Popular Banking Resume Examples

Entry-level banking resume

An entry-level resume for banking should highlight relevant coursework, internships, technical skills, and customer service experience to show competence and readiness for the financial industry, even with limited work history.

Emphasizes soft skills: This applicant’s resume effectively highlights soft skills like customer relationship management and problem-solving, which mitigate the limited experience in banking.

Prioritizes simplicity: Using a simple resume template improves readability, enabling hiring managers to quickly grasp your qualifications and achievements, making the selection process more efficient.

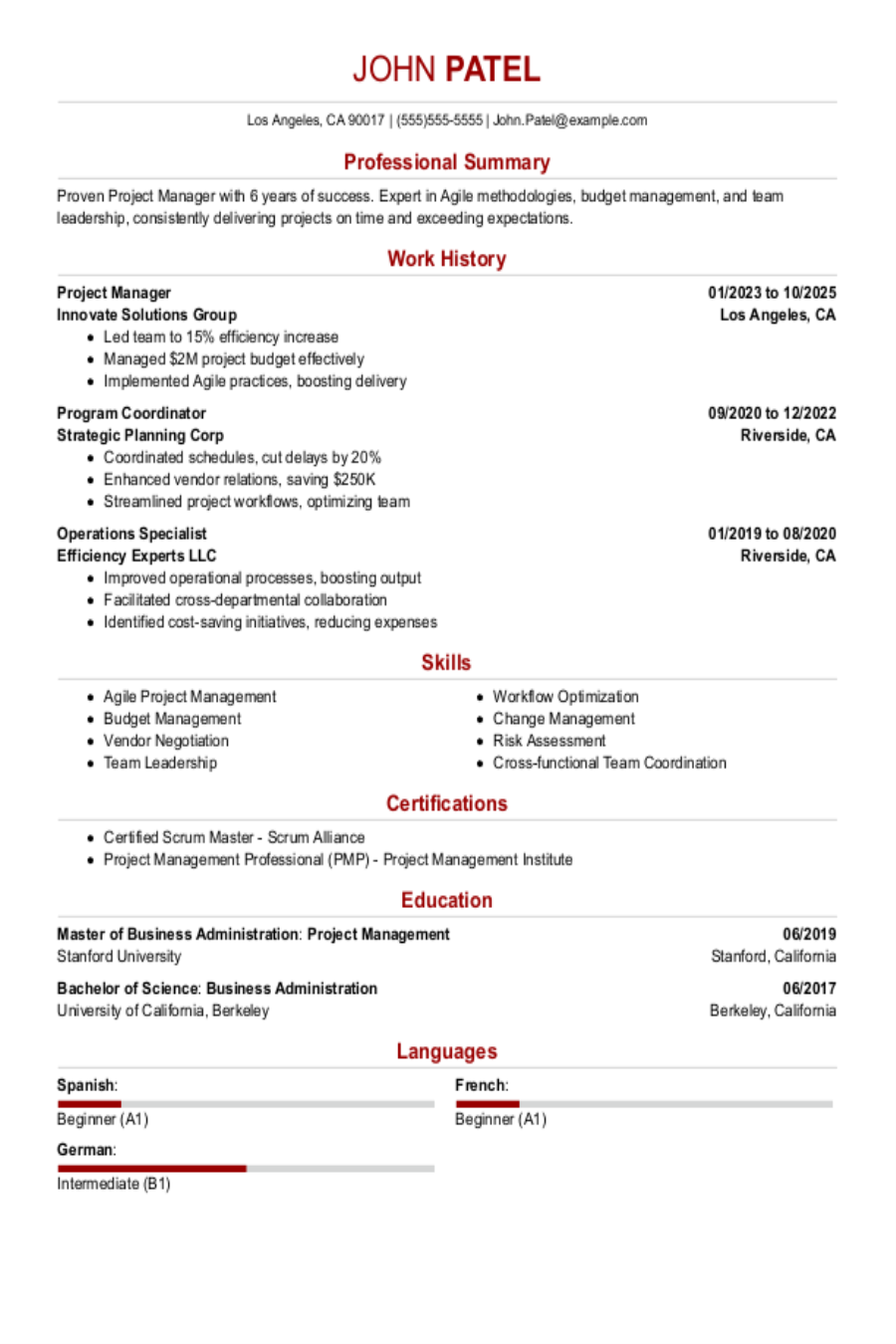

Mid-career banking resume

A mid-career banking professional's resume should effectively highlight a combination of extensive experience, key skills, and continuous advancement in the industry to attract potential employers' attention.

