Table of contents

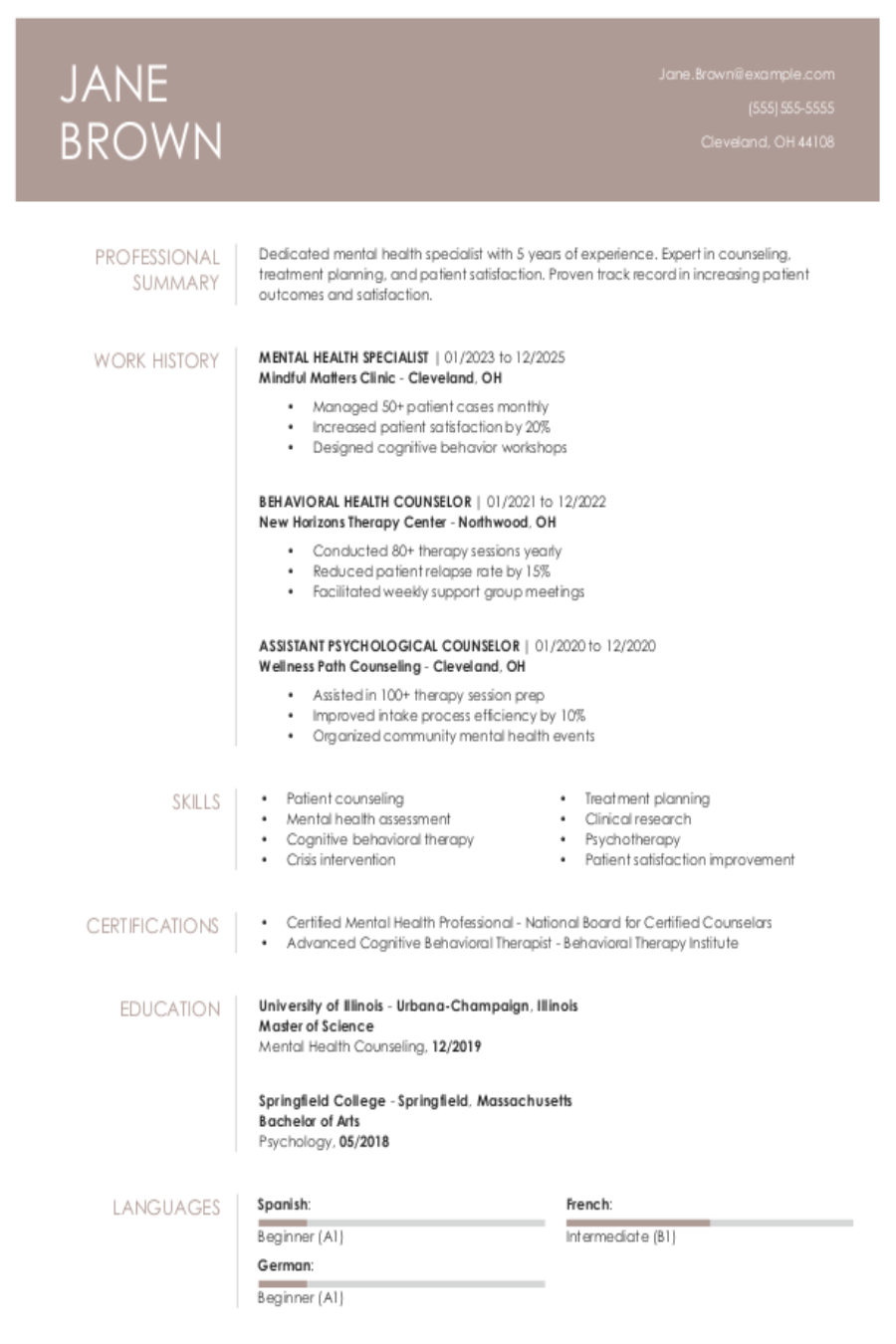

Popular Claims Adjuster Resume Examples

Entry-level claims adjuster resume

An entry-level resume for a claims adjuster should emphasize relevant coursework, internships, strong analytical skills, attention to detail, and any certifications that show dedication to the field.

Focuses on goals: The applicant demonstrates a proactive approach to their early career as a claims adjuster, focusing on improving efficiency and customer satisfaction through innovative claims management and risk evaluation strategies.

Showcases education: This resume prioritizes education by placing it first, using the candidate’s academic credentials to build trust despite their limited experience.

