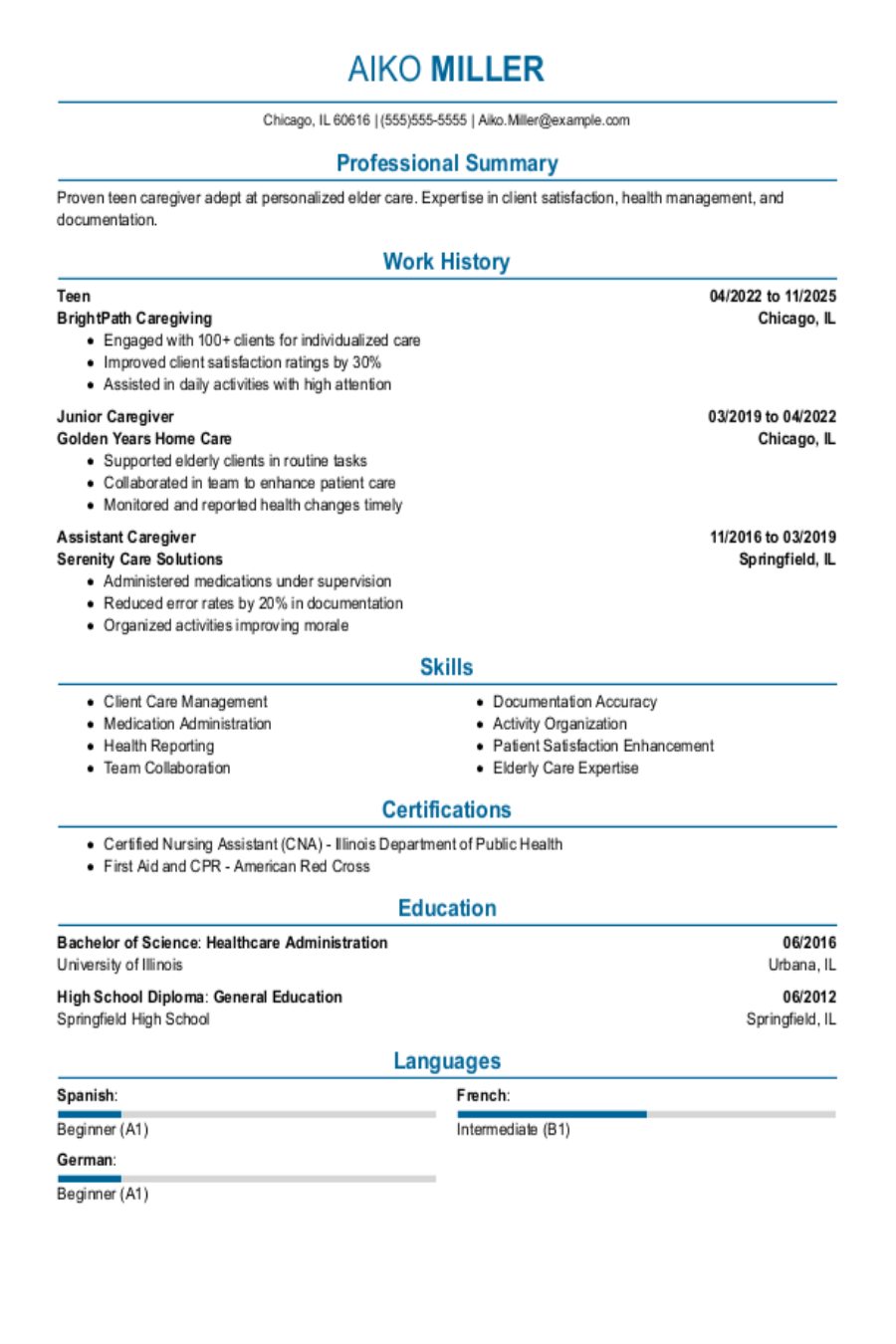

Teen Resume: Examples, Template & Advice for Beginners

As a teen entering the job market you need a resume that show...