Employs active language: Using action verbs like "managed," "led," and "optimized" highlights initiative and tangible results, showcasing a proactive approach in client retention and revenue growth.

Balances experience and skills: This experienced banking professional's resume skillfully balances technical expertise in financial advisory and credit analysis with notable career advancements, showing balance and leadership potential.

Experienced banking resume

An experienced banking resume should prioritize highlighting measurable achievements and skill development, clearly illustrating the applicant's career growth and expertise in financial services to attract potential employers.

Quantifies achievements: Quantifiable achievements provide clarity and impact to a job seeker's accomplishments, making them more relatable for recruiters. By showcasing specific metrics—like a 15% increase in loan portfolios or managing a $10M portfolio—this applicant showcases their value.

Embraces a modern style: This modern resume template effectively showcases the job seeker's innovative approach and professional brand by highlighting their achievements in financial analysis and client relationship building, all within a visually appealing layout.

No experience banking resume

A resume for an applicant with no experience should highlight relevant skills, coursework, and any internships or volunteer opportunities that showcase the job seeker's potential to excel in the financial industry.

Uses a simple style: The resume's clean and straightforward layout effectively highlights the qualifications in finance, showcasing relevant experiences and skills without unnecessary distractions.

Highlights accomplishments: Highlighting key achievements like grades and extracurriculars helps this candidate showcase their expertise despite limited experience.

More resume examples

Banking Resume Template

Looking to make a strong impression in the banking industry? Kickstart your journey with this customizable resume template, designed to showcase your skills and experience effectively.

Li Davis

Lakeside, CA 92058

(555)555-5555

Li.Davis@example.com

Professional Summary

Results-driven Banking professional with 9+ years in finance. Expertise in analytics, risk management, and boosting profitability.

Skills

- Financial Analysis

- Risk Management

- Customer Relationship

- Data Analytics

- Team Leadership

- Strategic Planning

- Regulatory Compliance

- Budgeting and Forecasting

Work History

Bank Operations Manager

Liberty Financial Services - Lakeside, CA

March 2020 - September 2025

- Increased loan portfolio by 15% annually.

- Reduced operational costs by 0K per year.

- Enhanced customer satisfaction to 95%.

Finance Analyst

Greenfield Banking Corp - Los Angeles, CA

September 2015 - March 2020

- Developed financial models boosting revenue 20%.

- Streamlined reporting process saving 10 hours weekly.

- Forecasted trends increasing strategic investment ROI.

Bank Teller Supervisor

Pinnacle National Bank - Los Angeles, CA

September 2013 - August 2015

- Managed a team of 10, increasing efficiency by 30%.

- Processed transactions reducing errors by 40%.

- Led customer service initiatives raising ratings.

Certifications

- Certified Financial Analyst - CFA Institute

- Professional Risk Manager - PRMIA

Education

Master of Business Administration Finance

University of Pennsylvania Philadelphia, Pennsylvania

May 2013

Bachelor of Science Economics

University of Michigan Ann Arbor, Michigan

May 2011

Languages

- Spanish - Beginner (A1)

- French - Beginner (A1)

- German - Intermediate (B1)

Writing Your Banking Resume

Having explored impressive resume examples, you’re now prepared to dive into the essentials of creating your own. We’ll take you through how to write a resume step by step, guiding you through each section to ensure your application stands out in the banking industry.

List your most relevant skills

An effective skills section on your banking resume is important for showcasing your qualifications and readiness for the role. You want to focus on both technical skills, such as financial analysis and regulatory compliance, as well as essential soft skills like customer service and teamwork. These elements are key in demonstrating how you can meet the demands of the position.

Make sure to review job listings carefully to identify keywords from the job listing that resonate with your experience. By incorporating these relevant terms into your skills section, you not only appeal to human recruiters but also optimize your resume for applicant tracking systems (ATS).

Example of skills on a banking resume

- Proficient in financial analysis and risk assessment to ensure sound banking decisions

- Adept at customer relationship management, fostering trust and satisfaction

- Strong communicator with the ability to explain complex financial concepts clearly

- Analytical thinker who thrives in fast-paced environments and adapts quickly to changes

When crafting your resume for a banking position, make sure to highlight your soft skills. Employers highly value interpersonal abilities such as communication and teamwork, as these are often more challenging to develop than technical skills, making them a significant asset in any applicant.

