Table of contents

Popular Insurance Underwriter Resume Examples

Entry-level insurance underwriter resume

An entry-level resume for an insurance underwriter should focus on analytical skills, relevant coursework, risk assessment training, and skill in industry software to demonstrate readiness for the role.

Showcases education: This resume starts with education, helping the candidate’s degrees serve as a foundation for their professional image.

Prioritizes readability: A clean, straightforward simple resume template allows recruiters to swiftly pinpoint relevant qualifications. This approach improves readability and ensures key achievements stand out in an insurance underwriter's profile.

Mid-career insurance underwriter resume

A mid-career insurance underwriter resume should emphasize a combination of relevant experience, technical skills, and evidence of professional growth to attract potential employers in the industry.

Encourages quick scanning: A clean layout and thoughtful organization highlight the applicant's key qualifications, making it straightforward for hiring managers to identify relevant experience and skills at a glance.

Balances skills and experience: This applicant's resume effectively showcases their technical skills in risk analysis and policy evaluation while highlighting career progression from financial analyst to insurance underwriter, underscoring their professional development in the industry.

Experienced insurance underwriter resume

An experienced insurance underwriter resume should highlight key achievements and demonstrate a clear path of professional growth in the field while maintaining a straightforward layout.

Highlights experience: The resume opens with a strong summary that showcases 15 years of experience as an insurance underwriter. This immediately establishes the applicant's expertise and sets a professional tone, highlighting their ability to improve efficiency and manage risks effectively.

Follows traditional format: The chronological resume format effectively highlights the job seeker's extensive experience by clearly presenting their career trajectory, making it easy for readers to understand their growth and achievements in the insurance industry.

No experience insurance underwriter resume

A resume for an applicant with no experience seeking a position as an insurance underwriter should highlight relevant coursework, transferable skills, and any certifications to showcase the job seeker's potential and enthusiasm for the role.

Draws from diverse experiences: Incorporating extracurricular activities and volunteer roles into a resume showcases transferable skills and community involvement. This approach demonstrates commitment and versatility, improving the overall applicant profile.

Leads with education: This resume arranges the education section up front, making the candidate’s formal training a focal point of their profile, alongside volunteer work and quantifiable achievements.

More resume examples

Insurance Underwriter Resume Template

Looking to create a standout application? Check out this insurance underwriter resume template, which you can easily personalize with your unique skills and experience.

Emily Wilson

Riverside, CA 92504

(555)555-5555

Emily.Wilson@example.com

Professional Summary

Experienced insurance underwriter with a proven track record of reducing claims and improving client retention. Skilled in risk analysis, policy underwriting, and data-driven decision-making, adept at enhancing efficiency and compliance.

Work History

Insurance Underwriter

Guardian Insurance Group - Riverside, CA

January 2023 - October 2025

- Managed risk assessments for 200+ clients monthly.

- Reduced claims by 15% through policy optimization.

- Collaborated with brokers to increase renewals by 10%.

Risk Assessment Specialist

Pinnacle Risk Solutions - Lakeside, CA

January 2019 - December 2022

- Conducted evaluations for high-value clients.

- Improved client retention by 20% annually.

- Assessed claims processes to reduce fraud.

Insurance Analyst

SafeGuard Insurers - San Diego, CA

January 2016 - December 2018

- Analyzed policyholder data for underwriting.

- Enhanced system efficiency, reducing time by 30%.

- Maintained compliance with regulations.

Skills

- Risk Analysis

- Policy Underwriting

- Client Relationship Management

- Regulatory Compliance

- Data Analysis

- Financial Forecasting

- Attention to Detail

- Problem Solving

Certifications

- Certified Insurance Underwriter - Insurance Institute of America

- Risk Management Professional - Risk Management Society

Education

Master of Business Administration Finance

Ohio State University Columbus, Ohio

May 2016

Bachelor of Science Economics

University of Dayton Dayton, Ohio

May 2014

Languages

- Spanish - Beginner (A1)

- French - Beginner (A1)

- German - Beginner (A1)

Writing Your Insurance Underwriter Resume

Having explored these effective resume examples, you are now prepared to dive into the process of how to write a resume. We'll walk you through each section in detail, ensuring you understand every step along the way.

List your most relevant skills

A powerful insurance underwriter resume includes a skills section that showcases both technical abilities, such as risk assessment and policy analysis, and important soft skills like attention to detail and decision-making.