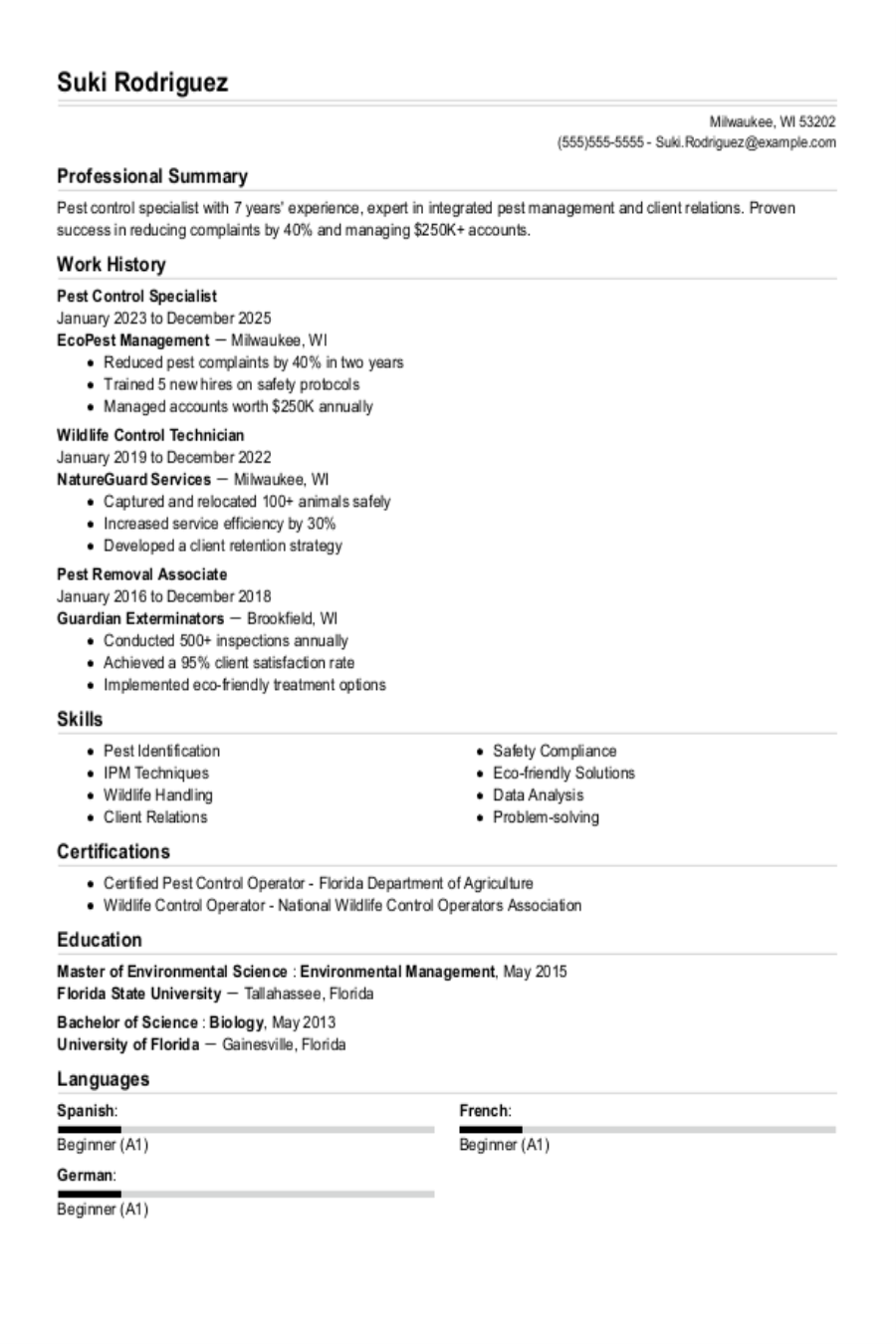

Mid-career claims adjuster resume

A mid-career claims adjuster resume should emphasize a combination of relevant experience, key skills in claim evaluation, and evidence of professional growth to attract potential employers.

Encourages quick scanning: A well-structured layout highlights the job seeker's extensive experience and achievements, making it straightforward for hiring managers to quickly assess qualifications and expertise in claims adjusting.

Begins with a powerful summary: This resume's strong professional summary highlights essential qualifications, showcasing extensive experience in claims adjustment and fraud detection.