Highlight your work history

Your work experience section is essential when crafting a resume in banking. This part of your resume should not only list your duties but also highlight your achievements, demonstrating how you’ve applied your skills in meaningful ways. By showcasing measurable results, such as increased efficiency or customer satisfaction, you can capture the attention of hiring managers who are looking for job seekers that deliver value.

When detailing each job entry, include essential information like your title, the name of the employer, and the dates of employment. This clarity helps employers quickly assess your career history and understand your level of expertise.

Example of a banking work experience entry

- Personal Banker

First National Bank - Dallas, TX

January 2021 - Present - Process over 150 customer transactions daily, ensuring accuracy in cash handling and compliance with banking regulations

- Deliver outstanding customer service by assisting clients with account inquiries, loan applications, and financial products, achieving a 90% satisfaction rate

- Collaborate effectively with colleagues to streamline operations and improve branch efficiency, contributing to a 15% increase in productivity

- Conduct regular audits of cash drawers and vaults to uphold security standards, resulting in zero discrepancies during quarterly reviews

- Mentor new tellers on operational procedures and customer service excellence, shortening training duration by 25%

Quantifying achievements in banking is important, as it provides tangible proof of your impact. For instance, stating that you increased loan approvals by 40% through optimized processes demonstrates your effectiveness and ability to drive results within the organization.

Include your education

The education section of your banking resume should be structured in reverse-chronological order, beginning with your most recent degree. Include relevant degrees and certifications, but leave off your high school diploma if you hold a bachelor's degree or higher.

For those currently in school or with incomplete education, it’s important to list your highest completed level along with an anticipated graduation date. Including bullet points detailing relevant coursework, internships, or academic achievements can help strengthen this section for recent graduates or current students.

Common certifications for a banking resume

- Certified Financial Planner (CFP) – Certified Financial Planner Board of Standards

- Chartered Financial Analyst (CFA) – CFA Institute

- Financial Risk Manager (FRM) – Global Association of Risk Professionals (GARP)

- Certified Public Accountant (CPA) – American Institute of Certified Public Accountants (AICPA)

Sum up your resume with an introduction

Your resume profile is your first opportunity to make a lasting impression on potential employers. It serves as an overview of your qualifications, experiences, and what you bring to the table, allowing hiring managers to quickly gauge your fit for the role.

If you have substantial experience in banking, a professional summary is ideal for showcasing your key accomplishments. If you're less experienced, write a goal-focused resume objective that showcases your career development.

Professional summary example

Dynamic banking professional with over 10 years of experience in retail and commercial banking sectors. Demonstrated success in improving customer engagement, optimizing operational processes, and driving revenue growth through innovative financial solutions. Highly proficient in risk assessment, portfolio management, and regulatory compliance, consistently exceeding performance benchmarks while delivering exceptional client service.

Resume objective example

Enthusiastic banking professional eager to use strong analytical skills and attention to detail in a dynamic financial institution. Committed to improving customer satisfaction and operational efficiency by applying expertise in data analysis and effective communication, while continuously seeking opportunities for growth and development within the banking sector.

To boost your chances of getting noticed, ensure your resume profile is packed with relevant keywords from the job description. This section is important as it’s often the first thing hiring managers read. By aligning your qualifications with the role's requirements, you can effectively navigate through applicant tracking systems (ATS) and stand out to employers.

Add unique sections to set you apart

Incorporating optional resume sections can significantly improve your application for banking positions by showcasing your unique qualifications. These additional elements provide you with the opportunity to stand out and highlight aspects of your experience that may not fit into the standard format.

By including relevant hobbies or volunteer work, you can reveal different dimensions of your professional persona. For example, if you've volunteered in financial literacy programs, it demonstrates both your commitment to community and your expertise in finance helping potential employers understand what you bring beyond traditional qualifications.

Three sections perfect for a banking resume

- Languages: In banking, precise communication is essential. Listing language skills on your resume can improve your ability to serve diverse clients and boost customer relations.

- Volunteer Work: Incorporating volunteer work on a resume can improve your professional skills and highlight your dedication to community service. It showcases your commitment to helping others, making you a more attractive job seeker to potential employers.

- Quantifiable Metrics: In banking, quantifiable accomplishments are important for demonstrating your impact on financial performance. You can showcase these in your experience bullet points or in a unique section.

5 Resume Formatting Tips

- Choose a format that matches your career stage.