To maximize your chances of getting noticed, carefully analyze job listings for keywords from the job listing. Include these keywords in your skills section to demonstrate a direct match with what employers are seeking. This not only appeals to human recruiters but also improves your visibility in applicant tracking systems, ensuring you stand out as a qualified job seeker.

Example of skills on an insurance underwriter resume

- Proficient in assessing risk factors and evaluating insurance applications

- Skilled in analyzing data to determine policy terms and conditions

- Strong communicator capable of building relationships with clients and brokers

- Detail-oriented with excellent organizational and analytical skills

Highlight your soft skills on your resume. Employers treasure interpersonal abilities as they are challenging to impart and often set you apart from other job seekers.

Highlight your work history

Your work experience section should showcase specific accomplishments that reflect your ability to evaluate risk, assess policies, and make informed decisions—this is what employers want to see.

Include essential details for each job entry: your title, the employer's name, and the dates of employment. This information not only establishes your professional credibility but also helps hiring managers quickly understand your background in the industry. Be sure to highlight any notable projects or outcomes that distinguish you from other applicants.

Example of an insurance underwriter work experience entry

- Insurance Underwriter

Allied Insurance - Denver, CO

June 2019 - Present - Evaluate insurance applications and determine risk levels, resulting in a 15% reduction in approval time while maintaining underwriting quality standards

- Analyze and assess policyholder information and claims history to make informed decisions, achieving a 98% accuracy rate in risk assessment

- Collaborate with agents to provide clear explanations of underwriting guidelines, improving communication and improving agent satisfaction by 20%

- Develop tailored insurance solutions for clients based on comprehensive data analysis, contributing to a 10% growth in new business acquisition year-over-year

- Mentor junior underwriters on industry regulations and best practices, fostering a culture of continuous improvement and professional development

Aim for clarity in your bullet points. Focus on specific achievements that highlight your skills, using concise language to convey impact without getting lost in unnecessary details.

Include your education

The education section of your insurance underwriter resume should be structured in reverse-chronological order, starting with your most recent degree or diploma. Include all relevant degrees and certifications while omitting your high school diploma if you possess a bachelor's degree or higher. This approach allows potential employers to quickly see your qualifications at a glance.

If you are currently enrolled in a program or have not yet completed a degree, list the highest level of education achieved along with an expected graduation date. Including bullet points that highlight relevant coursework or academic accomplishments can further strengthen this section, especially for those who are new graduates or still in school.

Common certifications for an insurance underwriter resume

- Chartered Property Casualty Underwriter (CPCU) – The Institutes

- Associate in Commercial Underwriting (ACU) – The Institutes

- Associate in Personal Insurance (API) – The Institutes

- Certified Insurance Counselor (CIC) – National Alliance for Insurance Education & Research

Sum up your resume with an introduction

The profile section of your resume is important for making a strong first impression on potential employers. It serves as an introduction to your professional self, offering a snapshot of your qualifications and career goals.

For experienced applicants, using a professional summary is often the best choice. This format allows you to showcase your most significant achievements and relevant experience right at the top of your resume. If you have a limited work history, consider a resume objective that emphasizes your eagerness to grow professionally.

Professional summary example

Experienced insurance underwriter with over 5 years in risk assessment and policy evaluation. Demonstrated success in identifying key underwriting risks, optimizing coverage options, and improving client relationships. Proficient in using advanced analytical tools to drive informed decision-making and ensure compliance with industry regulations.

Resume objective example

Enthusiastic insurance underwriter eager to apply analytical thinking and attention to detail in a collaborative environment. Looking to use strong risk assessment and communication skills to support the underwriting team and improve efficiency in policy evaluation processes.

As an insurance underwriter, your resume profile is a critical chance to showcase your skills. Carefully analyze job descriptions and incorporate relevant keywords to improve the likelihood of passing through applicant tracking systems. This strategic approach not only highlights your qualifications but also aligns your experience with what employers are seeking.

Add unique sections to set you apart

Optional resume sections can highlight your unique qualifications as an insurance underwriter. These sections allow you to share additional aspects of your professional identity that might set you apart from other job seekers.

By including relevant hobbies or volunteer work, you give potential employers insight into your values and skills. For instance, if you engage in financial literacy programs, it shows your commitment to helping others while improving your analytical abilities. Such experiences reflect not only your expertise but also the personal qualities that make you a great fit for the role.