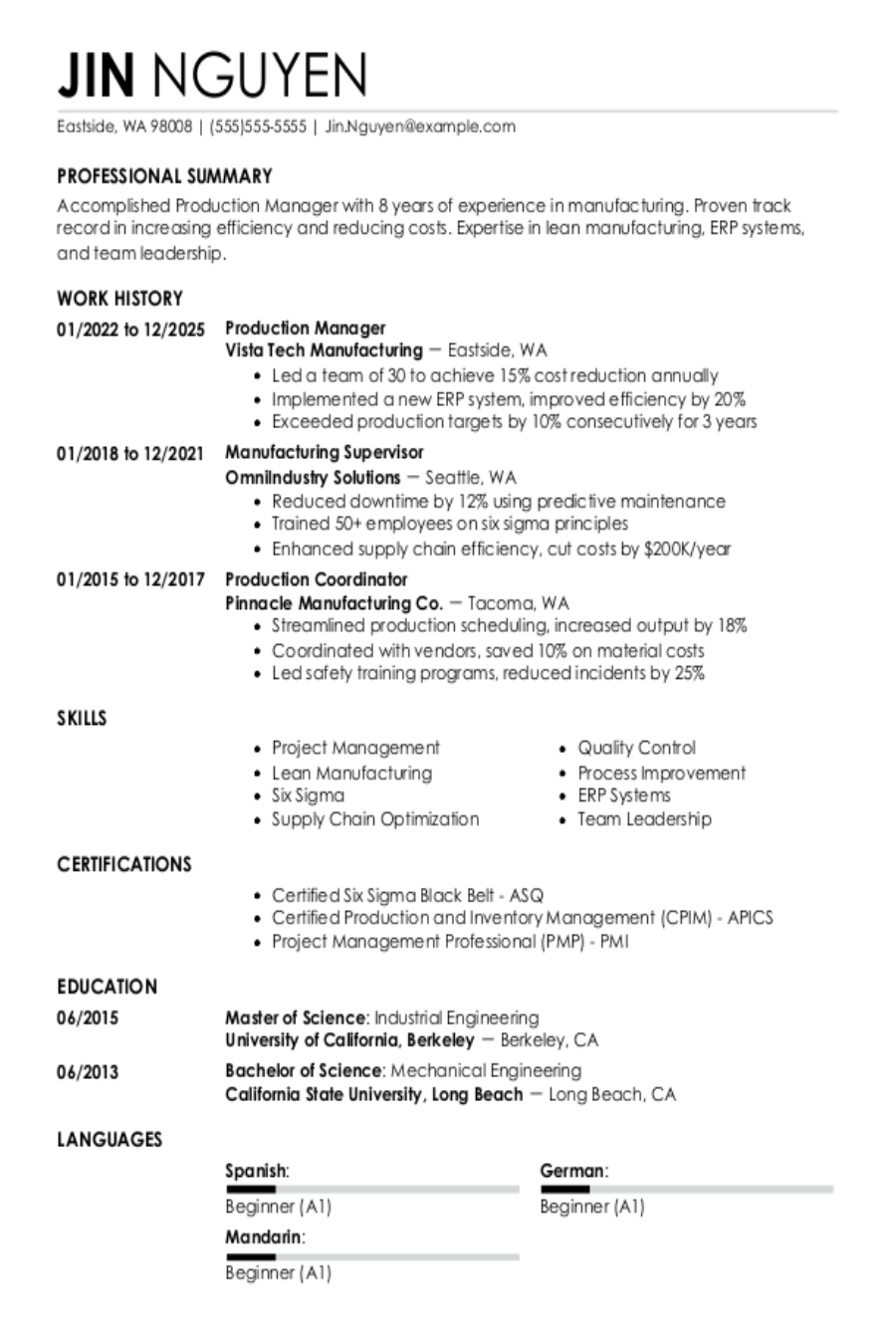

Experienced claims adjuster resume

An experienced claims adjuster resume should highlight relevant skills, notable achievements, and career progression in a clear format that showcases the applicant's expertise and value to potential employers.

Quantifies achievements: Quantifiable achievements, such as reducing claim processing time by 30% or managing a $5M portfolio, clearly highlight the impact of this candidate's work. These specific metrics enable recruiters to quickly grasp the applicant's effectiveness and value to potential employers.

Optimized for ATS: The resume employs a clean and professional template that effectively showcases a structured header alongside an ATS-friendly resume layout, catering to both recruiters and automated screening systems.