Choosing the appropriate resume format is important for showcasing your experience effectively. If you’re seasoned in banking, a chronological resume highlights your career progression well. For those just starting, consider a functional format to emphasize skills over experience. A combination resume can also be beneficial if you want to merge both approaches, presenting a well-rounded view of your qualifications.

- Pick a smart resume template.

Using a professional resume template greatly improves your document’s readability and formatting. By selecting a well-structured layout, you ensure that hiring managers can easily scan your key qualifications. If you prefer to create your own format, stick to clean designs and ATS-friendly fonts for optimal impact. This approach not only highlights your strengths but also demonstrates professionalism.

- Select a professional font.

When you're selecting a professional font for your resume, choose easily readable options like Garamond, Helvetica, or Verdana. This approach ensures clarity and improves your chances of making a positive impression on both applicant tracking systems and hiring managers.

- Use consistent formatting.

Ensure your resume is neatly formatted with left alignment and uniform margins to create a polished, professional look that stands out to hiring managers.

- Keep your resume to one or two pages.

When crafting your resume, remember that resumes should be one page long in most cases. This helps you highlight your key achievements without overwhelming the reader. Keep your content concise and focused on what truly matters to showcase your skills effectively.

Tools for Your Job Search

Are you gearing up to apply for a banking position? Before you hit that submit button, take advantage of our ATS Resume Checker. This essential tool provides valuable feedback on how your resume measures up against the automated systems many financial institutions use to filter applications during their initial screening process.

Want to elevate your resume even further? Our AI Resume Builder is designed to offer tailored content recommendations specifically for your banking background, complete with professional templates that effectively showcase your unique qualifications and achievements.

Frequently Asked Questions

Last Updated: September 18, 2025

Yes. A cover letter is important as it adds depth to your resume and serves as a direct line of communication with hiring managers. It allows you to convey your enthusiasm for the banking role and detail how your unique skills and experiences make you an ideal job seeker. Don’t overlook this opportunity; take the time to write a cover letter that highlights your qualifications.

If you're short on time, consider using our AI Cover Letter Generator to create a customized, effective cover letter in just minutes. Choose from various cover letter template options that align perfectly with your resume, ensuring a polished and professional presentation of your candidacy.

A resume is typically a concise document, spanning one to two pages, focusing on your skills and work experience. In contrast, a CV (curriculum vitae) can extend several pages and includes detailed information about your academic achievements, research contributions, publications, and professional history.

For positions in academia or specialized fields such as law or medicine, you should use a CV. If you need to create a tailored CV quickly, our online CV Maker offers the perfect solution. With various CV templates designed for different industries and career levels, you can effortlessly craft a standout document that meets your needs.

When you write a strong CV, start by organizing your document with clear sections like education, professional experience, skills, and achievements. Choose a clean and modern template that works well with applicant tracking systems (ATS). Customize your CV for each job application by incorporating specific keywords from the job posting to make an impression.

For more guidance, explore CV examples from seasoned professionals in the banking sector. Reviewing these samples can offer insights into how industry experts effectively showcase their expertise and accomplishments.

Selecting the ideal resume format hinges on your career stage and strengths. For entry-level individuals, a functional format highlights skills over experience, making it suitable for those lacking work history. Seasoned professionals should opt for chronological resumes that showcase their extensive career journey effectively. Mid-career job seekers can benefit from a combination format, harmonizing skill sets with practical experience to present a comprehensive profile. Consider your unique background to choose the most compelling format for you.

To craft a standout banking resume, select a polished, professional template and embed keywords from the job description. This strategic approach showcases your qualifications and aligns your skills with the employer's needs effectively.

To craft a standout banking resume, focus on tailoring your content to highlight the essential skills relevant to the positions you're targeting. Review job listings closely and extract keywords that resonate with your experience. By incorporating these terms into your resume, you’ll effectively showcase how your qualifications align with each specific role.

Was this information helpful? Let us know!

Hailey is a career advice writer dedicated to helping job seekers excel in their careers.

More resources

60% of U.S. Workers Expect AI to Eliminate More Jobs Than It Creates in 2026

Resume Now s newest report shows growing concerns about the im...

Best Resume Font for 2026 (+ Size and Formatting Tips)

Find the best resume font for your resume with our comprehensi...

Entry-Level Resume: Examples & Templates

As you embark on your career having a standout resume is impo...

Construction Project Manager Resume: Examples & Templates

As a construction project manager your resume must capture th...

Engineering Project Manager Resume: Examples & Templates

As an engineering project manager your resume must capture th...