Three sections perfect for a insurance underwriter resume

- Languages: In an insurance underwriter role, clear communication with clients and agents is essential. Highlighting your language skills on your resume showcases your ability to connect with diverse clients, improving trust and comprehension.

- Volunteer Work: Including volunteer work on a resume can improve your professional skills and demonstrate your dedication to community service. It showcases your values and commitment, making you a more attractive applicant to potential employers.

- Accomplishments: As an insurance underwriter, quantifiable accomplishments are important to illustrate your decision-making impact. Showcase these achievements by integrating them into your work experience section or by creating a dedicated accomplishments section.

5 Resume Formatting Tips

- Choose a format that matches your career stage.

Selecting the right resume format is important to showcase your experience effectively. If you have substantial experience, consider a chronological format to highlight your career progression. For those just starting out, a functional resume can emphasize skills over work history. A combination format also works well for mid-level professionals, mixing both approaches for maximum impact.

- Pick a smart resume template.

Use a professional resume template to improve readability. A well-structured format allows hiring managers to quickly identify your skills and experience. Stick to clean designs with easy-to-read fonts if you opt for a custom layout, ensuring your resume remains ATS-friendly.

- Select an appropriate font.

Selecting a clear and professional font is important for your resume's readability. Opt for a font like Verdana, Georgia, Arial, or Helvetica to ensure your information is easily digestible for both applicant tracking systems and hiring managers.

- Use consistent formatting.

Align your resume to the left and maintain uniform margins to ensure a polished and professional look that captures the attention of hiring managers.

- Keep your resume to one or two pages.

When crafting your resume, aim for a clean and concise format. Generally, resumes should be one page long to ensure hiring managers quickly see your key qualifications. Only extend it if you have extensive experience that adds significant value.

What’s the Average Insurance Underwriter Salary?

Insurance underwriter salaries vary based on location, career level, and qualifications.

This data, provided by the Bureau of Labor Statistics, will show you expected salary ranges for insurance underwriters in the top 5 highest-paying states, including the District of Columbia. The figures reflect the most current salary data available, collected in 2024.

- Full Range

- Most Common (25th–75th percentile)

- Average

District of Columbia

Most common: $81,240 - $133,600

Washington

Most common: $72,630 - $128,880

Massachusetts

Most common: $77,890 - $130,280

South Dakota

Most common: $60,050 - $110,390

California

Most common: $75,770 - $120,100

Tools for Your Job Search

Are you ready to pursue that insurance underwriter position you've been eyeing? Before you submit your application, take advantage of our ATS Resume Checker. This tool offers essential insights on how your resume fares with the automated systems many insurance companies rely on for initial job seeker screening.

Looking to elevate your resume further? Our AI Resume Builder provides tailored content recommendations specific to your insurance background and features professionally designed templates that effectively showcase your qualifications and expertise.

Frequently Asked Questions

Last Updated: October 23, 2025

Yes, a cover letter is important because it provides context to your resume and creates valuable communication opportunities with employers. It allows you to highlight what excites you about the insurance underwriter role and demonstrate how your skills make you a strong applicant. So, take the time to write a cover letter that improves your application.

If you're looking for a quick way to create a tailored cover letter, try our AI Cover Letter Generator. It's designed to help you craft compelling letters in just minutes, with various cover letter template options available that perfectly match your resume for a polished presentation.

A resume is usually concise, ranging from one to two pages, and highlights your relevant skills and experiences. In contrast, a curriculum vitae (CV) can be several pages long and provides an in-depth overview of your academic background, research contributions, publications, and professional achievements.

You’ll typically use a CV for positions in academia or specialized fields such as law or medicine. If you find yourself needing a CV for your next opportunity, our online CV Maker can help you create a professional document quickly. Choose from various CV templates designed for different industries and career levels to get started with ease.

To write a strong CV, focus on structuring your information under clear headings like Summary, Experience, Education, and Skills. Choose modern and professional templates that are compatible with applicant tracking systems. Tailor your content for each job application by including relevant keywords from the job posting to improve visibility.

Additionally, explore CV examples from industry experts to gain insights into effective presentation styles. Observing how successful individuals highlight their accomplishments can inspire you to create a compelling narrative that showcases your strengths and sets you apart from other job seekers.

Essential skills such as "risk assessment" and "analytical thinking" are important for insurance underwriter resumes. It's also beneficial to examine job descriptions for other significant keywords and phrases that employers prioritize.