No experience claims adjuster resume

A resume for an applicant with no experience aiming to become a claims adjuster should emphasize relevant skills, education, and any applicable volunteer work to showcase the applicant's potential and enthusiasm for the position.

Favors clarity over complexity: The resume’s straightforward design highlights qualifications such as relevant volunteer experience and academic achievements, ensuring potential employers easily recognize the candidate's abilities.

Overcomes lack of work history: Emphasizing strong analytical and communication skills, this job seeker demonstrates their readiness for a claims adjuster role despite limited experience through relevant volunteer work and academic achievements.

More resume examples

Claims Adjuster Resume Template

Looking to showcase your skills? This claims adjuster resume template serves as a solid foundation—simply personalize it with your details for an compelling presentation.

Aya Johnson

Louisville, KY 40205

(555)555-5555

Aya.Johnson@example.com

Professional Summary

Experienced Claims Adjuster adept in processing claims, risk assessment, and customer satisfaction. Proven track record of reducing costs and handling high volumes of claims efficiently. Strong analytical skills and detail-oriented approach enhancing processing accuracy.

Work History

Claims Adjuster

Integrity Insurance Group - Louisville, KY

September 2023 - October 2025

- Processed claims, reducing costs by 15%.

- Reviewed reports, ensuring accuracy in 98% cases.

- Achieved customer satisfaction score of 92%.

Insurance Claims Examiner

Absolute Coverage Corp. - Louisville, KY

May 2021 - August 2023

- Audited claim files, reducing errors by 20%.

- Managed a portfolio of 150+ active claims.

- Improved processing time by 30%.

Loss Adjuster

Guardian Assurance Ltd. - Louisville, KY

May 2019 - April 2021

- Conducted site inspections, assessing damages.

- Negotiated settlements, saving $50k annually.

- Reduced fraudulent claims by 12%.

Skills

- Claims Processing

- Risk Assessment

- Customer Service

- Analytical Thinking

- Negotiation

- Detail Oriented

- Fraud Detection

- Time Management

Education

Master of Business Administration Risk Management

University of Chicago Chicago, Illinois

June 2019

Bachelor of Science Finance

University of Illinois Urbana, Illinois

June 2017

Certifications

- Certified Claims Adjuster - National Institute of Insurance

- Fraud Investigator Certification - Society of Insurance Professionals

Languages

- Spanish - Beginner (A1)

- French - Beginner (A1)

- German - Intermediate (B1)

Must-Have Skills on a Claims Adjuster Resume

A strong skills section is important for showcasing your qualifications in a resume.

Professionals in finance, banking, and insurance play a crucial role in maintaining trust and stability. The skills you highlight should reflect your ability to support accurate, efficient operations and contribute to sound decision-making. This section is your chance to show how you help safeguard and advance organizational goals.

The following data outlines the most prevalent hard and soft skills relevant to claims adjusters, derived from Resume Now’s comprehensive internal resume data.

When you’re ready to improve your resume with relevant skills, check out our AI Resume Skills Generator. This tool provides tailored suggestions for both hard and soft skills based on your job title, allowing you to create a personalized skill set that stands out.

Writing Your Claims Adjuster Resume

With a solid grasp of effective resume examples, you're now prepared to delve into the process of how to write a resume. We'll walk you through each section step by step, ensuring you create a compelling document that stands out.

List your most relevant skills

An effective skills section on your claims adjuster resume should focus on both technical competencies, such as knowledge of insurance policies and regulations, and key soft skills like negotiation and attention to detail. These elements are important in demonstrating that you can handle the responsibilities of a claims adjuster effectively.

To stand out to human recruiters and applicant tracking systems (ATS), incorporate keywords from the job listing directly into your skills section. This strategy not only highlights your alignment with the role but also improves visibility in ATS searches.

Example of skills on a claims adjuster resume

- Proficient in evaluating insurance claims and assessing damages

- Adept at negotiating settlements with strong communication skills

- Analytical thinker with a focus on detail-oriented investigations

- Compassionate listener committed to providing excellent customer service

Highlighting your soft skills on your resume can set you apart from other job seekers. Employers value interpersonal abilities because they contribute to a positive work environment and are often challenging to develop, making them an asset that can improve your application.

Highlight your work history

The work experience section of your claims adjuster resume is your opportunity to showcase achievements—such as successfully resolving claims or improving processes—to demonstrate the value you bring to potential employers.

