Popular Insurance Agent Resume Examples

Entry-level insurance agent resume

An entry-level resume for an insurance agent should highlight relevant coursework, certifications, customer service skills, and internships to show readiness for a sales-driven environment.

Places skills over experience: Using a functional resume format is strategic for this entry-level insurance agent because it highlights key skills like risk assessment and policy sales, focusing on relevant contributions instead of chronological experience.

Showcases education: This resume organizes the education section near the top, allowing the candidate’s degrees to provide an early impression of expertise.

Mid-career insurance agent resume

A mid-career insurance agent resume should emphasize a strategic mix of client relationships, sales achievements, and ongoing professional development to demonstrate value and adaptability in the industry.

Begins with a powerful summary: This resume's professional summary highlights key accomplishments in client retention and revenue growth, ensuring recruiters spot vital skills like risk management and cross-sales expertise quickly.

Includes mix of skills: This resume effectively highlights a mix of analytical skills in risk management and interpersonal abilities in client relations, showcasing the applicant's well-rounded capabilities as an insurance agent.

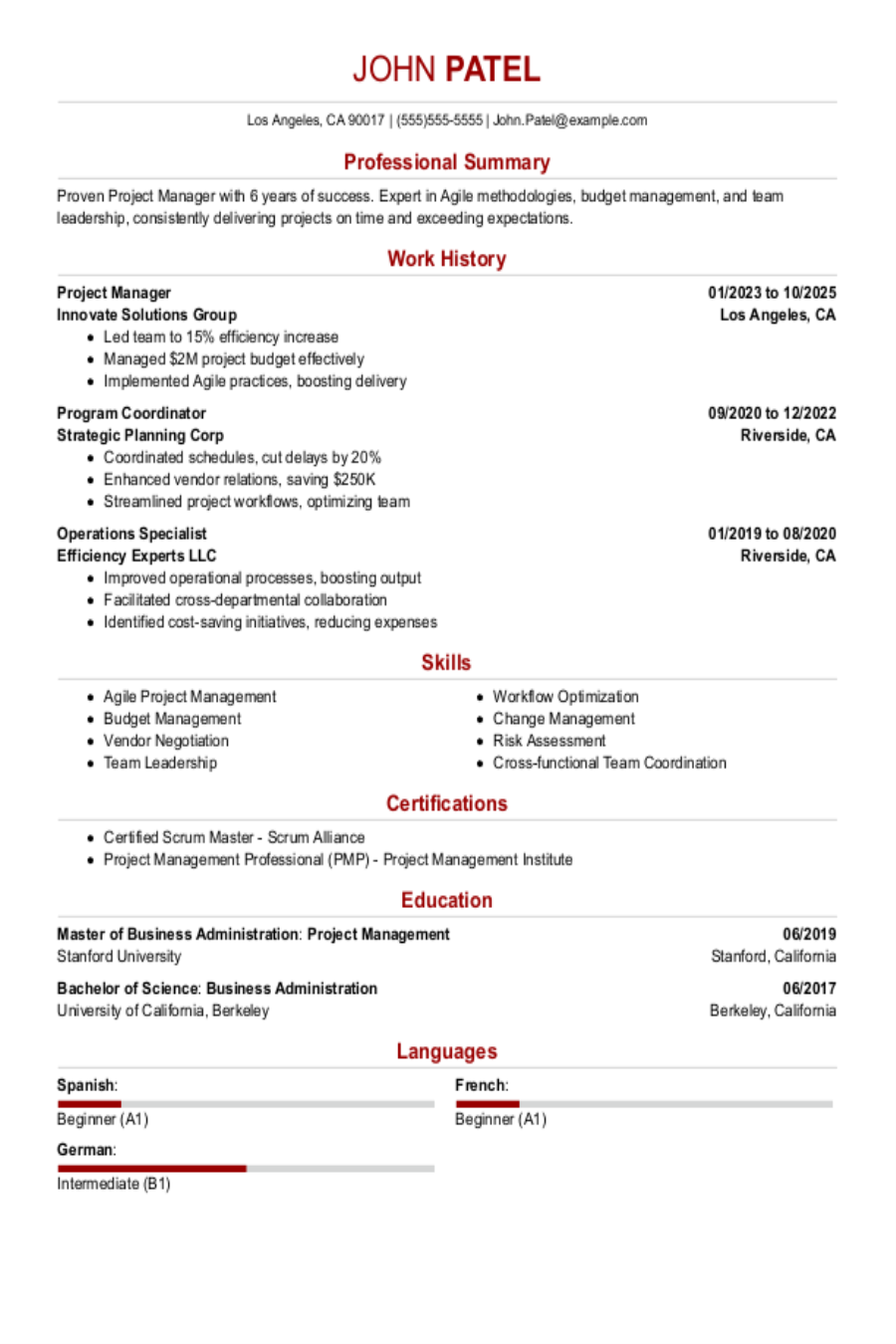

Experienced insurance agent resume

An experienced insurance agent resume should prioritize highlighting sales achievements and client relationships to effectively demonstrate career growth and expertise in the insurance industry.