When making your resume as an insurance underwriter, briefly mention your aspirations in the summary. Use your cover letter to elaborate on your career goals and how specific roles can facilitate your growth. Target positions that align with these ambitions to improve your professional development and open doors for advancement.

Was this information helpful? Let us know!

Hailey is a career advice writer dedicated to helping job seekers excel in their careers.

More resources

How to Make a Canadian Resume (Format, Template + Examples)

Creating a Canadian resume is key to getting a job in Canada. ...

How to Write a Resume for an Internal Position (Guide + Examples)

Ready for a new role within the same company? We ll help you...

The Great Workplace Reckoning: How 2025 Burned Out Workers & What’s Next for 2026

The workforce spent much of 2025 in survival mode navigating ...

Mechanical Engineering Resume: Examples & Templates

As a mechanical engineer you need a resume that showcases you...

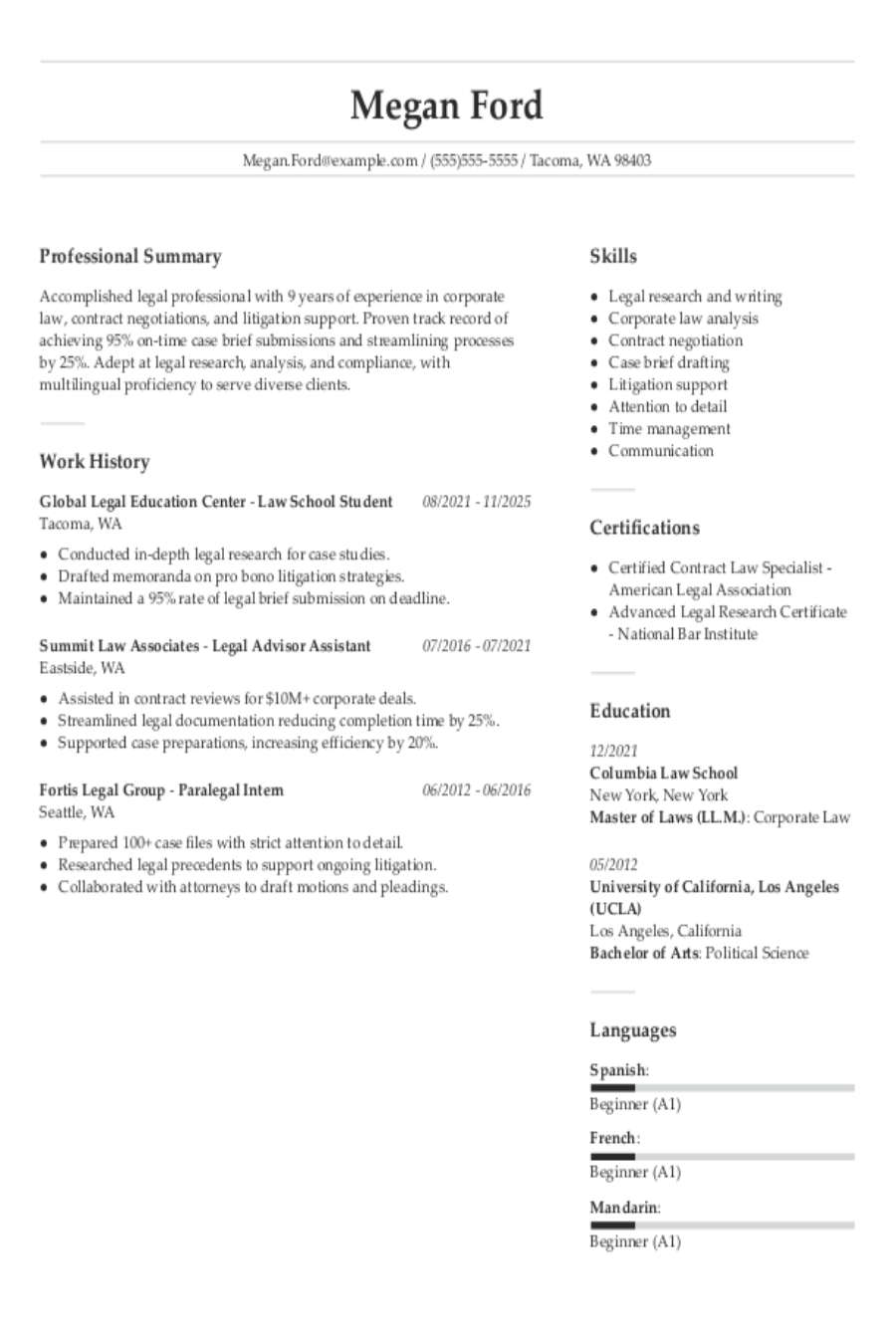

Law School Resume: Examples, Templates and Tips

Creating a standout law school resume means highlighting criti...