When detailing job entries, include key information like your title, employer name, and dates of employment. This foundational data helps establish professional credibility and provides hiring managers with context about your background. Ensure you use action verbs that convey impact and expertise in the insurance field.

Example of a claims adjuster work experience entry

- Claims Adjuster

Allstate Insurance - Dallas, TX

January 2021 - Present - Investigate and evaluate insurance claims by gathering information from policyholders, witnesses, and experts to determine the validity of claims

- Negotiate settlements with claimants, achieving an average resolution time reduction of 25% while maintaining compliance with policy guidelines

- Prepare detailed reports outlining findings and recommendations based on thorough analysis of damages and liability issues

- Use strong communication skills to effectively convey decisions to customers and address their concerns, improving customer trust and satisfaction ratings by 15%

- Collaborate with legal teams to resolve complex claims disputes, contributing to a decrease in litigation cases by 30%

Quantifying achievements as a claims adjuster is important for illustrating your impact on the organization. For example, stating that you reduced claim processing time by 40% not only highlights your efficiency but also showcases your commitment to improving customer satisfaction.

Include your education

The education section of your claims adjuster resume should detail your academic qualifications in reverse-chronological order beginning with the most recent degree. Include any diplomas and relevant certifications while leaving out your high school diploma if you have a higher degree. This approach allows potential employers to quickly see your highest level of education.

For those currently pursuing degrees or who have incomplete education, it is essential to list the highest completed level along with an expected graduation date. Bullet points that highlight relevant coursework or notable achievements can be helpful for recent graduates or current students as they showcase knowledge and skills relevant to the claims adjusting field.

Common certifications for a claims adjuster resume

- Associate in Claims (AIC) – The Institutes

- Certified Insurance Counselor (CIC) – National Alliance for Insurance Education & Research

- Claims Adjuster License – State Department of Insurance

- Chartered Property Casualty Underwriter (CPCU) – The Institutes

Sum up your resume with an introduction

Creating an effective profile section on your resume is important as it forms the first impression employers have of you. This section sets the tone for your entire application, providing a snapshot of your qualifications and career goals.

For those with extensive experience in claims adjusting, a professional summary is the ideal choice. This format allows you to showcase your most significant achievements and skills prominently at the top of your resume. If your professional experience is minimal, write a resume objective that shows your intent to grow and contribute.

Professional summary example

Results-driven claims adjuster with over 5 years of experience in managing complex insurance claims. Demonstrated success in conducting thorough investigations, negotiating settlements, and improving client relationships. Expert in evaluating damages and ensuring compliance with industry regulations to deliver optimal outcomes for all parties involved.

Resume objective example

Enthusiastic claims adjuster eager to use strong analytical abilities and effective communication skills to support a dedicated team. Committed to improving claims processing efficiency while fostering positive relationships with clients and stakeholders for improved satisfaction and outcomes.

As a claims adjuster job seeker, your resume profile should be concise and packed with key information. Aim to limit it to three sentences that highlight your most relevant skills and experiences. Remember, you can effectively communicate any additional details in your cover letter.

Add unique sections to set you apart

Optional resume sections are a fantastic way for you to highlight your unique qualifications as a claims adjuster. These sections allow you to stand out by showcasing experiences and skills that may not fit into the traditional format.

Including relevant hobbies or volunteer work can illustrate your personal values and commitment to the field. For instance, if you've volunteered in community support programs, it shows your dedication to helping others. Such details provide potential employers with a richer picture of who you are as a professional, emphasizing attributes like empathy and problem-solving skills.

Three sections perfect for a claims adjuster resume

- Languages: As a claims adjuster, you often interact with clients and insurance professionals. Being multilingual can improve your language skills, making it easier to resolve claims efficiently. Highlight these skills on your resume to stand out.

- Volunteer Work: Including volunteer work on a resume is an excellent way to showcase your commitment to community service and improve your professional skills. It highlights your values and can set you apart from other job seekers.

- Accomplishments: As a claims adjuster, quantifiable accomplishments highlight your ability to resolve claims efficiently. Bring attention to these achievements by adding them to your work experience or listing them in a special accomplishments section.

5 Resume Formatting Tips

- Choose a format that matches your career stage.

Choosing the right resume format is important for showcasing your skills. If you’re an experienced claims adjuster, a chronological format highlights your professional journey effectively. For those just starting, a functional resume can emphasize relevant skills over job history. Consider a combination format if you want to mix both approaches for maximum impact.