Quantifies achievements: Quantifiable achievements, such as a 15% increase in policy sales or managing portfolio growth from $1M to $3M, provide clear evidence of an insurance agent's impact. Numbers make accomplishments tangible and easily recognizable for recruiters, improving the applicant's appeal.

Follows traditional format: The chronological resume format effectively showcases the job seeker's extensive experience, allowing for a clear and coherent presentation of their career progression through well-defined roles and responsibilities over time.

No experience insurance agent resume

A resume for an applicant with no experience should highlight relevant skills, certifications, and any customer service or sales-related activities to showcase the applicant's potential and enthusiasm for the insurance agent role.

Avoids jargon: Job seekers often feel pressured to embellish their resumes with complex terminology, thinking it will impress employers. However, a straightforward and clear presentation of skills and experiences is much more effective. Simple language effectively conveys expertise without unnecessary confusion.

Leads with education: Positioning education near the top of the document and highlighting academic achievements helps this resume stand out despite lacking experience.

More resume examples

Insurance Agent Resume Template

Looking to create a standout application? Use this insurance agent resume template as your base—simply tailor it with your personal details and experiences.

Daniel Brown

Jersey City, NJ 07309

(555)555-5555

Daniel.Brown@example.com

Professional Summary

Accomplished Insurance Agent with a solid track record in risk management, superior client service, and sales expertise. Proven success in increasing premium growth, enhancing retention, and streamlining operations.

Work History

Insurance Agent

SafeGuard Insurance Group - Jersey City, NJ

June 2022 - September 2025

- Increased client base by 30% in 18 months

- Exceeded sales targets by $50k annually

- Developed tailored policies for 200+ clients

Insurance Consultant

Freedom Insurance Co. - Jersey City, NJ

January 2020 - May 2022

- Boosted policy renewal rate to 85% annually

- Secured $100k in new business quarterly

- Conducted 100+ client interviews monthly

Insurance Advisor

United Assurance Inc. - Maplewood, NJ

January 2019 - December 2019

- Achieved premium growth by 20% annually

- Implemented retention strategies boosting loyalty

- Evaluated 300 policy applications monthly

Skills

- Risk Assessment

- Client Relationship Management

- Sales Strategy

- Policy Analysis

- Compliance Expertise

- Negotiation Skills

- Financial Planning

- Problem-Solving

Education

Master's in Business Administration Insurance and Risk Management

University of Illinois Urbana-Champaign, Illinois

May 2019

Bachelor of Science Finance

Illinois State University Normal, Illinois

May 2017

Certifications

- Certified Insurance Counselor (CIC) - National Alliance

- Chartered Property Casualty Underwriter (CPCU) - The Institutes

Languages

- Spanish - Beginner (A1)

- French - Beginner (A1)

- German - Beginner (A1)

Must-Have Skills on an Insurance Agent Resume

A strong skills section is a important part of any effective resume.

Professionals in finance, banking, and insurance play a crucial role in maintaining trust and stability. The skills you highlight should reflect your ability to support accurate, efficient operations and contribute to sound decision-making. This section is your chance to show how you help safeguard and advance organizational goals.

The following data highlights the key hard and soft skills that are typically sought in insurance agents based on insights from Resume Now’s internal resume analytics.

When you’re ready to improve your resume, explore our AI Resume Skills Generator. It offers tailored skill suggestions according to your job title, helping you create a comprehensive and personalized skill profile.

Writing Your Insurance Agent Resume

Having explored these effective resume examples, you are now prepared to dive into the detailed process of how to write a resume. We will guide you step by step, breaking down each section for clarity and ease.

List your most relevant skills

Creating a powerful skills section allows you to highlight both your technical expertise and interpersonal abilities like customer service and negotiation. By incorporating keywords from the job listing, you demonstrate not only your qualifications but also your understanding of what the employer values.