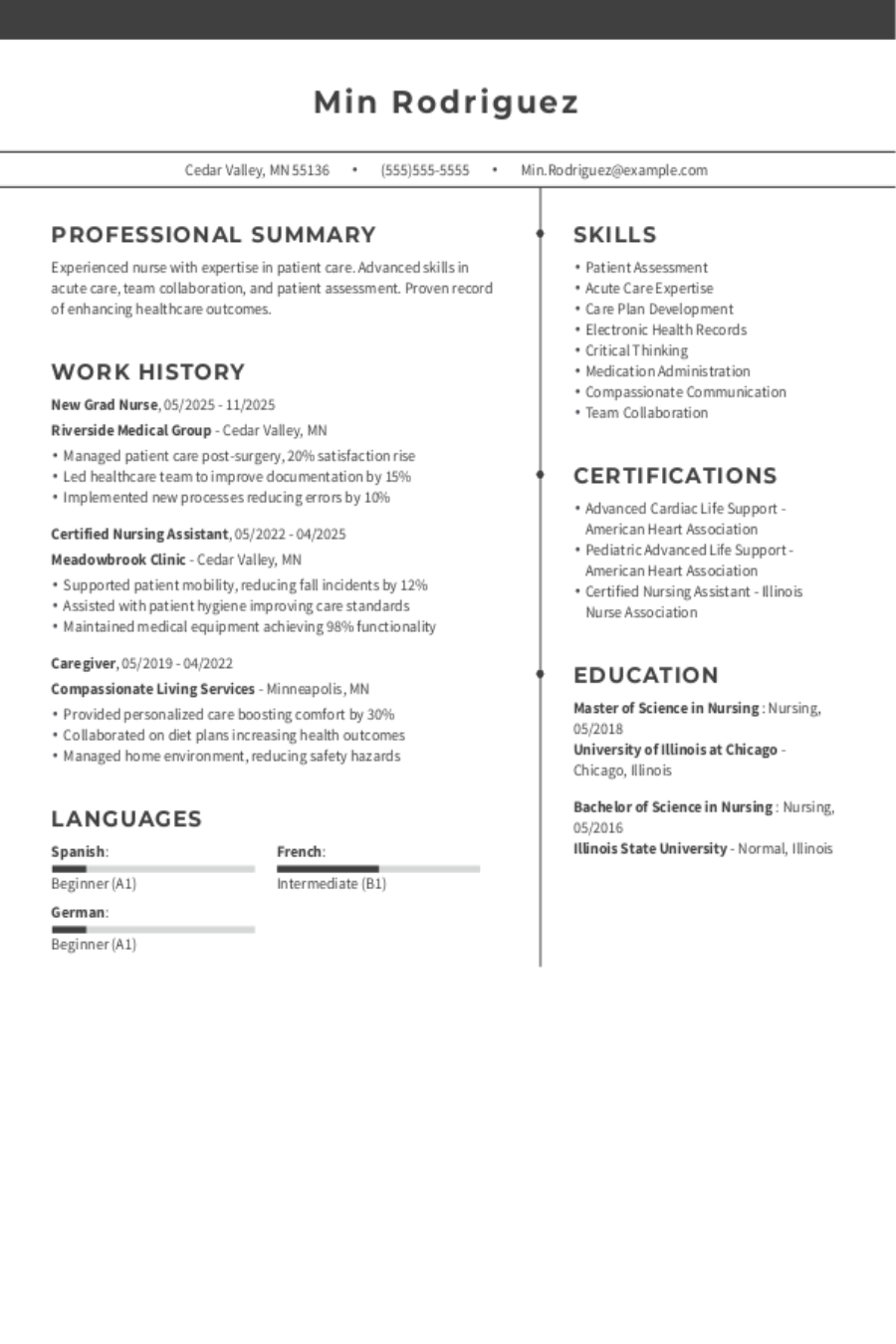

New Grad Nurse Resume: Examples & Templates for 2025

As a new grad nurse you need a resume that highlights your cl...