- Pick a smart resume template.

Using a professional resume template is key for making your application stand out. It improves readability and allows hiring managers to quickly grasp your qualifications. Whether you opt for a premade template or design your own, ensure the layout is clean and uses ATS-friendly fonts for optimal results.

- Select an appropriate font.

Choose a clear and professional font to improve your resume's readability. Fonts like Arial, Calibri, or Georgia are excellent options that appeal to both applicant tracking systems and hiring managers.

- Use consistent formatting.

Align your resume text to the left and maintain uniform margins. This creates a polished look that improves readability and professionalism.

- Keep your resume to one or two pages.

When crafting your resume, remember that resumes should be one page long unless you have extensive experience. Keep your content concise and prioritize the most relevant information to make a strong impression.

What’s the Average Claims Adjuster Salary?

Claims adjuster salaries vary based on location, career level, and qualifications.

This data, provided by the Bureau of Labor Statistics, will show you expected salary ranges for claims adjusters in the top 5 highest-paying states, including the District of Columbia. The figures reflect the most current salary data available, collected in 2024.

- Full Range

- Most Common (25th–75th percentile)

- Average

Connecticut

Most common: $65,770 - $107,000

District of Columbia

Most common: $62,690 - $115,100

California

Most common: $75,170 - $104,480

Maryland

Most common: $72,240 - $107,580

New Jersey

Most common: $68,490 - $104,310

Tools for Your Job Search

Are you preparing to apply for that claims adjuster role you've been interested in? Before you send off your application, take advantage of our ATS Resume Checker. This essential tool gives you insights into how your resume performs with the automated systems many insurance companies use to filter applicants during their initial screening process.

Do you want to craft a standout resume? Our AI Resume Builder provides tailored recommendations that cater to your claims adjusting experience, along with professional templates designed to effectively showcase your skills and achievements to potential employers.

Frequently Asked Questions

Last Updated: October 23, 2025

Absolutely. A cover letter is important as it adds depth to your resume and creates valuable communication opportunities with employers. It allows you to highlight why you're passionate about the claims adjuster role and how your unique experiences make you a strong applicant. Don’t overlook this chance—write a cover letter that sets you apart.

For a quick and effective solution, consider using our AI Cover Letter Generator. It streamlines the process of crafting personalized cover letters in minutes, offering various cover letter template options that will align perfectly with your resume, improving your job application’s impact.

A resume is typically concise, spanning one to two pages and focusing on key skills and experiences relevant to the job you're applying for. In contrast, a CV (curriculum vitae) can extend several pages, providing comprehensive details about your academic background, research contributions, publications, and professional experiences.

You should use a CV when applying for specialized roles in academia or fields such as law and medicine. If you need to create a tailored CV quickly, our online CV Maker is an excellent resource. With various CV templates designed for different industries and career levels, you can craft a stunning document in just minutes.

Choosing the right resume format hinges on your career stage and individual strengths. Inexperienced individuals often find a functional format helpful as it highlights relevant skills over job history. For seasoned professionals, a chronological format is more effective since it showcases extensive experience. Mid-level applicants may opt for a combination format, which provides a well-rounded view by integrating skills with work history.

A frequent resume error claims adjusters encounter is using a template that fails to comply with ATS standards. To improve your chances of getting noticed, choose a resume template is ATS-friendly and tailor your resume content to reflect the specifics of the job description you are applying for.

To build a strong skills section as a claims adjuster, mix technical skills like data analysis and claims software skill with soft skills such as negotiation and communication. In your experience section, illustrate how you applied these skills to resolve claims efficiently and improve customer satisfaction, highlighting your contributions to successful outcomes.

An active LinkedIn presence is important for a claims adjuster seeking new opportunities. It helps you connect with industry professionals and effectively showcase your expertise and achievements.

Was this information helpful? Let us know!

Hailey is a career advice writer dedicated to helping job seekers excel in their careers.

More resources

Only 1 in 10 Resumes Include Measurable Results, New Analysis of 18.4M U.S. Resumes Finds

Resume Now takes a closer look at measurable results on resume...

Top Entry‑Level Careers That Are Fast‑Growing, Higher‑Paying, and AI‑Resistant

Artificial intelligence is touching more parts of work every y...

What Does It Mean if an Interviewer Says "Good Luck" or "We'll Be In Touch"?

Read on to learn the meaning behind these standard post-interv...