Carefully analyze the job description to identify key phrases and requirements that resonate with your experience. This approach will help you connect with human recruiters while ensuring that applicant tracking systems recognize you as a strong job seeker.

Example of skills on an insurance agent resume

- Proficient in analyzing client needs to recommend suitable insurance coverage

- Experienced in negotiating terms and conditions with clients

- Strong communicator with exceptional customer service skills

- Detail-oriented with expertise in policy documentation and claims processing

Highlighting your soft skills on your resume is essential. Employers place great value on interpersonal abilities, as they are challenging to teach and can significantly improve teamwork and client relationships in the insurance field.

Highlight your work history

Your work experience section is where you can shine by showcasing achievements and illustrating how your skills have been applied in real-world situations. Make sure each entry highlights specific accomplishments and incorporates industry-relevant keywords that will grab the attention of hiring managers.

For each job entry, include essential details such as your title, employer name, and employment dates. These elements help establish credibility and enable employers to quickly gauge your background. As you write this section, focus on demonstrating the positive impact of your contributions within each role.

Example of an insurance agent work experience entry

- Insurance Agent

State Farm - Dallas, TX

June 2019 - Present - Develop and maintain a robust client portfolio, achieving a 30% increase in policy renewals year-over-year

- Conduct thorough needs assessments for clients to recommend tailored insurance solutions, resulting in a 95% satisfaction rate

- Use CRM software to track client interactions and follow-ups, improving response time by 40%

- Educate clients about coverage options and risk management strategies through informative presentations and workshops

- Collaborate with underwriting teams to expedite claims processes, leading to a 20% reduction in claim resolution times

Aim for clarity in your bullet points. Include specific achievements that highlight your skills and contributions, while keeping each point concise enough to maintain the reader's interest.

Include your education

The education section of your insurance agent resume should detail your academic qualifications in reverse-chronological order, starting with the most recent degree or diploma. Include any relevant certifications and consider omitting your high school diploma if you have attained a higher degree.

For those currently pursuing an education or who have incomplete degrees, it is advisable to list the highest completed level along with an expected graduation date. You may also want to include bullet points highlighting relevant coursework or achievements that showcase your skills in insurance and related fields. This approach is particularly effective for current students or recent graduates.

Common certifications for an insurance agent resume

- Certified Insurance Counselor (CIC) – National Alliance for Insurance Education & Research

- Chartered Property Casualty Underwriter (CPCU) – The Institutes

- Accredited Advisor in Insurance (AAI) – The National Underwriter Company

- Life Underwriter Training Council Fellow (LUTCF) – National Association of Insurance and Financial Advisors

Sum up your resume with an introduction

Creating a compelling profile section on your resume is important for making a strong first impression. This section serves as your introduction, providing potential employers with a snapshot of your professional identity and what you bring to the table.

If you’re an experienced applicant, consider using a professional summary to showcase your notable achievements and skills right at the top of your resume. If your experience is still growing, write a resume objective that underscores your commitment to learning and improvement.

Professional summary example

Dynamic insurance agent with over 5 years of experience in delivering tailored insurance solutions to diverse clients. Recognized for building strong relationships and driving policy growth through exceptional customer service and thorough risk assessment. Proficient in navigating complex coverage options, ensuring clients receive optimal protection and peace of mind.

Resume objective example

Enthusiastic insurance agent eager to harness strong communication, problem-solving, and customer service skills to improve client satisfaction and drive policy sales. Committed to building lasting relationships and delivering tailored insurance solutions that meet client needs.

As an insurance agent applicant, your resume profile should be concise and packed with essential information. Aim for a maximum of three sentences that highlight your key skills and achievements. Remember, any additional details can be elaborated on in your cover letter.

Add unique sections to set you apart

Improve your resume by adding optional sections that highlight your unique qualifications as an insurance agent. These sections allow you to showcase your individual strengths beyond standard job descriptions.

By including relevant hobbies and volunteer experiences, you can reveal different dimensions of your professional life. Employers appreciate seeing how you engage with the community or develop skills that align with their values. Whether it's participating in local charity events or pursuing interests related to finance and risk management, these insights provide a deeper understanding of your character and work ethic.

Three sections perfect for a insurance agent resume

- Languages: As an insurance agent, effective communication is important. If you are fluent in multiple languages, highlight your language skills on your resume. It can help you connect with diverse clients and expand your client base.

- Volunteer Work: Including volunteer work on a resume not only improves your experience but also highlights your dedication to community service and strengthens essential professional skills. Demonstrating that you care about making a positive impact can appeal to potential employers.

- Accomplishments: As an insurance agent, measurable results are important for building trust and demonstrating your effectiveness. Emphasize these achievements within your work history or by making a dedicated accomplishments section.

5 Resume Formatting Tips

- Choose a format that matches your career stage.

Choosing the right resume format is important based on your experience. If you have a wealth of experience, a chronological format can showcase your career progression effectively. For those starting out, a functional format highlights skills over work history. Consider a combination resume if you want to merge both approaches for a well-rounded presentation.

- Pick a smart resume template.

Using a professional resume template is key for making your application stand out. It improves readability and allows hiring managers to quickly find important information. Opting for a clean, organized layout simplifies formatting and ensures you present your qualifications in the best light possible.

- Select an appropriate font.

Using a clear, professional font improves your resume's readability. Opting for widely accepted fonts like Helvetica, Georgia, or Verdana ensures both ATS compatibility and a polished look for recruiters.

- Use consistent formatting.

Ensure your resume is neatly left-aligned with uniform margins to create a polished and professional look that stands out to potential employers.

- Keep your resume to one or two pages.

Remember, resumes should be one page long to keep your content focused. If you have extensive experience, a second page is acceptable, but ensure every word counts and highlights your key achievements.

Tools for Your Job Search

Are you excited to pursue a new opportunity as an insurance agent? Before you submit your application, make sure to use our ATS Resume Checker. This tool offers essential feedback on how your resume performs with the automated systems commonly used by insurance companies to screen applicants.

Looking for a way to elevate your application? Our AI Resume Builder can provide targeted recommendations tailored to your specific experience in the insurance field, along with professionally designed templates that effectively showcase your skills and achievements.

Frequently Asked Questions

Last Updated: October 22, 2025

Yes, cover letters are important. They add depth to your resume and provide a platform for you to communicate directly with employers. A cover letter lets you express why you're passionate about the role and how your experience makes you an ideal fit. Take this opportunity to write a cover letter that stands out.

For a quick and effective solution, use our AI Cover Letter Generator. It creates personalized, job-specific cover letters in minutes, ensuring a professional presentation. Plus, you can choose from various cover letter template options that align perfectly with your resume for a cohesive application package.

A resume is typically concise, ranging from one to two pages, focusing on your most relevant work experience and skills. In contrast, a CV (curriculum vitae) can be several pages long and provides comprehensive details about your academic background, research contributions, publications, and professional experiences.

For specialized positions in academia or fields like law and medicine, you should use a CV. If you're uncertain about which document to create, our online CV Maker can assist you! With various tailored CV templates for different industries and career levels, crafting a stunning CV that meets your needs becomes effortless.

To make your insurance agent resume stand out, opt for a polished template and weave in relevant keywords from the job description. This strategy ensures your qualifications catch the employer's eye effectively.

To tailor your insurance agent resume, focus on highlighting skills that match the job description. Review the listing for keywords and phrases that resonate with the role. Incorporate these terms into your resume to illustrate your qualifications and how you can meet the employer's needs effectively.

Insurance agents often begin as trainees or assistants, learning the industry. With experience and certifications, they can advance to senior agent roles or specialize in areas like underwriting or claims management.

When crafting your resume as an insurance agent, briefly mention your career aspirations in the summary. However, use your cover letter to elaborate on these goals. Focus on applying for positions that provide opportunities for growth and skill enhancement, as this will help you advance in your insurance career.

Was this information helpful? Let us know!

Hailey is a career advice writer dedicated to helping job seekers excel in their careers.

More resources

Only 1 in 10 Resumes Include Measurable Results, New Analysis of 18.4M U.S. Resumes Finds

Resume Now takes a closer look at measurable results on resume...

Top Entry‑Level Careers That Are Fast‑Growing, Higher‑Paying, and AI‑Resistant

Artificial intelligence is touching more parts of work every y...

What Does It Mean if an Interviewer Says "Good Luck" or "We'll Be In Touch"?

Read on to learn the meaning behind these standard post-interv...

Entry-level Resume: Examples, Templates & Tips

As you embark on your career having a standout resume is impo...

Construction Project Manager Resume Examples & Guide

As a construction project manager your resume must capture th...

Engineering Project Manager Resume Examples & Guide

As an engineering project manager your resume must capture th...